Question: Print a Problem 8-43 (Algorithmic) (LO. 2, 3, 9) On January 20, 2017, Javier Sanchez purchased and placed in service a new 7-year class asset

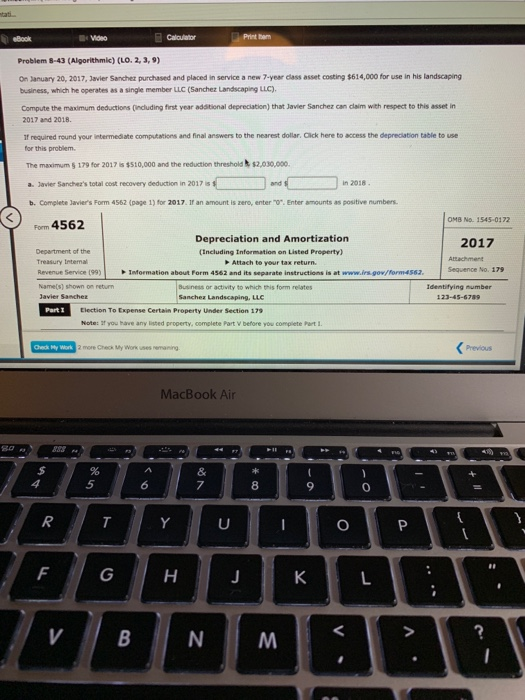

Print a Problem 8-43 (Algorithmic) (LO. 2, 3, 9) On January 20, 2017, Javier Sanchez purchased and placed in service a new 7-year class asset costing $614,000 for use in his landscaping business, which he operates as a single member LLC (Sanchez Landscaping LLC). Compute the maximum deductions Cincluding first year additional depreciation) that Javier Sanchez can claim with respect to this asset in 2017 and 2018 If required round your intermediate computations and final answers to the nearest dollar. Cick here to access the deprecation table to use for this problem The manimum 179 for 2017 sts 10,000 and the reduction threshold $2,030,000. a. Javier Sanchez's total cost recovery deduction in 2017 is in 2018 b. Complete Javier's Form 4562 (page 1) for 2017. If an amount is zero, enter "". Enter amounts as positive numbers. OMB No. 1545-0172 Fom 4562 Depreciation and Amortization (Including Information on Listed Property) 2017 Department of the Treasury teternal Revenue Service t Name(s) shown on return Davier Sanchez Attach to your Sequence No. 179 Information about Form 4562 and its separate instructions is at www.irs gov/orm4562 Identifying number Buiness or activity to Sanchez Landscaping. LLC Part Election To Expense Certain Property Under section 179 Note: 3 you have any listed property, complete Part v before you compiete Part 1 2 more Check My Work uses nemaning MacBook Air 8 9 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts