Question: Prepare statement of cash flows using the indirect method. The income statement for 2017 and the balance sheets for 2017 and 2016 are presented for

Prepare statement of cash flows using the indirect method. The income statement for 2017 and the balance sheets for 2017 and 2016 are presented for Harding Industries, Inc.

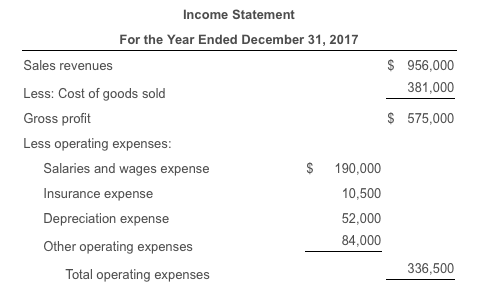

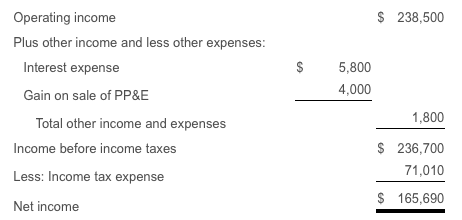

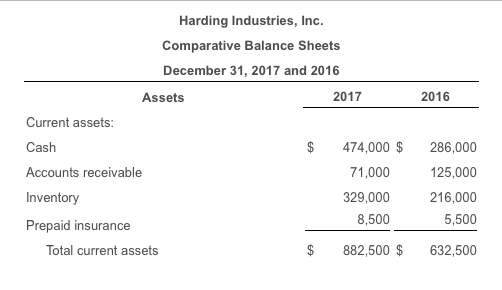

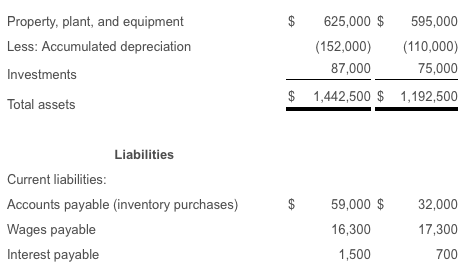

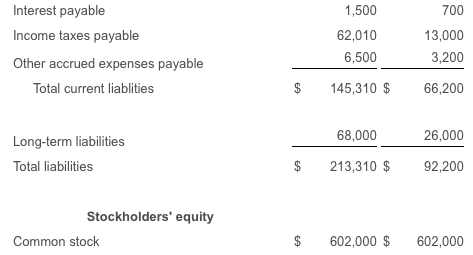

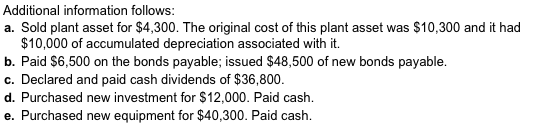

Income Statement For the Year Ended December 31, 2017 Sales revenues Less: Cost of goods sold Gross profit Less operating expenses $ 956,000 381,000 $ 575,000 Salaries and wages expense Insurance expense Depreciation expense S 190,000 10,500 52,000 84,000 ther operating expenses 336,500 Total operating expenses Operating income Plus other income and less other expenses: $ 238,500 $ 5,800 4,000 Interest expense Gain on sale of PP&E 1,800 $ 236,700 71,010 $ 165,690 Total other income and expenses Income before income taxes Less: Income tax expense Net income Harding Industries, Inc Comparative Balance Sheets December 31, 2017 and 2016 Assets 2017 2016 Current assets: Cash Accounts receivable Inventory Prepaid insurance $474,000 $ 286,000 1000 25,000 329,000 216,000 5,500 $ 882,500 $ 632,500 8,500 Total current assets Property, plant, and equipment Less: Accumulated depreciation Investments Total assets $ 625,000 $ 595,000 (152,000) (110,000) 75,000 $ 1,442,500 $ 1,192,500 87,000 Liabilities Current liabilities Accounts payable (inventory purchases) Wages payable Interest payable 59,000$ 32,000 17,300 700 16,300 1,500 627,190 498,300 Retained earnings Total stockholders' equity $ 1,229,190 $ 1,100,300 $ 1,442,500 $ 1,192,500 Total liabilities and equity Additional information follows a. Sold plant asset for $4,300. The original cost of this plant asset was $10,300 and it had $10,000 of accumulated depreciation associated with it. b. Paid $6,500 on the bonds payable; issued $48,500 of new bonds payable. c. Declared and paid cash dividends of $36,800. d. Purchased new investment for $12,000. Paid cash. e. Purchased new equipment for $40,300. Paid cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts