Question: Portfolio analysis You have been given the expected retum data shown in the first table on three assets - F, G, and H - over

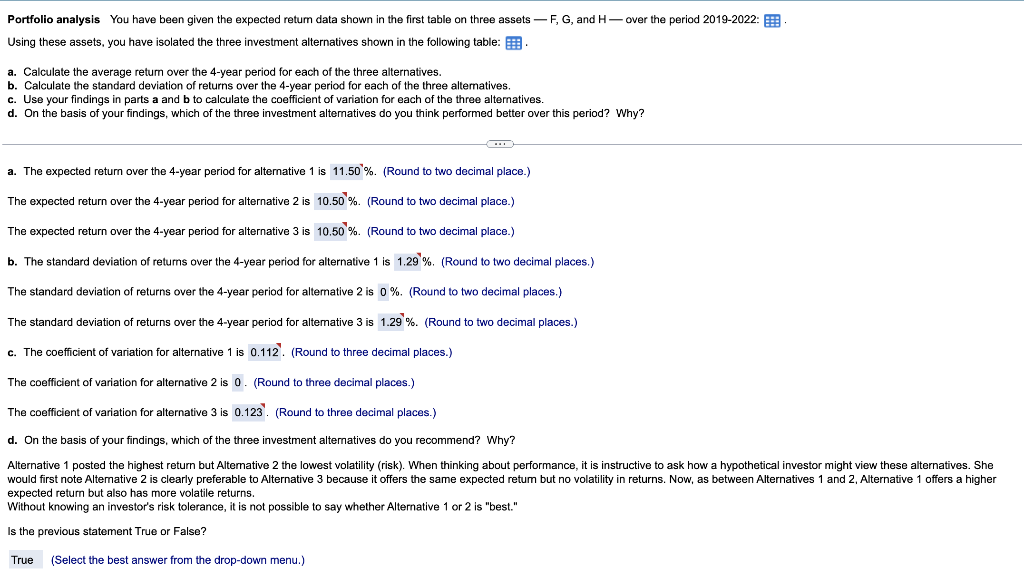

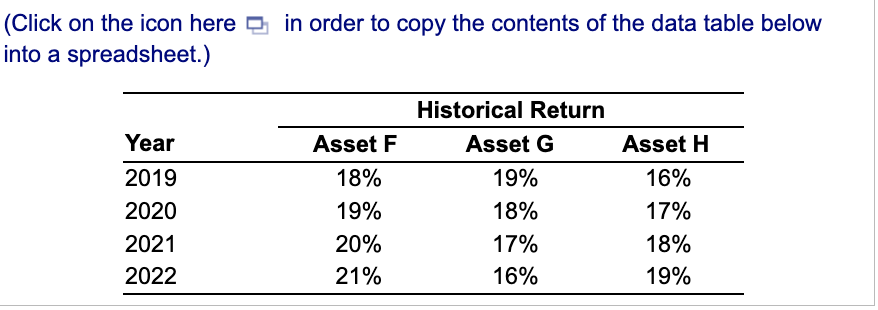

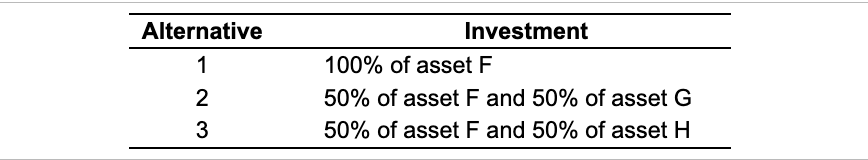

Portfolio analysis You have been given the expected retum data shown in the first table on three assets - F, G, and H - over the period 20192022 : Using these assets, you have isolated the three investment alternatives shown in the following table: a. Calculate the average retum over the 4-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives. c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives. d. On the basis of your findings, which of the three investment altematives do you think performed better over this period? Why? a. The expected return over the 4-year period for alternative 1 is . (Round to two decimal place.) The expected return over the 4-year period for alternative 2 is . (Round to two decimal place.) The expected return over the 4-year period for alternative 3 is %. (Round to two decimal place.) b. The standard deviation of retums over the 4-year period for alternative 1 is 6. (Round to two decimal places.) The standard deviation of returns over the 4-year period for altemative 2 is 0%. (Round to two decimal places.) The standard deviation of returns over the 4-year period for altemative 3 is \%. (Round to two decimal places.) c. The coefficient of variation for alternative 1 is (Round to three decimal places.) The coefficient of variation for alternative 2 is 0 . (Round to three decimal places.) The coefficient of variation for alternative 3 is (Round to three decimal places.) d. On the basis of your findings, which of the three investment altematives do you recommend? Why? expected retum but also has more volatile returns. Without knowing an investor's risk tolerance, it is not possible to say whether Alternative 1 or 2 is "best." Is the previous statement True or False? (Select the best answer from the drop-down menu.) (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts