Question: Problem 1. (5 Points) We have a financial market with many stocks and a risk-free asset. Assume that the expected return and risk of the

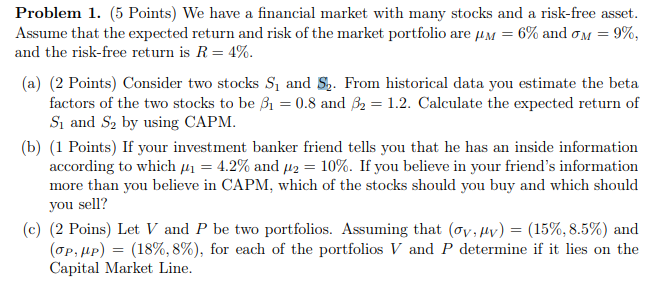

Problem 1. (5 Points) We have a financial market with many stocks and a risk-free asset. Assume that the expected return and risk of the market portfolio are um = 6% and om = 9%, and the risk-free return is R = 4%. (a) (2 Points) Consider two stocks S, and S. From historical data you estimate the beta factors of the two stocks to be B1 = 0.8 and B2 = 1.2. Calculate the expected return of Si and S, by using CAPM. (b) (1 Points) If your investment banker friend tells you that he has an inside information according to which y1 = 4.2% and M2 = 10%. If you believe in your friend's information more than you believe in CAPM, which of the stocks should you buy and which should you sell? (C) (2 Poins) Let V and P be two portfolios. Assuming that (ov, uv) = (15%, 8.5%) and (OP, Mp) = (18%,8%), for each of the portfolios V and P determine if it lies on the Capital Market Line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts