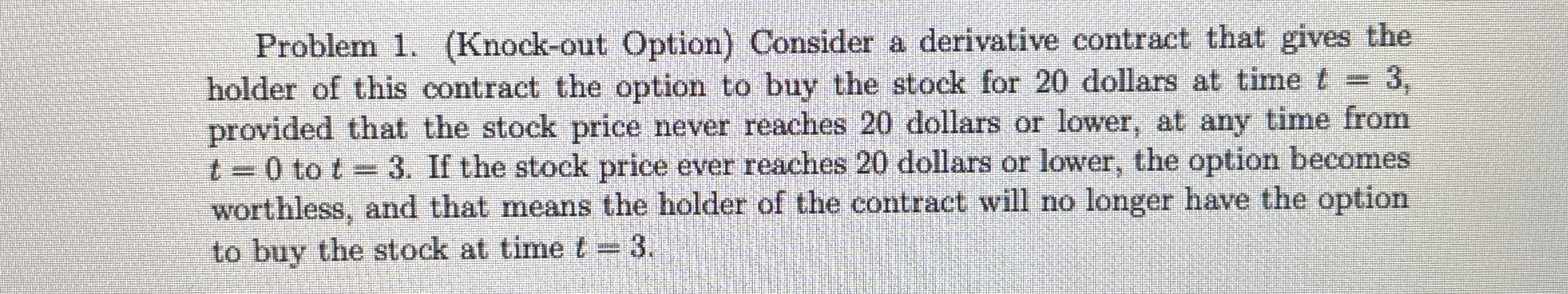

Question: Problem 1 . ( Knock - out Option ) Consider a derivative contract that gives the holder of this contract the option to buy the

Problem Knockout Option Consider a derivative contract that gives the

holder of this contract the option to buy the stock for dollars at time

provided that the stock price never reaches dollars or lower, at any time from

to If the stock price ever reaches dollars or lower, the option becomes

worthless, and that means the holder of the contract will no longer have the option

to buy the stock at time

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock