Question: Problem 1 Consider an economy where there are three types of agents. Each type wishes to borrow $500,000 for their small business from your bank.

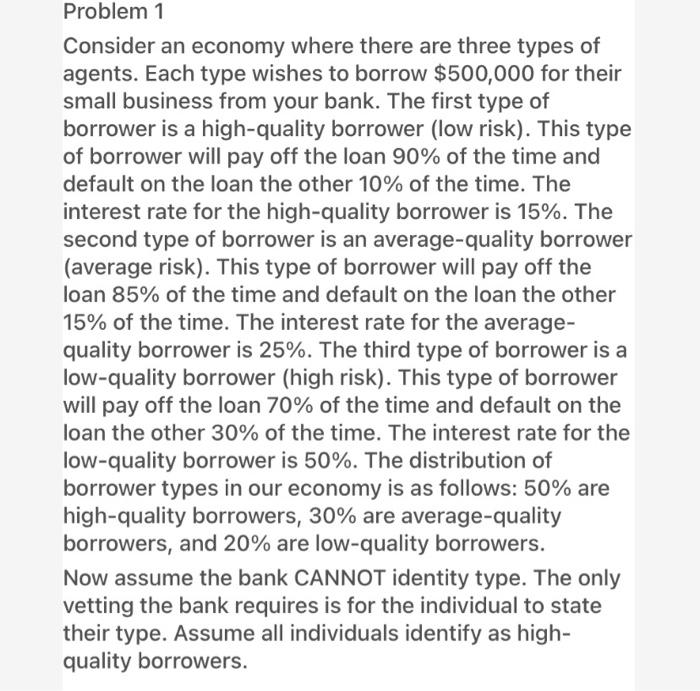

Problem 1 Consider an economy where there are three types of agents. Each type wishes to borrow $500,000 for their small business from your bank. The first type of borrower is a high-quality borrower (low risk). This type of borrower will pay off the loan 90% of the time and default on the loan the other 10% of the time. The interest rate for the high-quality borrower is 15%. The second type of borrower is an average-quality borrower (average risk). This type of borrower will pay off the loan 85% of the time and default on the loan the other 15% of the time. The interest rate for the average- quality borrower is 25%. The third type of borrower is a low-quality borrower (high risk). This type of borrower will pay off the loan 70% of the time and default on the loan the other 30% of the time. The interest rate for the low-quality borrower is 50%. The distribution of borrower types in our economy is as follows: 50% are high-quality borrowers, 30% are average-quality borrowers, and 20% are low-quality borrowers. Now assume the bank CANNOT identity type. The only vetting the bank requires is for the individual to state their type. Assume all individuals identify as high- quality borrowers. d. Calculate the expected NET earnings for the bank (across all types) assuming the bank cannot correctly identify the type (self-identification). e. Calculate the expected interest rate for the bank (across all types) assuming the bank cannot correctly identify the type (self-identification). f. Can this bank still operate under the self-identification rule? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts