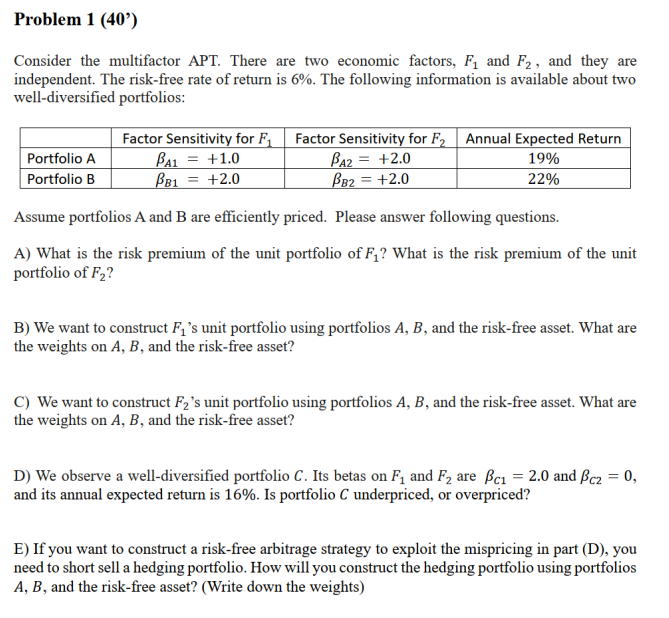

Question: The question is attached. Problem I (40') Consider the multifactor APT. There are two economic factors, F1 and F2, and they.r are independent. The risk-free

The question is attached.

Problem I (40') Consider the multifactor APT. There are two economic factors, F1 and F2, and they.r are independent. The risk-free rate of return is 6%. The following information is available about two well-diversied portfolios: Factor Sensitioitmr for F Factor L'iensitisilnlr for F Annual Expected Fteturn Portfolio A Assume portfolios A and B are efficiently.Ir priced. Please answer following questions. A) What is the risk premium of the unit portfolio of F1? What is the risk premium of the unit portfolio of F2? B] We want to construct Fl's unit portfolio using portfolios A, B, and the risk-free asset. What are the weights on A, B, and the risk-free asset? C] We 1Iii-font to construct F: '5 unit portfolio using portfolios A E, and the risk-free asset. What are the weights on A, B, and the risk-ee asset? D] We observe a welldiversified portfolio C. Its hetas on F1 and it2 are {in = 2.0 and u = , and its annual expected return is 115%. Is portfolio (2' underpriced, or overpriced? E} If you want to construct a riskofree arbitrage strategyr to exploit the mispricing in part (D), you need to short sells hedging portfolio How will you construct the hedging portfolio using portfolios it, 34, and the risk-free asset? (Write down the weights)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts