Question: Prepare a model for the case 2.3, if a $500,000 of $2,500,000 us financed by issuing bonds. The sale tax is %3.8. Table 2-3. Economic

Prepare a model for the case 2.3, if a $500,000 of $2,500,000 us financed by issuing bonds. The sale tax is %3.8.

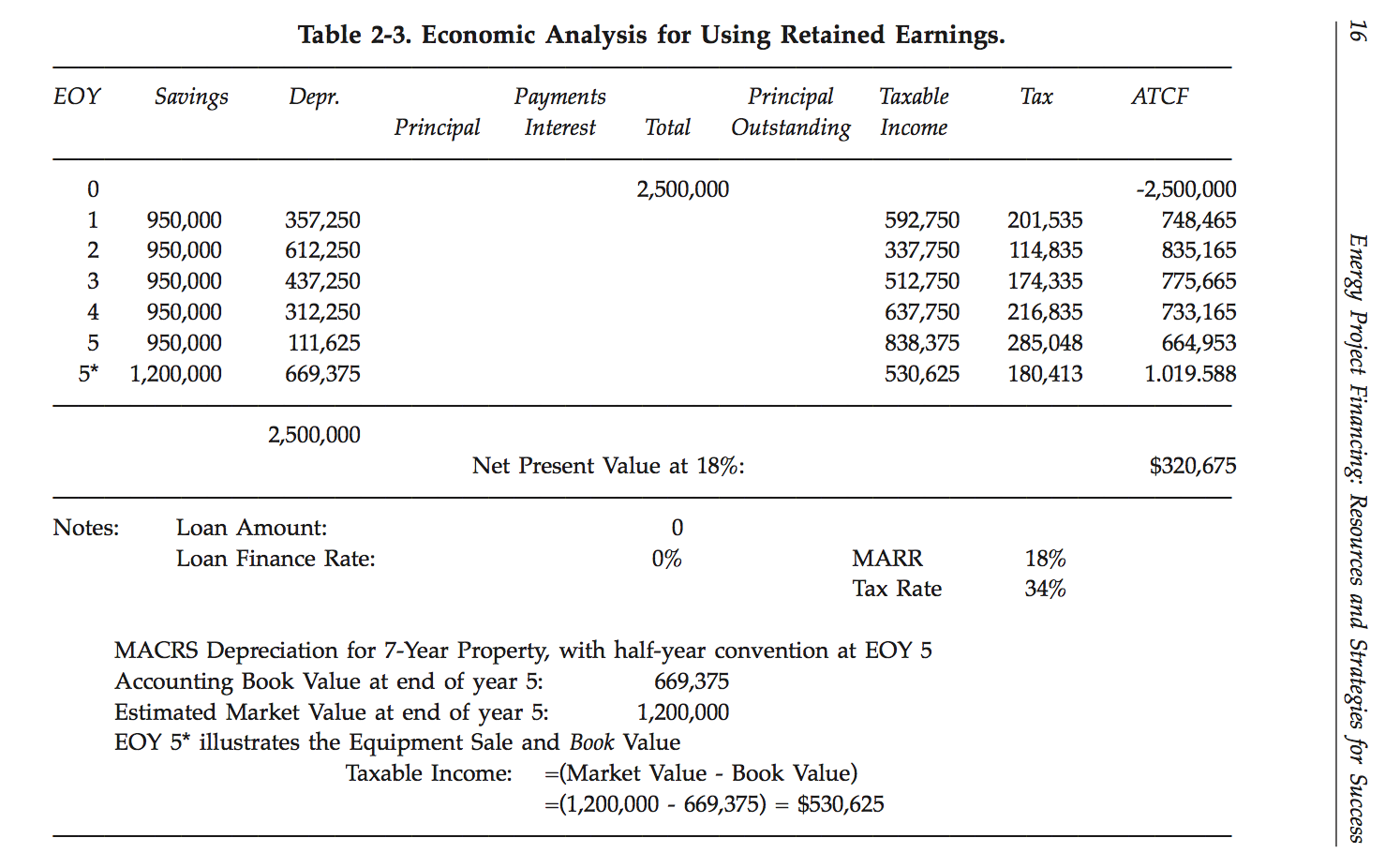

Table 2-3. Economic Analysis for Using Retained Earnings. 16 EOY Savings Depr. Tax ATCF Payments Interest Principal Taxable Outstanding Income Principal Total 2,500,000 3 950,000 950,000 950,000 950,000 950,000 1,200,000 357,250 612,250 437,250 312,250 111,625 669,375 592,750 337,750 512,750 637,750 838,375 530,625 201,535 114,835 174,335 216,835 285,048 180,413 -2,500,000 748,465 835,165 775,665 733,165 664,953 1.019.588 5 5* 2,500,000 Net Present Value at 18%: $320,675 Notes: Loan Amount: Loan Finance Rate: 0 0% Energy Project Financing: Resources and Strategies for Success MARR Tax Rate 18% 34% MACRS Depreciation for 7-Year Property, with half-year convention at EOY 5 Accounting Book Value at end of year 5: 669,375 Estimated Market Value at end of year 5: 1,200,000 EOY 5* illustrates the Equipment Sale and Book Value Taxable Income: =(Market Value - Book Value) =(1,200,000 - 669,375) = $530,625 Table 2-3. Economic Analysis for Using Retained Earnings. 16 EOY Savings Depr. Tax ATCF Payments Interest Principal Taxable Outstanding Income Principal Total 2,500,000 3 950,000 950,000 950,000 950,000 950,000 1,200,000 357,250 612,250 437,250 312,250 111,625 669,375 592,750 337,750 512,750 637,750 838,375 530,625 201,535 114,835 174,335 216,835 285,048 180,413 -2,500,000 748,465 835,165 775,665 733,165 664,953 1.019.588 5 5* 2,500,000 Net Present Value at 18%: $320,675 Notes: Loan Amount: Loan Finance Rate: 0 0% Energy Project Financing: Resources and Strategies for Success MARR Tax Rate 18% 34% MACRS Depreciation for 7-Year Property, with half-year convention at EOY 5 Accounting Book Value at end of year 5: 669,375 Estimated Market Value at end of year 5: 1,200,000 EOY 5* illustrates the Equipment Sale and Book Value Taxable Income: =(Market Value - Book Value) =(1,200,000 - 669,375) = $530,625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts