Question: Problem 1 A Bookmark this page Problem 1 (a) 0.0/2.0 points (ungraded) (a) A firm with excess cash in its bank account should use the

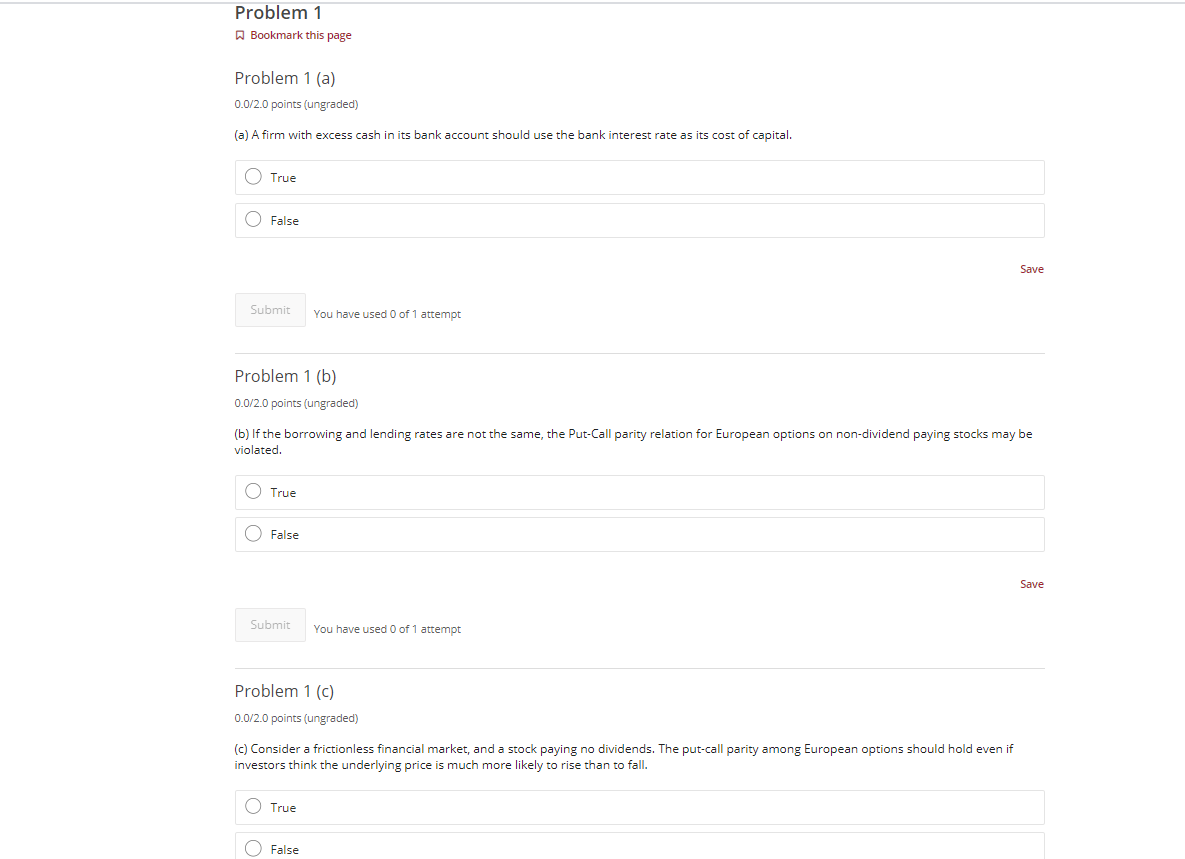

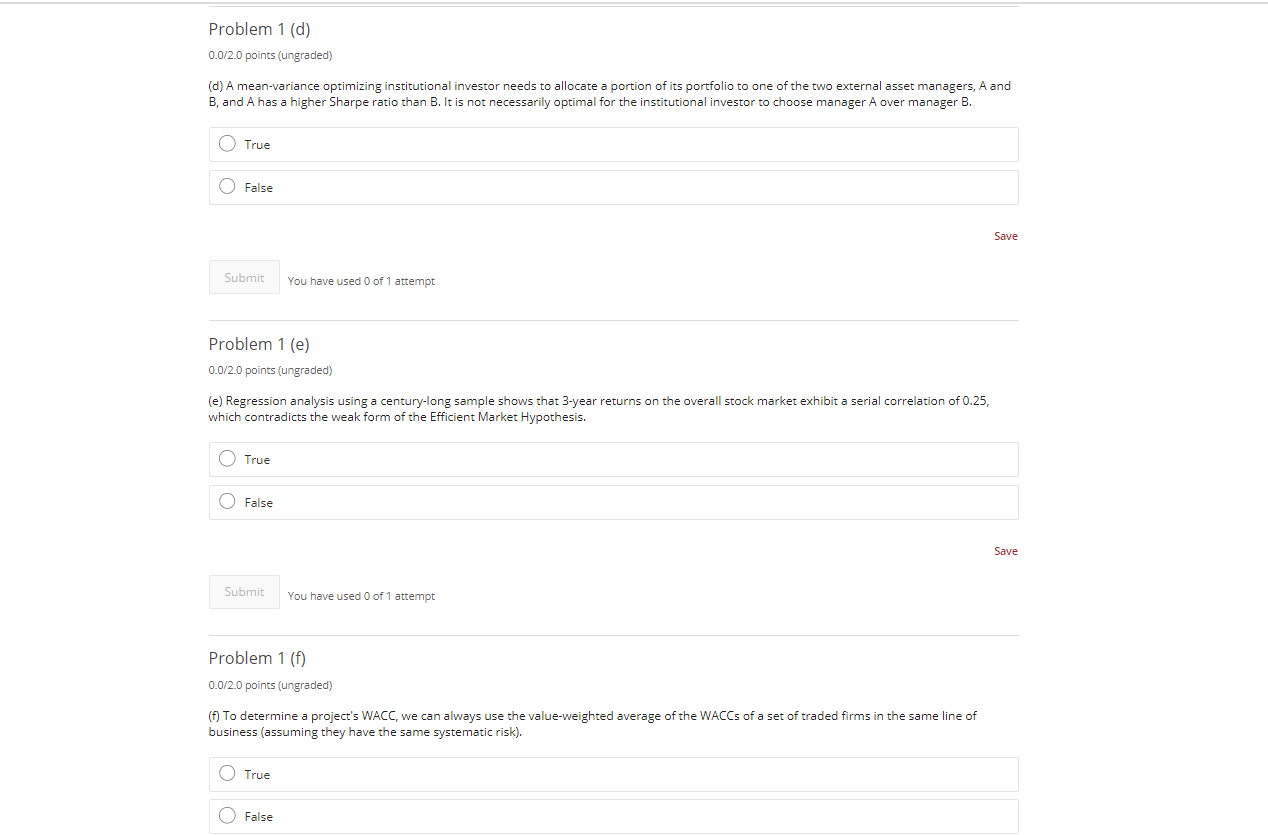

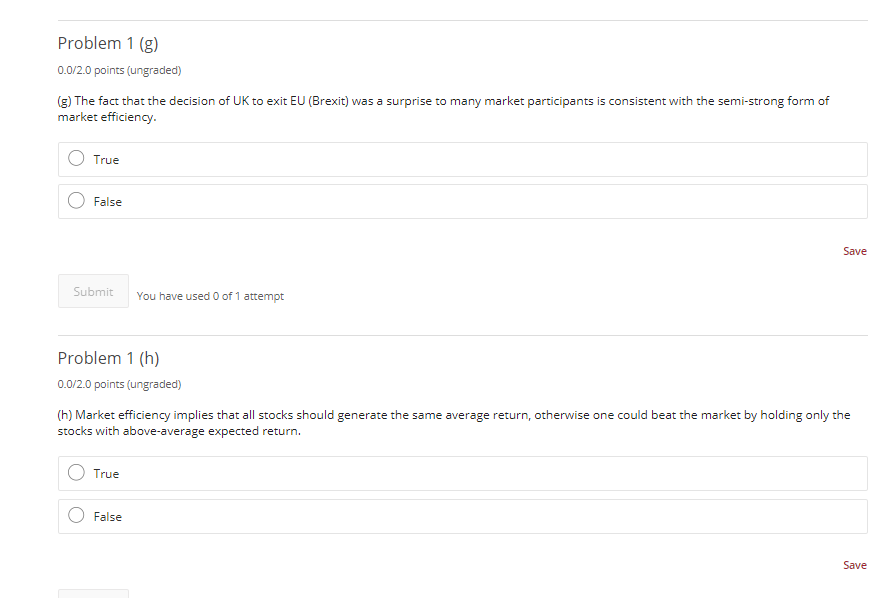

Problem 1 A Bookmark this page Problem 1 (a) 0.0/2.0 points (ungraded) (a) A firm with excess cash in its bank account should use the bank interest rate as its cost of capital. O True O False Save Submit You have used 0 of 1 attempt Problem 1 (b) 0.0/2.0 points (ungraded) (b) If the borrowing and lending rates are not the same, the Put-Call parity relation for European options on non-dividend paying stocks may be violated. O True O False Save Submit You have used 0 of 1 attempt Problem 1 (c) 0.0/2.0 points (ungraded) (c) Consider a frictionless financial market, and a stock paying no dividends. The put-call parity among European options should hold even if investors think the underlying price is much more likely to rise than to fall. O True O False Problem 1 (d) 0.0/2.0 points (ungraded) (d) A mean-variance optimizing institutional investor needs to allocate a portion of its portfolio to one of the two external asset managers, A and B, and A has a higher Sharpe ratio than B. It is not necessarily optimal for the institutional investor to choose manager A over manager B. O True O False Save Submit You have used 0 of 1 attempt Problem 1 (e) 0.0/2.0 points (ungraded) (e) Regression analysis using a century-long sample shows that 3-year returns on the overall stock market exhibit a serial correlation of 0.25, which contradicts the weak form of the Efficient Market Hypothesis. O True False Save Submit You have used 0 of 1 attempt Problem 1 (1) 0.0/2.0 points (ungraded) () To determine a project's WACC, we can always use the value-weighted average of the WACCs of a set of traded firms in the same line of business (assuming they have the same systematic risk). O True O False Problem 1 (g) 0.0/2.0 points (ungraded) (E) The fact that the decision of UK to exit EU (Brexit) was a surprise to many market participants is consistent with the semi-strong form of market efficiency. True False Save Submit You have used 0 of 1 attempt Problem 1 (h) 0.0/2.0 points (ungraded) (h) Market efficiency implies that all stocks should generate the same average return, otherwise one could beat the market by holding only the stocks with above-average expected return. True False Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts