Question

Prepare a one-statement of profit or loss and comprehensive income in accordance with the AASB 101 presentation of financial statements. (the left line is an

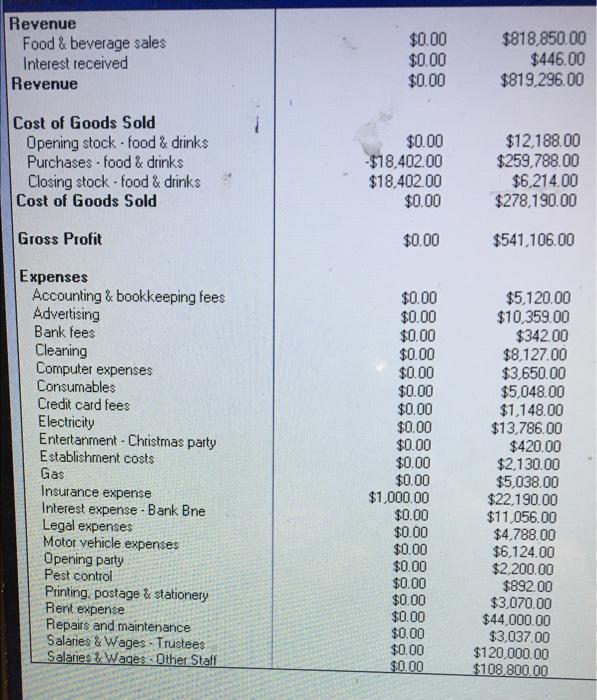

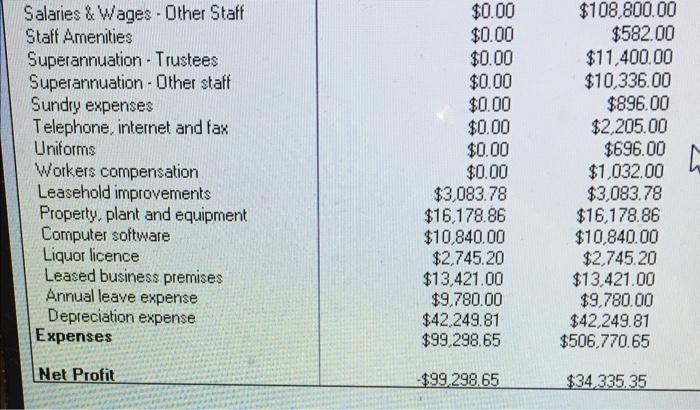

Prepare a one-statement of profit or loss and comprehensive income in accordance with the AASB 101 presentation of financial statements. (the left line is an amount which is a selected period that records journal entry adjustment, and the right line is a result of the year to date)

Revenue Food & beverage sales Interest received Revenue Cost of Goods Sold Opening stock food & drinks Purchases food & drinks Closing stock food & drinks Cost of Goods Sold Gross Profit Expenses Accounting & bookkeeping fees Advertising Bank fees Cleaning Computer expenses Consumables Credit card fees Electricity Entertanment Christmas party Establishment costs Gas Insurance expense Interest expense-Bank Bne Legal expenses Motor vehicle expenses Opening party Pest control Printing, postage & stationery Rent expense Repairs and maintenance Salaries & Wages Trustees Salaries & Wages Other Staff $0.00 $0.00 $0.00 $0.00 -$18,402.00 $18,402.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1,000.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $818,850.00 $446.00 $819,296.00 $12,188.00 $259,788.00 $6,214.00 $278,190.00 $541,106.00 $5,120.00 $10,359.00 $342.00 $8,127.00 $3,650.00 $5,048.00 $1,148.00 $13,786.00 $420.00 $2,130.00 $5,038.00 $22,190.00 $11,056.00 $4,788.00 $6,124.00 $2,200.00 $892.00 $3,070.00 $44,000.00 $3,037.00 $120,000.00 $108,800,00

Step by Step Solution

3.48 Rating (125 Votes )

There are 3 Steps involved in it

Step: 1

Answer PARTICULAR AMOUNT PATICULARS AMOUNT 1Accounting and Gross profit book keeping 512...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started