Question: Present Value, explored in Exercises 1 5 - 1 8 , is an important concept in economic analysis. Present value is used to compare the

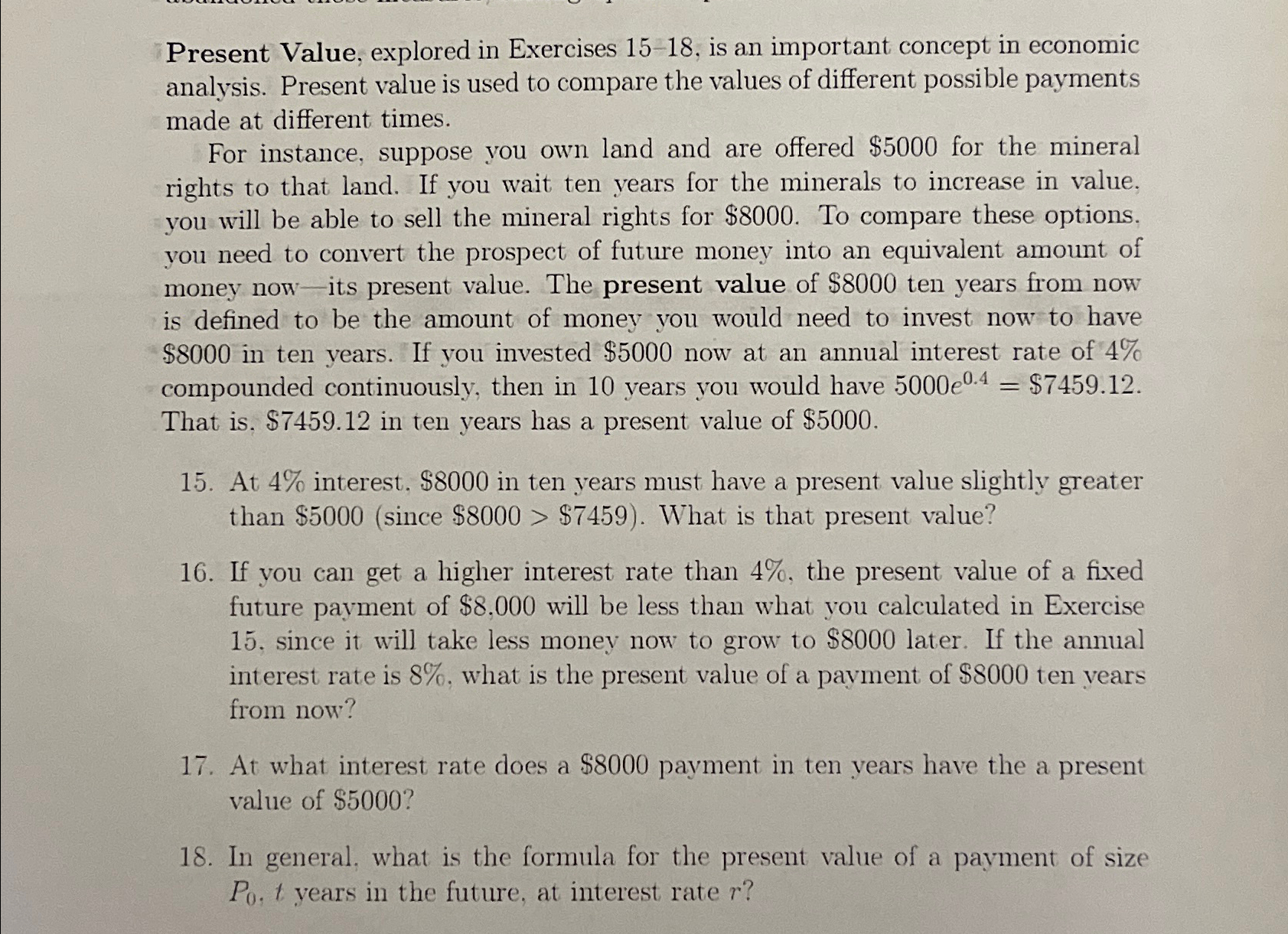

Present Value, explored in Exercises is an important concept in economic analysis. Present value is used to compare the values of different possible payments made at different times.

For instance, suppose you own land and are offered $ for the mineral rights to that land. If you wait ten years for the minerals to increase in value, you will be able to sell the mineral rights for $ To compare these options, you need to convert the prospect of future money into an equivalent amount of money now its present value. The present value of $ ten years from now is defined to be the amount of money you would need to invest now to have $ in ten years. If you invested $ now at an annual interest rate of compounded continuously, then in years you would have $ That is $ in ten years has a present value of $

At interest, $ in ten years must have a present value slightly greater than $since $$ What is that present value?

If you can get a higher interest rate than the present value of a fixed future payment of $ will be less than what you calculated in Exercise since it will take less money now to grow to $ later. If the annual interest rate is what is the present value of a payment of $ ten vears from now?

At what interest rate does a $ payment in ten years have the a present value of $

In general, what is the formula for the present value of a payment of size years in the future, at interest rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock