Question: Prepare 2016 Forms 1040 and 8949 Prepare 2016 Schedules A, B, and D Prepare Qualified Dividends and Capital Gain Tax Worksheet-Line 44 Found in the

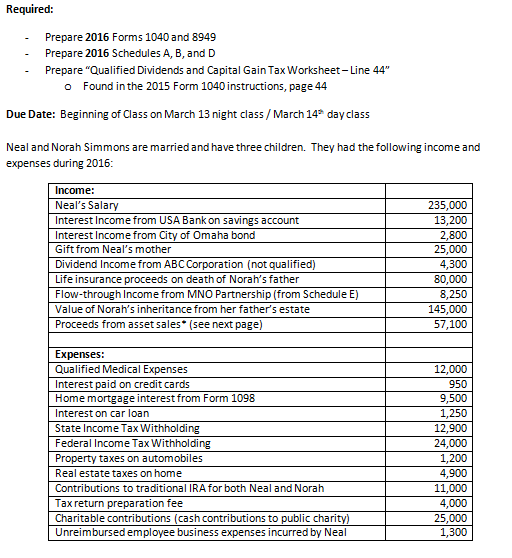

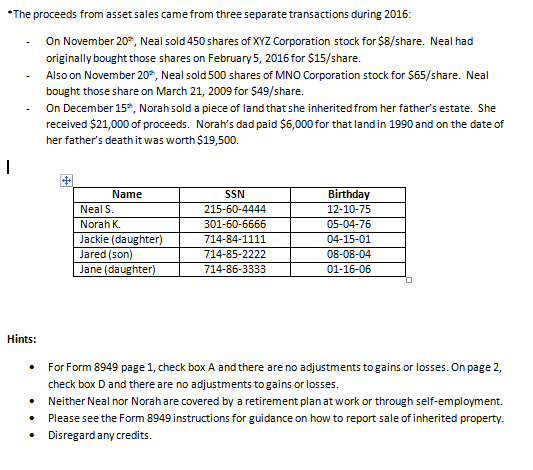

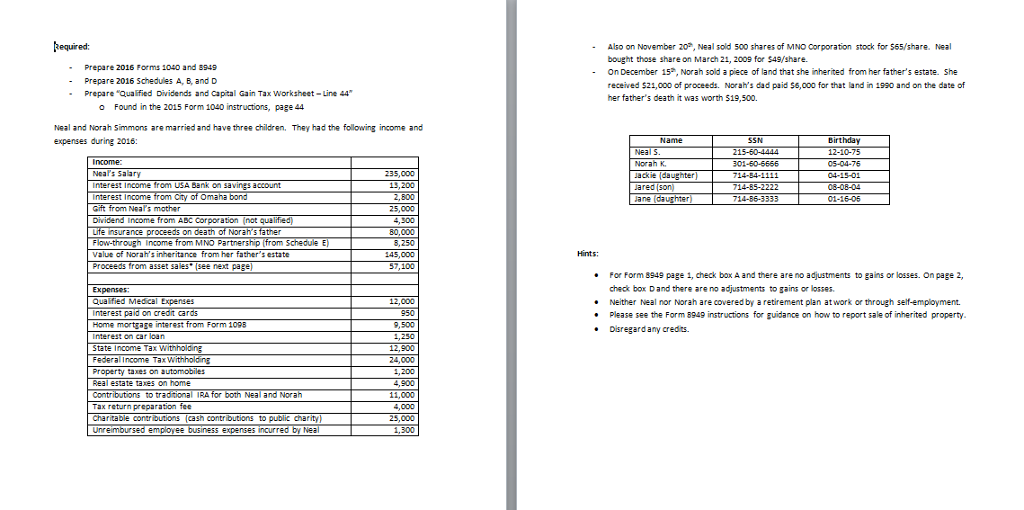

Prepare 2016 Forms 1040 and 8949 Prepare 2016 Schedules A, B, and D Prepare "Qualified Dividends and Capital Gain Tax Worksheet-Line 44" Found in the 2015 Form 1040 instructions, page 44 Due Date: Beginning of Class on March 13 night class/March 14^th day class Neal and Norah Simmons are married and have three children. They had the following income and expenses during 2016: The proceeds from asset sales came from three separate transactions during 2016: On November 205", Neal sold 450 shares of XYZ Corporation stock for $8/5 ha re. Neal had originally bought those shares on February 5, 2016 for $15/share. Also on November 20^th, Neal sold 500 shares of MNO Corporation stock for $65/share. Neal bought those share on March 21, 2009for $49/share. On December 15^th, Norah sold a piece of land that she inherited from her father's estate. She received $21,000 of proceeds. Norah's dad paid $6,000for that land in 1990 and on the date of her father's death it was worth $19, 500. Prepare 2016 Forms 1040 and 8949 Prepare 2016 Schedules A, B, and D Prepare "Qualified Dividends and Capital Gain Tax Worksheet-Line 44" Found in the 2015 Form 1040 instructions, page 44 Due Date: Beginning of Class on March 13 night class/March 14^th day class Neal and Norah Simmons are married and have three children. They had the following income and expenses during 2016: The proceeds from asset sales came from three separate transactions during 2016: On November 205", Neal sold 450 shares of XYZ Corporation stock for $8/5 ha re. Neal had originally bought those shares on February 5, 2016 for $15/share. Also on November 20^th, Neal sold 500 shares of MNO Corporation stock for $65/share. Neal bought those share on March 21, 2009for $49/share. On December 15^th, Norah sold a piece of land that she inherited from her father's estate. She received $21,000 of proceeds. Norah's dad paid $6,000for that land in 1990 and on the date of her father's death it was worth $19, 500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts