Question: Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are typical of common

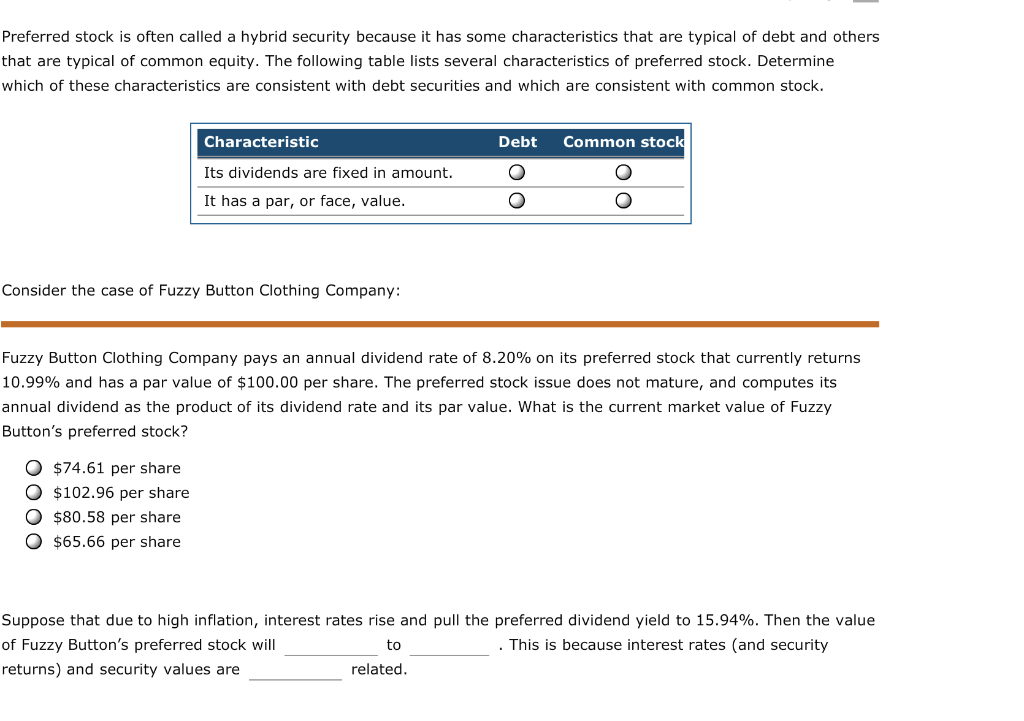

Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are typical of common equity. The following table lists several characteristics of preferred stock. Determine which of these characteristics are consistent with debt securities and which are consistent with common stock Common stock Characteristic Debt Its dividends are fixed in amount. It has a par, or face, value. Consider the case of Fuzzy Button Clothing Company: Fuzzy Button Clothing Company pays an annual dividend rate of 8.20% on its preferred stock that currently returns 10.99% and has a par value of $100.00 per share. The preferred stock issue does not mature, and computes its annual dividend as the product of its dividend rate and its par value. What is the current market value of Fuzzy Button's preferred stock? O $74.61 per share O $102.96 per share O $80.58 per share $65.66 per share Suppose that due to high inflation, interest rates rise and pull the preferred dividend yield to 15.94%. Then the value . This is because interest rates (and security of Fuzzy Button's preferred stock will to related returns) and security values are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts