Question: PPI's management is afraid that an error was made when calculating ending inventory and COGS for the year. They would like you to go back

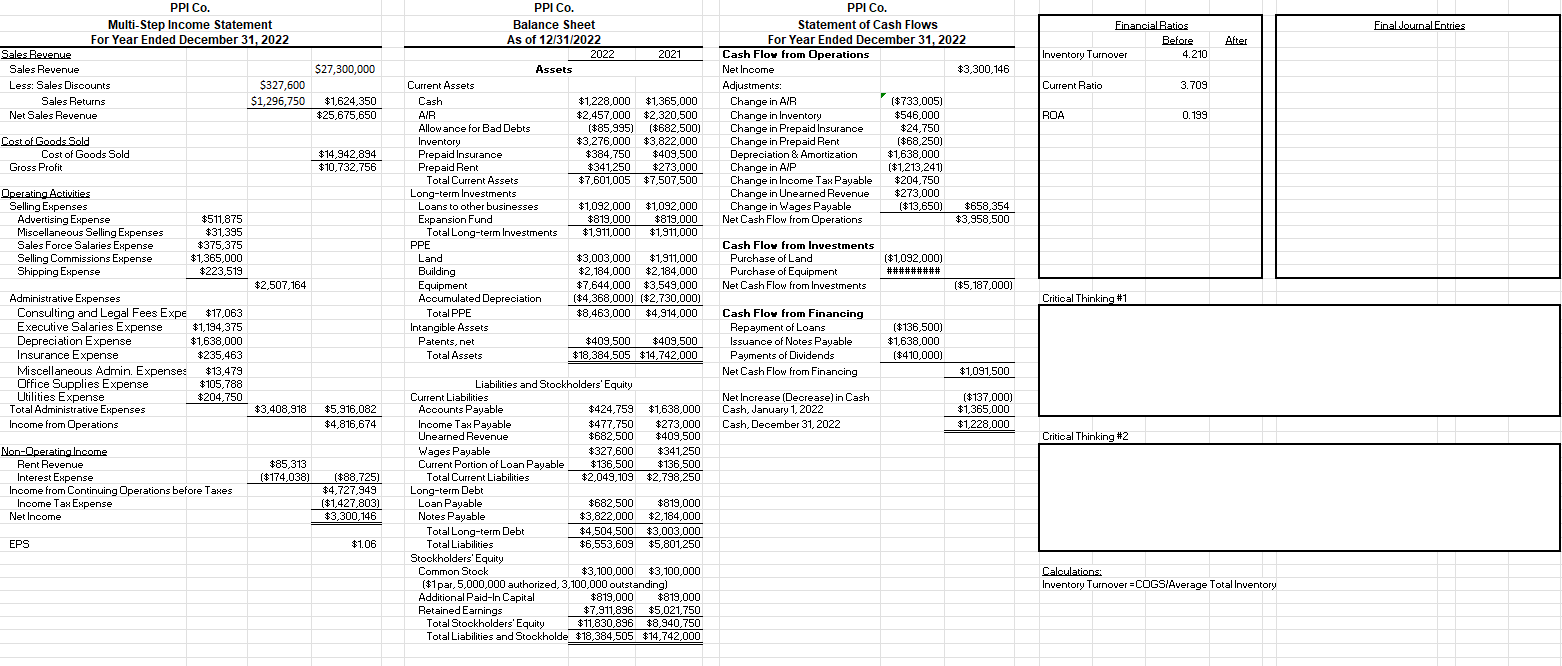

PPI's management is afraid that an error was made when calculating ending inventory and COGS for the year. They would like you to go back through the inventory calculations to correct any possible mistakes. PPI uses the Dollar Value LIFO system for calculating inventory. The price index for 2022 is 108, and the price indices for 2021 and 2020 were 105 and 100, respectively.

If PPI had purchased its 2020 inventory at the end of 2020, it would have cost the company $2,942,940. If the company had purchased its 2021 on December 31, 2021, it would have cost the company $3,969,147. If the company had purchased all of the items still in inventory on December 31, 2022 on December 31, 2022, it would have cost the company $3,885,991.

PPIs management would like to know the effect of your adjustment, if any, on the following ratios

Inventory Turnover (COGS / average total inventory)

Current Ratio

ROA (Net Income / Average Total Assets)

Assignment:

Calculations

- Make the appropriate journal entries, if any, to correct the reported values of inventory and COGS (including any necessary changes to income tax expense).

- Make any necessary changes to the financial statements.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts