Question: Preferred stock is often called a hybrid security because it has some characteristies that are typical of debt and others that are typical of equity.

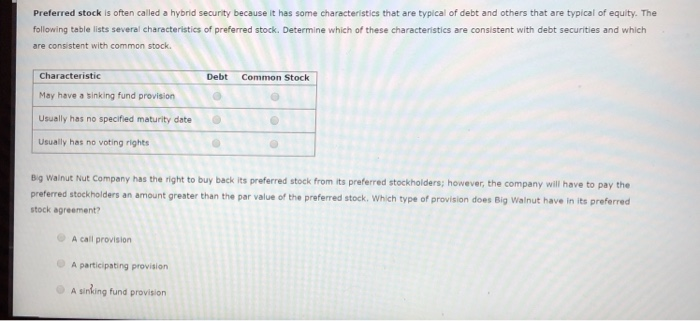

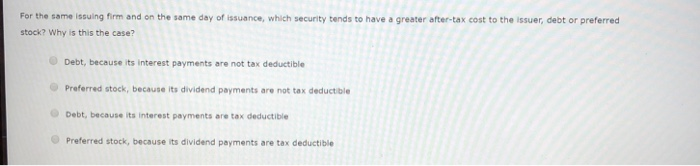

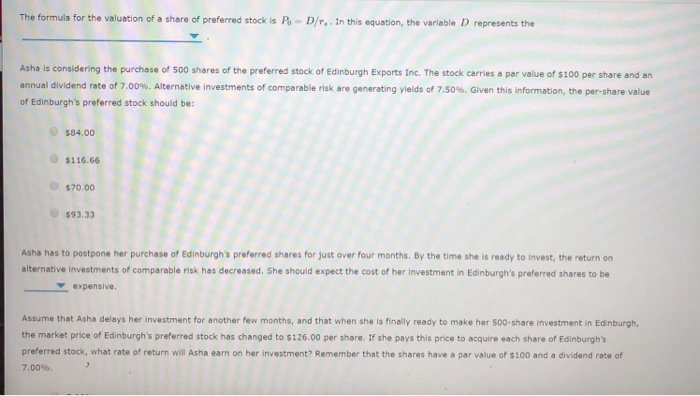

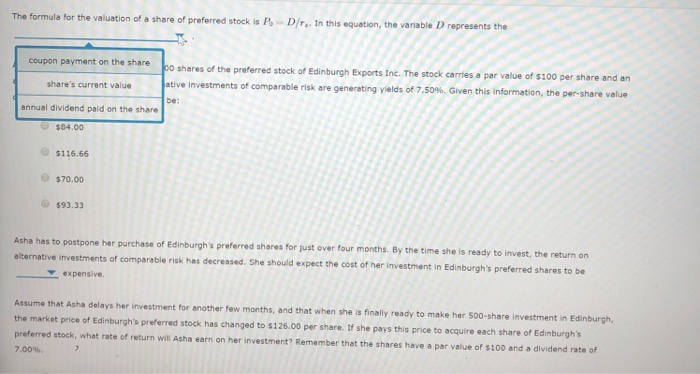

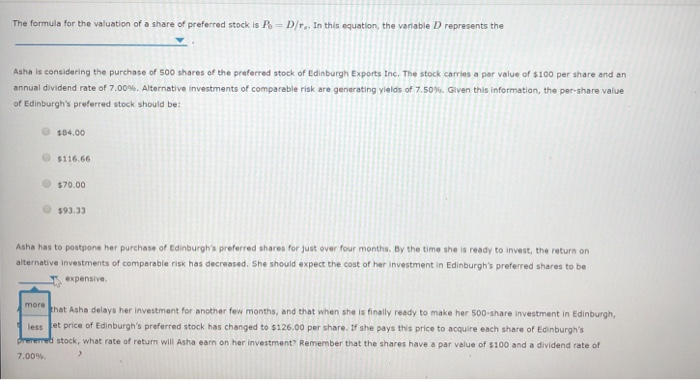

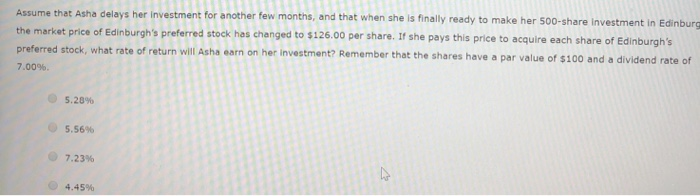

Preferred stock is often called a hybrid security because it has some characteristies that are typical of debt and others that are typical of equity. The following table lists severel characteristics of preferred stock. Determine which of these characteristics are consistent with debt securities and which are consistent with common stock Characteristic May have sinking fund provision Usually has no specified maturity date O Usually has no voting rights Debt Common Stock Big Wainut Nut Company has the right to buy back its preferred stock from its preferred stockholders; however, the company will have to pay the preferred stockholders an amount greater than the par value of the preferred stock. Which type of provision does Big Walnut have in its preferred stock agreement? A call provision A participating provision sinking fund provision A For the same Issuing firm and on the same day of issuance, which security tends to have a greater after-tax cost to the issuer, debt or preferred stock? Why is this the case? Debt, because its interest payments are not tax deductible Preferred stock, because its dividend payments are not tax deductible Debt, because its interest payments are tax deductible Preferred stock, because its dividend payments are tax deductible The formula for the valuation of a share of preferred stock is Po D/r, In this equation, the variable D represents the Asha is considering the purchase of 500 shares of the preferred stock of Edinburgh Exports Inc. The stock carries a par value of $100 per share and an annual dividend rate of 7.00%. Alternative investments of comparable risk are generating yields of 7.50%. Given this information, the per-share value of Edinburgh's preferred stock should be: $84.00 $116.66 $70.00 $93.33 Asha has to postpone her purchase of Edinburgh's preferred shares for just over four months. By the time she is ready to invest, the return on alternative investments of comparable risk has decreased. She should expect the cost of her investment in Edinburgh's preferred shares to be expensive. Assume that Asha delays her investment for another few months, and that when she is finally ready to make her 500-share investment in Edinburgh, the market price of Edinburgh's preferred stock has changed to s126.00 per share. If she pays this price to acquire each share of Edinburgh's preferred stock, what rate of return will Asha earn on her investment? Remember that the shares have a par value of $100 and a divideand rate of 7.00%. The formula for the valuation of a share of preferred stock is Po D/r.. In this equation, the variable D represents the Asha is considering the purchase of 500 shares of the preferred stock of Edinburgh Exports Inc. The stock carries a par value of $100 per share and an annual dividend rate of 7.00%. Alternative investments of comparable risk are generating yields of 7.50%. Given this information, the per-share value of Edinburgh's preferred stock should be: $84.00 $116.66 $70.00 $93.33 Asha has to postpone her purchase of Edinburgh's preferred shares for just over four months. By the time she is ready to invest, the return on alternative investments of comparable risk has decreased. She should expect the cost of her investment in Edinburgh's preferred shares to be expensive. hat Asha delays her investment for another few months, and that when she is finally ready to make her 500-share investment in Edinburgh, stock, what rate of return will Asha earn on her investment? Remember that the shares have a par value of $100 and a dividend rate of more less et price of Edinburgh's preferred stock has changed to $126.00 per share. If she pays this price to acquire each share of Edinburgh's 7.00%. months, and that when she is finally ready to make her 500-share Investment in Edinburg Assume that Asha delays her investment for another few the market price of Edinburgh's preferred stock hes changed to $126.00 per share. If preferred stock, what rate of return will Asha earn on her investment? Remember th 7.00%. she pays this price to acquire each share of Edinburgh's at the shares have a par value of $100 and a dividend rate of 5.20% -5.56% @ 7.23% 4.45%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts