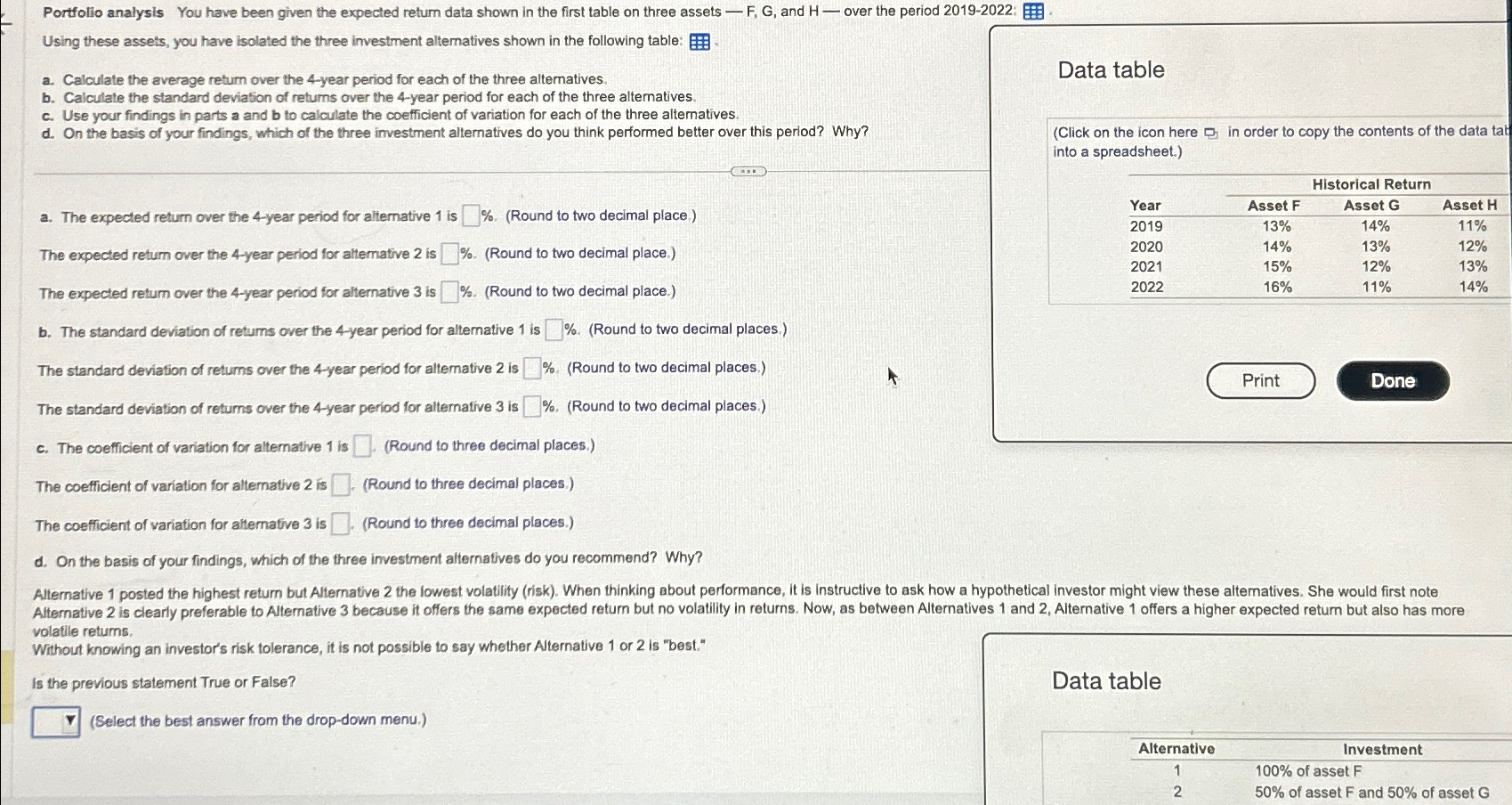

Question: Portfolio analysis You have been given the expected retum data shown in the first table on three assets - F , G , and H

Portfolio analysis You have been given the expected retum data shown in the first table on three assets F G and H over the period :

Using these assets, you have isolated the three investment alternatives shown in the following table:

a Calculate the average return over the year period for each of the three alternatives.

b Calculate the standard deviation of retums over the year period for each of the three alternatives.

c Use your findings in parts a and to calculate the coefficient of variation for each of the three alternatives.

d On the basis of your findings, which of the three investment alternatives do you think performed better over this period? Why?

Data table

Click on the icon here pr in order to copy the contents of the data tat into a spreadsheet.

tableHistorical ReturnYearAsset FAsset GAsset H

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock