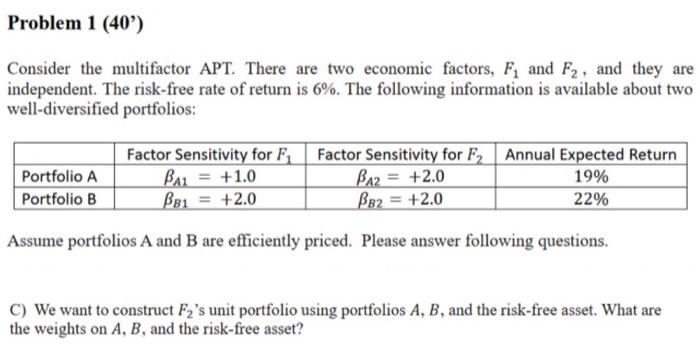

Question: Problem 1 (40') Consider the multifactor APT. There are two economic factors, F, and F2, and they are independent. The risk-free rate of return is

Problem 1 (40') Consider the multifactor APT. There are two economic factors, F, and F2, and they are independent. The risk-free rate of return is 6%. The following information is available about two well-diversified portfolios: Portfolio A Portfolio B Factor Sensitivity for F, Factor Sensitivity for F, Annual Expected Return Bai = +1.0 BA2 = +2.0 19% Bei = +2.0 BB2 = +2.0 22% Assume portfolios A and B are efficiently priced. Please answer following questions. C) We want to construct Fy's unit portfolio using portfolios A, B, and the risk-free asset. What are the weights on A, B, and the risk-free asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts