Question: Problem 1 An entity purchases a building on December 31, 20x2 at a cost of $9,000,000. On December 31, 20x3, they purchase another building at

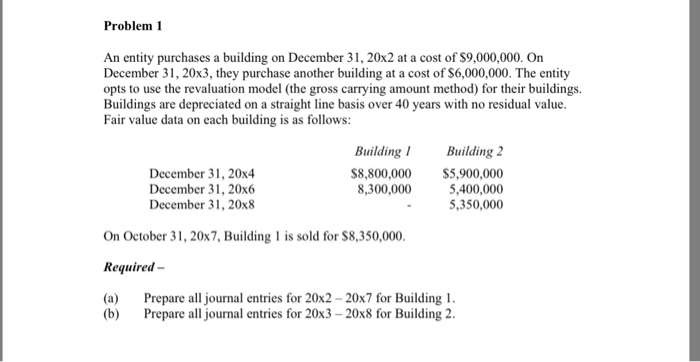

Problem 1 An entity purchases a building on December 31, 20x2 at a cost of $9,000,000. On December 31, 20x3, they purchase another building at a cost of S6,000,000. The entity opts to use the revaluation model (the gross carrying amount method) for their buildings Buildings are depreciated on a straight line basis over 40 years with no residual value. Fair value data on each building is as follows: Building Building 2 December 31,20x4 December 31, 20x6 December 31, 20x8 8,800,000 $5,900,000 5,400,000 5,350,000 8,300,000 On October 31, 20x7, Building 1 is sold for $8,350,000. Required- (a) Prepare all journal entries for 20x2-20x7 for Building . (b) Prepare all journal entries for 20x3-20x8 for Building 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts