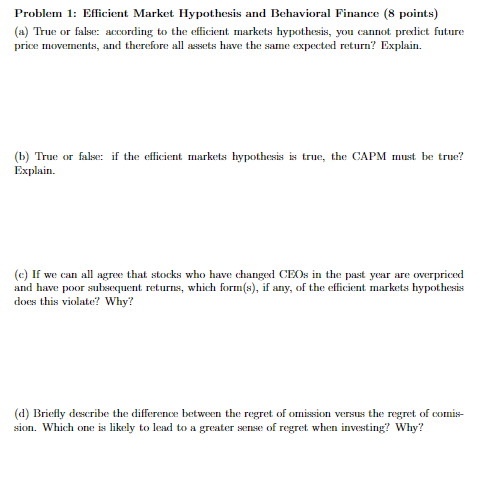

Question: Problem 1: Efficient Market Hypothesis and Behavioral Finance (8 points (a) True or false: according to the efficient markets hypothesis, youcannot predict future price moverments,

Problem 1: Efficient Market Hypothesis and Behavioral Finance (8 points (a) True or false: according to the efficient markets hypothesis, youcannot predict future price moverments, and therefore all assets have the same expected return? Explain. (b) True or false if the efficient markets hypotheisitrue, the CAPMt be true? Explain. and have poor subsequent returns, which fors) if any, of the efficient markets hypothesis does this violate? Why? (d) Briefly describe the difference between the regret of omission versus the regret of coms- sion. Which one is likely to lead to a greatersese of regret when investing? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts