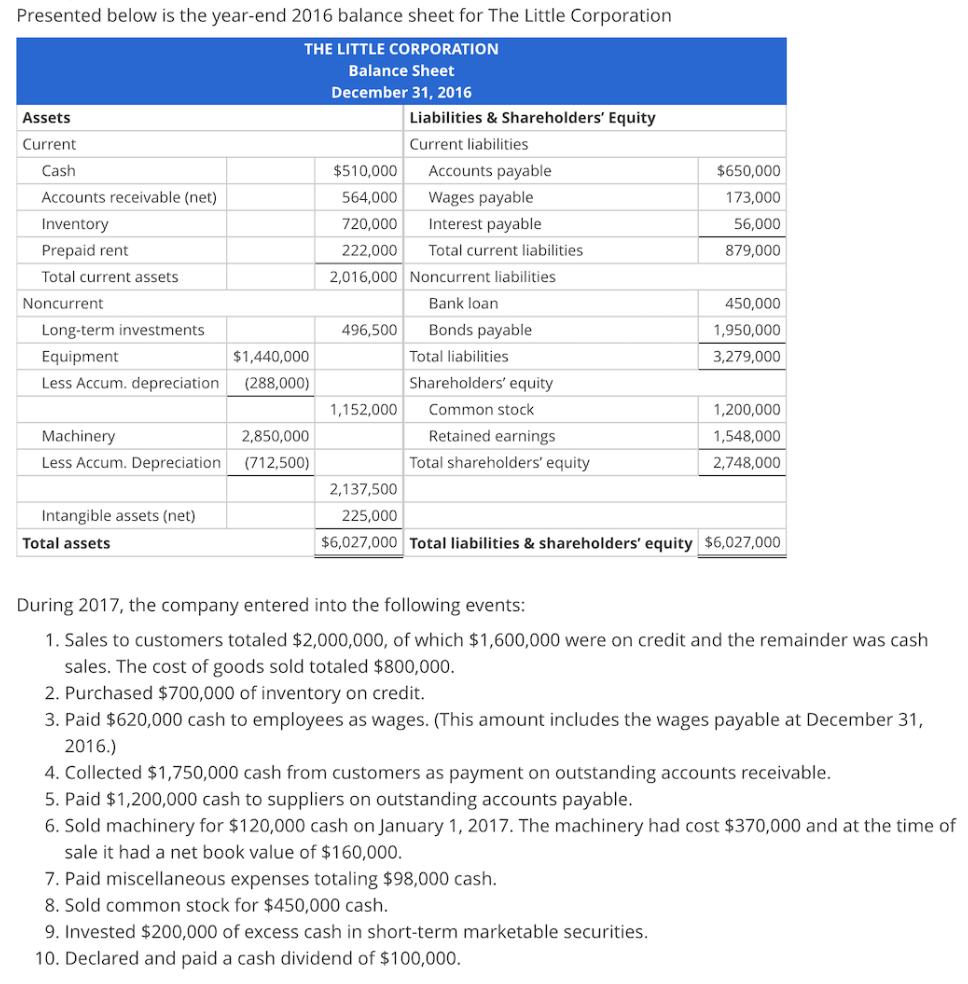

Question: Presented below is the year-end 2016 balance sheet for The Little Corporation THE LITTLE CORPORATION Balance Sheet December 31, 2016 Assets Current. Cash Accounts

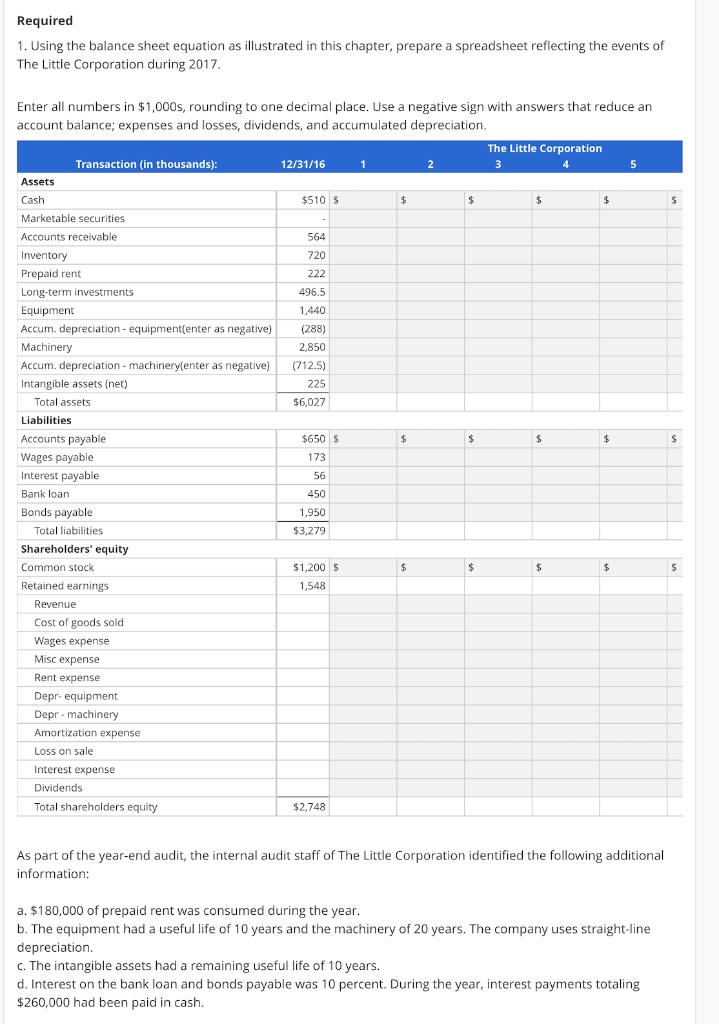

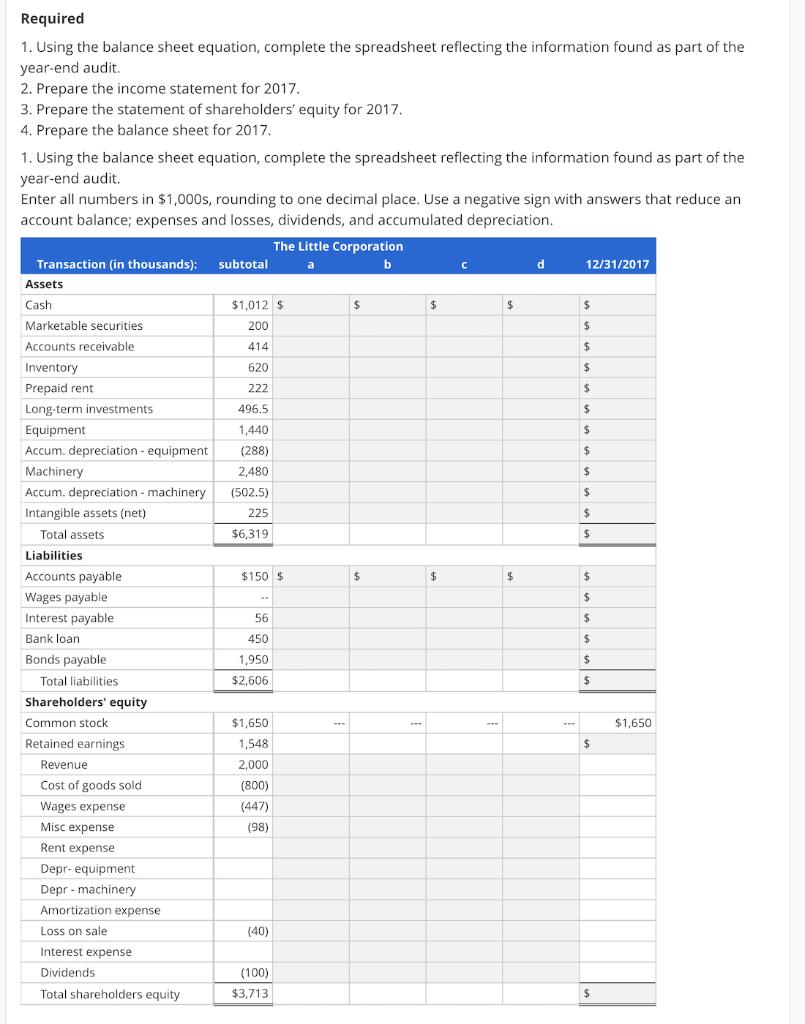

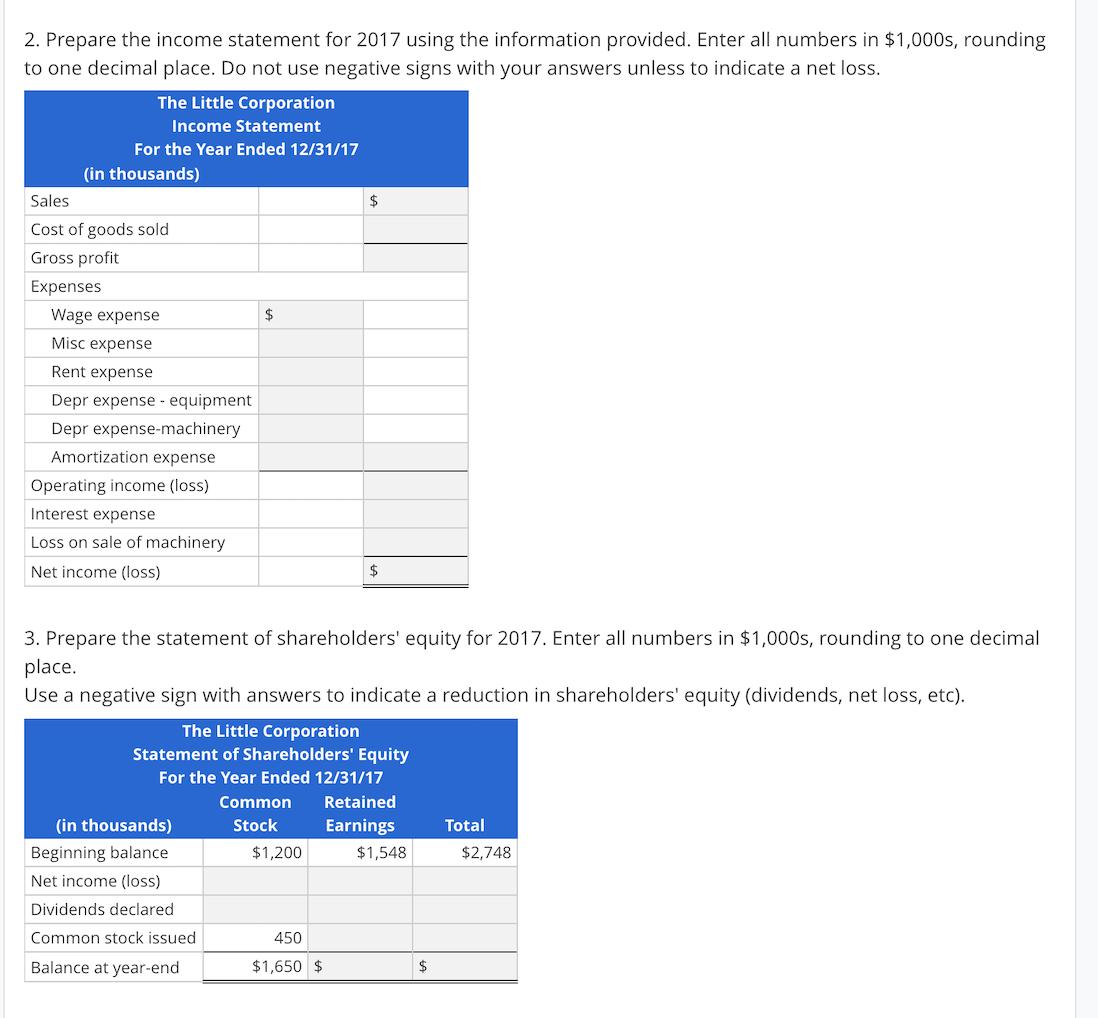

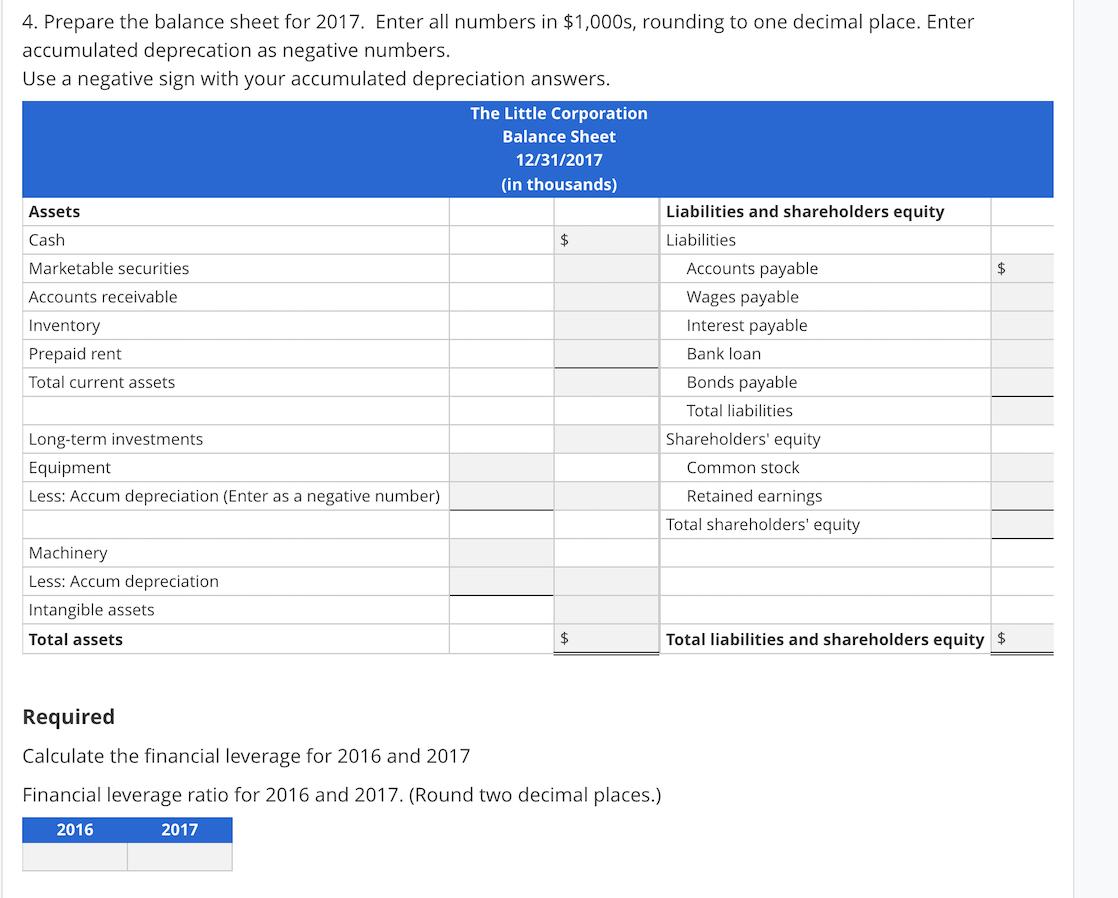

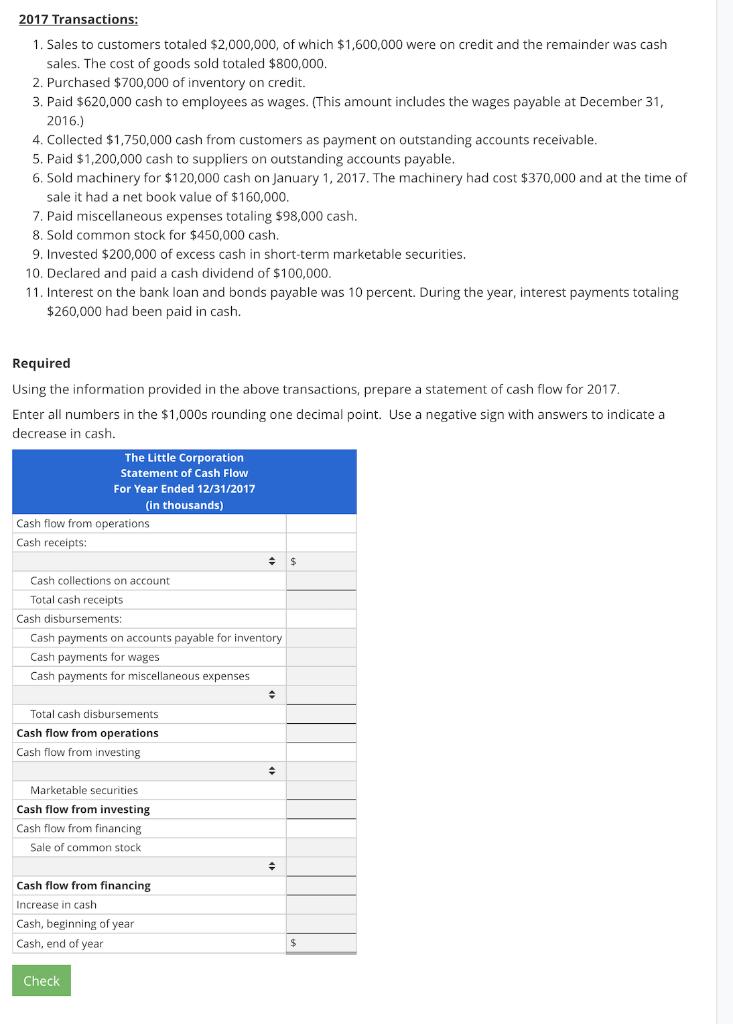

Presented below is the year-end 2016 balance sheet for The Little Corporation THE LITTLE CORPORATION Balance Sheet December 31, 2016 Assets Current. Cash Accounts receivable (net) Inventory. Prepaid rent Total current assets Noncurrent Long-term investments Equipment Less Accum. depreciation Machinery Less Accum. Depreciation Intangible assets (net) Total assets $1,440,000 (288,000) 2,850,000 (712,500) $510,000 Accounts payable 564,000 Wages payable 720,000 Interest payable 222,000 Total current liabilities 2,016,000 Noncurrent liabilities Bank loan Bonds payable 496,500 Liabilities & Shareholders' Equity Current liabilities 1,152,000 Total liabilities Shareholders' equity Common stock Retained earnings Total shar ders' equity $650,000 173,000 56,000 879,000 450,000 1,950,000 3,279,000 1,200,000 1,548,000 2,748,000 2,137,500 225,000 $6,027,000 Total liabilities & shareholders' equity $6,027,000 7. Paid miscellaneous expenses totaling $98,000 cash. 8. Sold common stock for $450,000 cash. 9. Invested $200,000 of excess cash in short-term marketable securities. 10. Declared and paid a cash dividend of $100,000. During 2017, the company entered into the following events: 1. Sales to customers totaled $2,000,000, of which $1,600,000 were on credit and the remainder was cash sales. The cost of goods sold totaled $800,000. 2. Purchased $700,000 of inventory on credit. 3. Paid $620,000 cash to employees as wages. (This amount includes the wages payable at December 31, 2016.) 4. Collected $1,750,000 cash from customers as payment on outstanding accounts receivable. 5. Paid $1,200,000 cash to suppliers on outstanding accounts payable. 6. Sold machinery for $120,000 cash on January 1, 2017. The machinery had cost $370,000 and at the time of sale it had a net book value of $160,000. Required 1. Using the balance sheet equation as illustrated in this chapter, prepare a spreadsheet reflecting the events of The Little Corporation during 2017. Enter all numbers in $1,000s, rounding to one decimal place. Use a negative sign with answers that reduce an account balance; expenses and losses, dividends, and accumulated depreciation. Assets Cashi Transaction (in thousands): Marketable securities Accounts receivable Inventory Prepaid rent Long-term investments Equipment Accum. depreciation - equipment(enter as negative) Machinery Accum. depreciation - machinery(enter as negative) Intangible assets (net) Total assets Liabilities Accounts payable Wages payable Interest payable Bank loan Bonds payable Total liabilities Shareholders' equity Common stock Retained earnings Revenue Cost of goods sold Wages expense Misc expense Rent expense Depr-equipment Depr - machinery Amortization expense Loss on sale Interest expense Dividends Total shareholders equity 12/31/16 $510 S 564 720 222 496.5 1,440 (288) 2,850. (712.5) 225 $6,027 $650 $ 173 56 450 1,950 $3,279 $1,200 $ 1,548 $2,748 1 $ $ $ 2 $ $ $ The Little Corporation 3 4 $ $ $ $ $ $ 5 As part of the year-end audit, the internal audit staff of The Little Corporation identified the following additional information: a. $180,000 of prepaid rent was consumed during the year. b. The equipment had a useful life of 10 years and the machinery of 20 years. The company uses straight-line depreciation. c. The intangible assets had a remaining useful life of 10 years. d. Interest on the bank loan and bonds payable was 10 percent. During the year, interest payments totaling $260,000 had been paid in cash. S $ Required 1. Using the balance sheet equation, complete the spreadsheet reflecting the information found as part of the year-end audit. 2. Prepare the income statement for 2017. 3. Prepare the statement of shareholders' equity for 2017. 4. Prepare the balance sheet for 2017. 1. Using the balance sheet equation, complete the spreadsheet reflecting the information found as part of the year-end audit. Enter all numbers in $1,000s, rounding to one decimal place. Use a negative sign with answers that reduce an account balance; expenses and losses, dividends, and accumulated depreciation. Transaction (in thousands): subtotal Assets Cash Marketable securities Accounts receivable Inventory Prepaid rent Long-term investments Equipment Accum. depreciation - equipment Machinery Accum. depreciation - machinery. Intangible assets (net) Total assets Liabilities Accounts payable Wages payable Interest payable Bank loan Bonds payable Total liabilities Shareholders' equity Common stock Retained earnings. Revenue Cost of goods sold Wages expense Misc expense Rent expense Depr- equipment Depr machinery Amortization expense Loss on sale Interest expense Dividends Total shareholders equity $1,012 $ 200 414 620 222 496.5 1,440 (288) 2,480 (502.5) 225 $6,319 $150 $ 56 450 1,950 $2,606 $1,650 1,548 2,000 (800) (447) (98) The Little Corporation a b (40) (100) $3,713 $ $ $ $ $ $ d T 12/31/2017 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $1,650 2. Prepare the income statement for 2017 using the information provided. Enter all numbers in $1,000s, rounding to one decimal place. Do not use negative signs with your answers unless to indicate a net loss. The Little Corporation Income Statement For the Year Ended 12/31/17 (in thousands) Sales Cost of goods sold Gross profit Expenses Wage expense Misc expense Rent expense Depr expense - equipment Depr expense-machinery Amortization expense Operating income (loss) Interest expense Loss on sale of machinery Net income (loss) $ (in thousands) Beginning balance Net income (loss) Dividends declared Common stock issued Balance at year-end 3. Prepare the statement of shareholders' equity for 2017. Enter all numbers in $1,000s, rounding to one decimal place. Use a negative sign with answers to indicate a reduction in shareholders' equity (dividends, net loss, etc). The Little Corporation Statement of Shareholders' Equity For the Year Ended 12/31/17 Common Stock $ $1,200 $ 450 $1,650 $ Retained Earnings $1,548 $ Total $2,748 4. Prepare the balance sheet for 2017. Enter all numbers in $1,000s, rounding to one decimal place. Enter accumulated deprecation as negative numbers. Use a negative sign with your accumulated depreciation answers. Assets Cash Marketable securities Accounts receivable Inventory Prepaid rent Total current assets Long-term investments Equipment Less: Accum depreciation (Enter as a negative number) Machinery Less: Accum depreciation Intangible assets Total assets The Little Corporation Balance Sheet 2017 12/31/2017 (in thousands) $ Required Calculate the financial leverage for 2016 and 2017 Financial leverage ratio for 2016 and 2017. (Round two decimal places.) 2016 Liabilities and shareholders equity Liabilities Accounts payable Wages payable Interest payable Bank loan. Bonds payable Total liabilities Shareholders' equity Common stock Retained earnings Total shareholders' equity $ Total liabilities and shareholders equity $ 2017 Transactions: 1. Sales to customers totaled $2,000,000, of which $1,600,000 were on credit and the remainder was cash sales. The cost of goods sold totaled $800,000. 2. Purchased $700,000 of inventory on credit. 3. Paid $620,000 cash to employees as wages. (This amount includes the wages payable at December 31, 2016.) 4. Collected $1,750,000 cash from customers as payment on outstanding accounts receivable. 5. Paid $1,200,000 cash to suppliers on outstanding accounts payable. 6. Sold machinery for $120,000 cash on January 1, 2017. The machinery had cost $370,000 and at the time of sale it had a net book value of $160,000. 7. Paid miscellaneous expenses totaling $98,000 cash. 8. Sold common stock for $450,000 cash. 9. Invested $200,000 of excess cash in short-term marketable securities. 10. Declared and paid a cash dividend of $100,000. 11. Interest on the bank loan and bonds payable was 10 percent. During the year, interest payments totaling $260,000 had been paid in cash. Required Using the information provided in the above transactions, prepare a statement of cash flow for 2017. Enter all numbers in the $1,000s rounding one decimal point. Use a negative sign with answers to indicate a decrease in cash. The Little Corporation Statement of Cash Flow For Year Ended 12/31/2017 (in thousands) Cash flow from operations Cash receipts: Cash collections on account Total cash receipts. Cash disbursements: Cash payments on accounts payable for inventory. Cash payments for wages Cash payments for miscellaneous expenses Total cash disbursements Cash flow from operations Cash flow from investing Marketable securities Cash flow from investing Cash flow from financing Sale of common stock, Cash flow from financing Increase in cash Cash, beginning of year Cash, end of year Check + + = $ $

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

1 Journal Entries Date 11 12 2 3 4 5 6 7 8 9 10 Date 1 21 22 3 4 Cash Accounts Receivable Sales Reve... View full answer

Get step-by-step solutions from verified subject matter experts