Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm's financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows associated with each project. These estimates are shown in the following table. a. The range of annual cash inflows for project A is $ . (Round to the nearest dollar.) The range of annual cash inflows for project B is $ . (Round to the nearest dollar.) b. Assume that the firm's cost of capital is 10.4 % and that both projects have 20-year lives. Complete the NPV table below for project A: (Round to two decimal points.) NPVs Outcome Project A Pessimistic $ Most Likely $ Optimistic $ Range $ Complete the NPV table below for project B: (Round to two decimal points.) NPVs Outcome Project B Pessimistic $ Most Likely $ Optimistic $ Range $ c. Based on the findings above, we can conclude that Project (enter 'A' or 'B') is more risky than Project (enter 'A' or 'B'). Project (enter 'A' or 'B') has the possibility of a greater return.

Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm's financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows associated with each project. These estimates are shown in the following table. a. The range of annual cash inflows for project A is $ . (Round to the nearest dollar.) The range of annual cash inflows for project B is $ . (Round to the nearest dollar.) b. Assume that the firm's cost of capital is 10.4 % and that both projects have 20-year lives. Complete the NPV table below for project A: (Round to two decimal points.) NPVs Outcome Project A Pessimistic $ Most Likely $ Optimistic $ Range $ Complete the NPV table below for project B: (Round to two decimal points.) NPVs Outcome Project B Pessimistic $ Most Likely $ Optimistic $ Range $ c. Based on the findings above, we can conclude that Project (enter 'A' or 'B') is more risky than Project (enter 'A' or 'B'). Project (enter 'A' or 'B') has the possibility of a greater return.

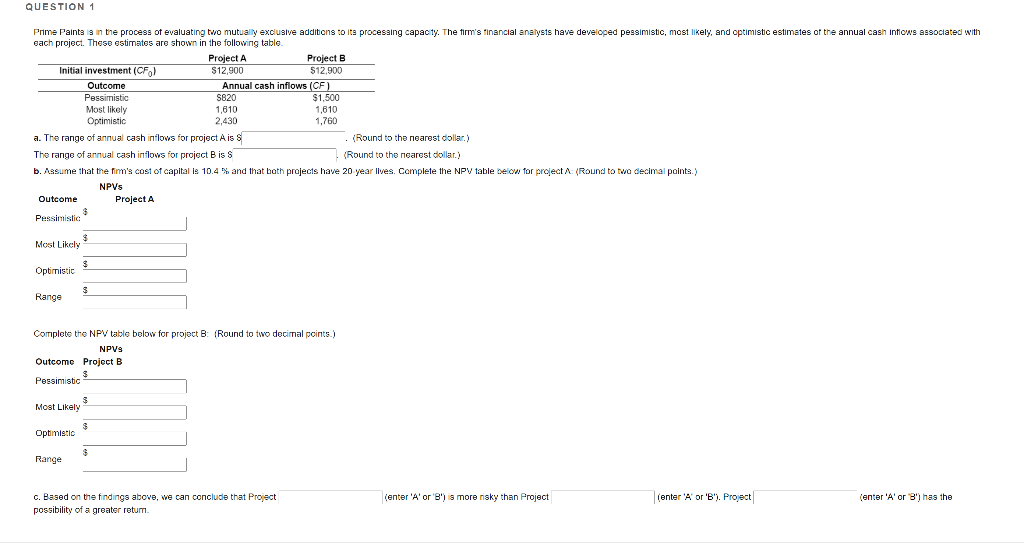

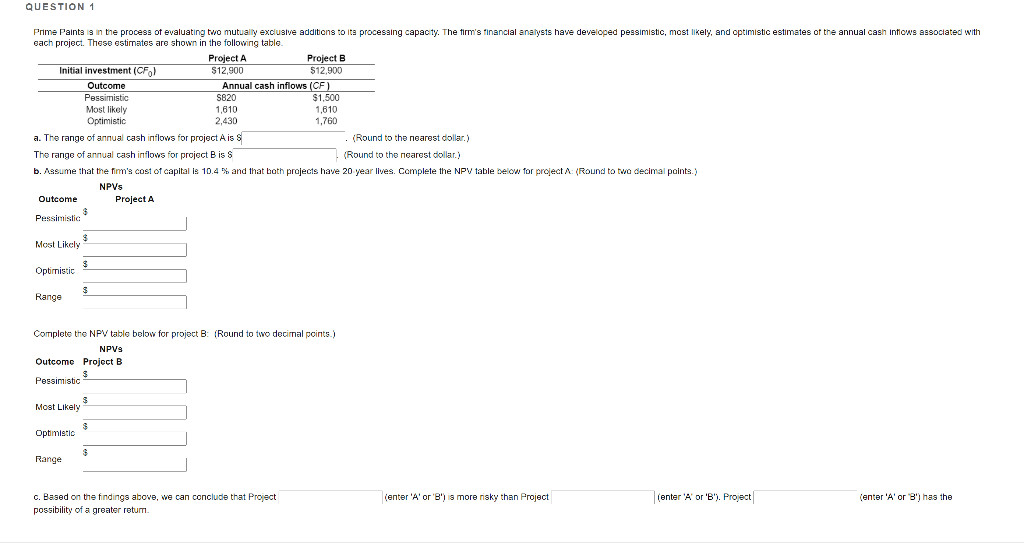

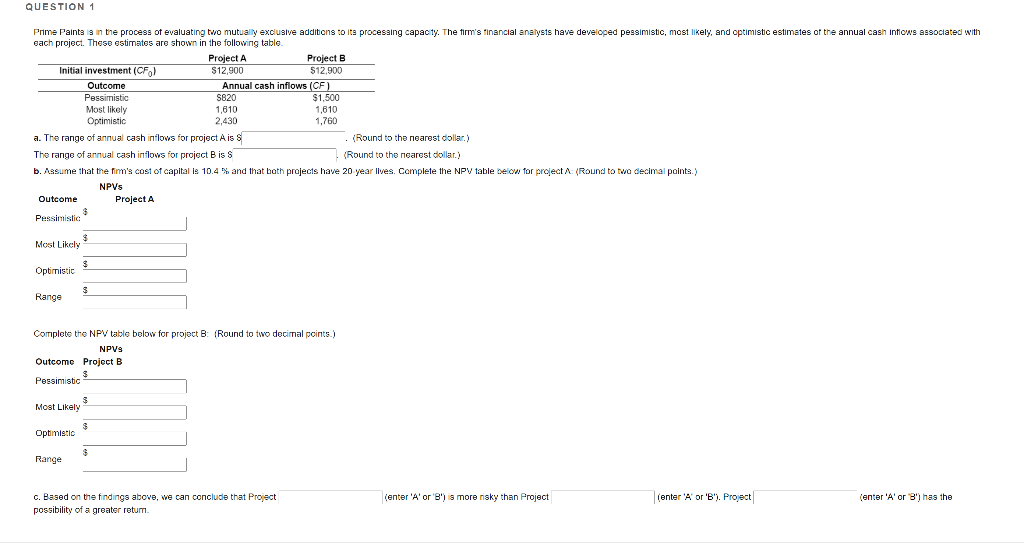

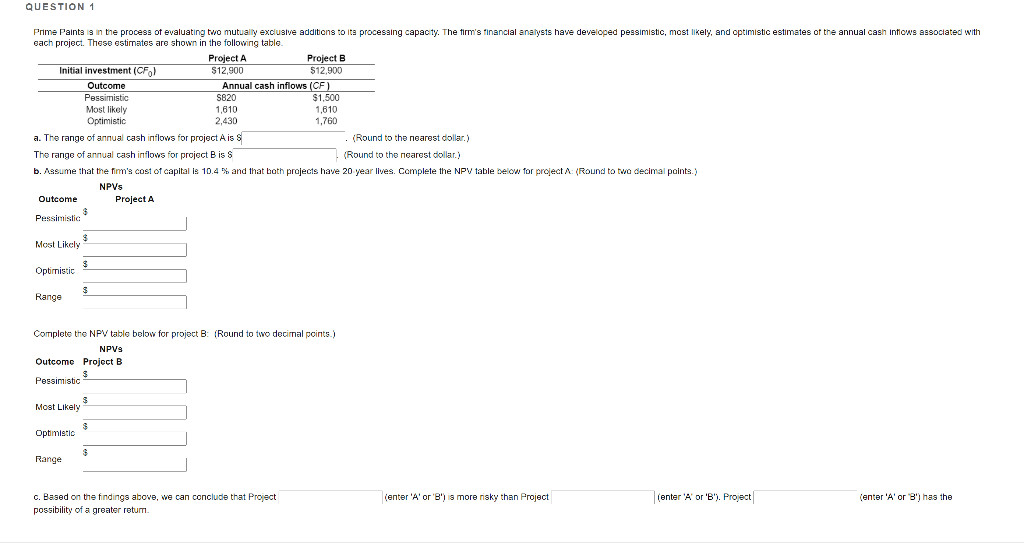

QUESTION 1 Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capac ty. The firm's financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash Intiows associated with each project. These estimates are shown in the following table. Project A Project B Initial investment (CF) $12,900 $12,900 Outcome Annual cash inflows (CF) Pessimistic S820 $1,500 Most likely 1.610 1,610 Optimistic 2,430 1,760 a. The range of annual cash inflows for project Ais S (Round to the nearest dollar) The range of annual cash inflows for project Bis S (Round to the nearest dollar.) b. Assume that the firm's cost of capital is 10.4 %, and that both projects have 20 year lives. Complete the NPV table below for project A: (Round to two decimal paints. NPVs Outcome Project A Pessimisties $ Most Likely $ Optimistic $ Range Complete the NPV table below for project B (Round to two decimal points.) NPVS Outcome Project B $ Pessimistic $ Most Likely $ Optimistic $ Range (enter 'A' or 'B') is more risky than Project (enter 'A' or 'B'), Project (enter 'A' or 'B') has the C. Based on the findings above, we can conclude that Project possibility of a greater retum. QUESTION 1 Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capac ty. The firm's financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash Intiows associated with each project. These estimates are shown in the following table. Project A Project B Initial investment (CF) $12,900 $12,900 Outcome Annual cash inflows (CF) Pessimistic S820 $1,500 Most likely 1.610 1,610 Optimistic 2,430 1,760 a. The range of annual cash inflows for project Ais S (Round to the nearest dollar) The range of annual cash inflows for project Bis S (Round to the nearest dollar.) b. Assume that the firm's cost of capital is 10.4 %, and that both projects have 20 year lives. Complete the NPV table below for project A: (Round to two decimal paints. NPVs Outcome Project A Pessimisties $ Most Likely $ Optimistic $ Range Complete the NPV table below for project B (Round to two decimal points.) NPVS Outcome Project B $ Pessimistic $ Most Likely $ Optimistic $ Range (enter 'A' or 'B') is more risky than Project (enter 'A' or 'B'), Project (enter 'A' or 'B') has the C. Based on the findings above, we can conclude that Project possibility of a greater retum

Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm's financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows associated with each project. These estimates are shown in the following table. a. The range of annual cash inflows for project A is $ . (Round to the nearest dollar.) The range of annual cash inflows for project B is $ . (Round to the nearest dollar.) b. Assume that the firm's cost of capital is 10.4 % and that both projects have 20-year lives. Complete the NPV table below for project A: (Round to two decimal points.) NPVs Outcome Project A Pessimistic $ Most Likely $ Optimistic $ Range $ Complete the NPV table below for project B: (Round to two decimal points.) NPVs Outcome Project B Pessimistic $ Most Likely $ Optimistic $ Range $ c. Based on the findings above, we can conclude that Project (enter 'A' or 'B') is more risky than Project (enter 'A' or 'B'). Project (enter 'A' or 'B') has the possibility of a greater return.

Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm's financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows associated with each project. These estimates are shown in the following table. a. The range of annual cash inflows for project A is $ . (Round to the nearest dollar.) The range of annual cash inflows for project B is $ . (Round to the nearest dollar.) b. Assume that the firm's cost of capital is 10.4 % and that both projects have 20-year lives. Complete the NPV table below for project A: (Round to two decimal points.) NPVs Outcome Project A Pessimistic $ Most Likely $ Optimistic $ Range $ Complete the NPV table below for project B: (Round to two decimal points.) NPVs Outcome Project B Pessimistic $ Most Likely $ Optimistic $ Range $ c. Based on the findings above, we can conclude that Project (enter 'A' or 'B') is more risky than Project (enter 'A' or 'B'). Project (enter 'A' or 'B') has the possibility of a greater return.