Question: Problem 1 A binomial tree for the stock price can be described by a Bernoulli process. A Bernoulli process is a series of independent and

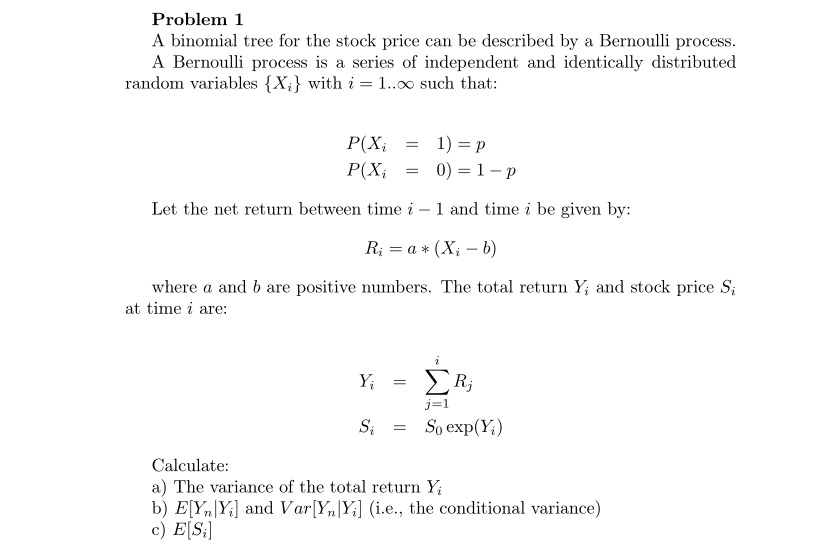

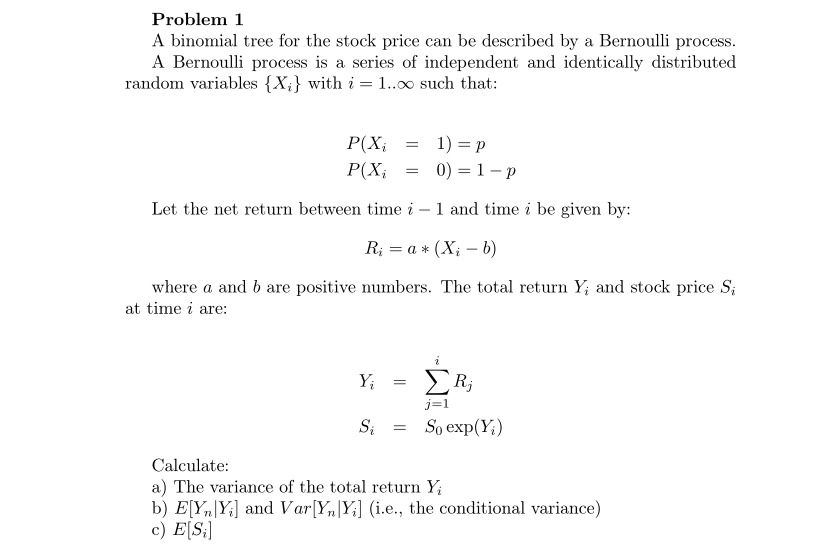

Problem 1 A binomial tree for the stock price can be described by a Bernoulli process. A Bernoulli process is a series of independent and identically distributed random variables {X,} with i = 1..co such that: P(X, = 1) =p P(X; = 0) =1-p Let the net return between time i - 1 and time i be given by: Ri = a * (X; - b) where a and b are positive numbers. The total return Y, and stock price S; at time i are: Yi = R; j=1 Si = So exp(Yi) Calculate: a) The variance of the total return Y b) E[Y, |Y] and Var[Y, |Y] (i.e., the conditional variance) c) E[Si]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts