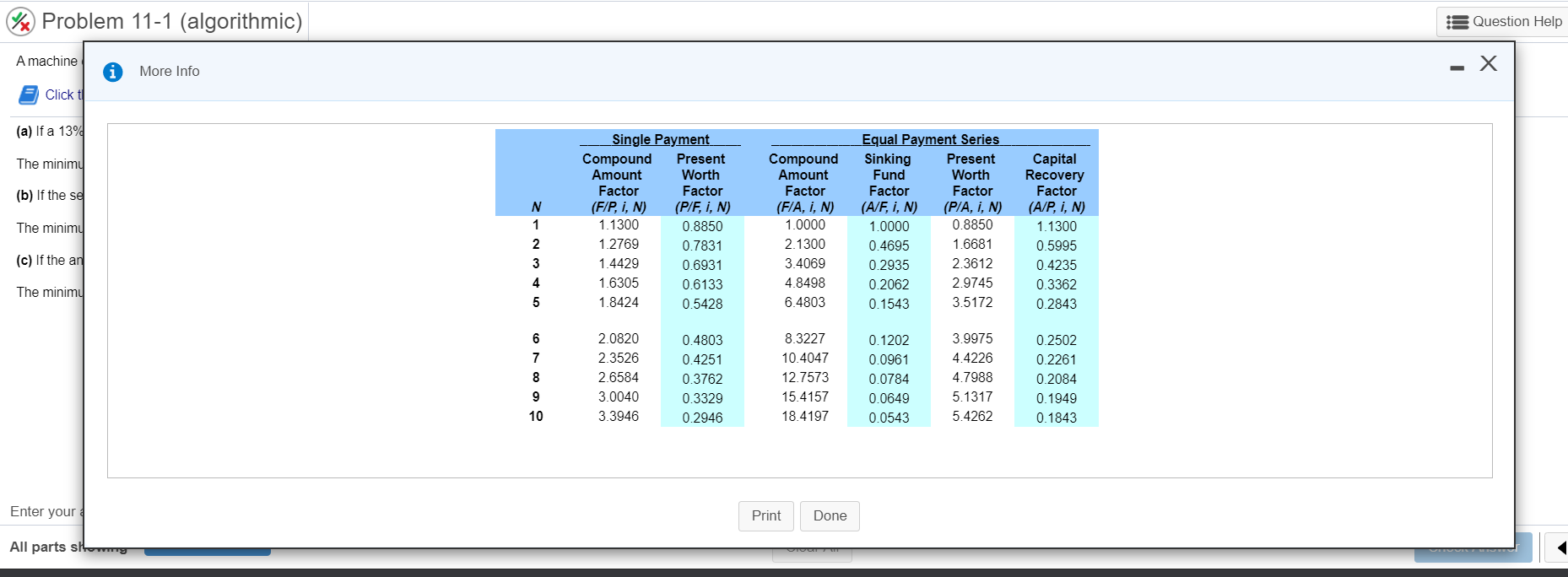

Question: %) Problem 11-1 (algorithmic) Question Help A machine i More Info Click | (a) If a 13% The minimu (b) If the se N The

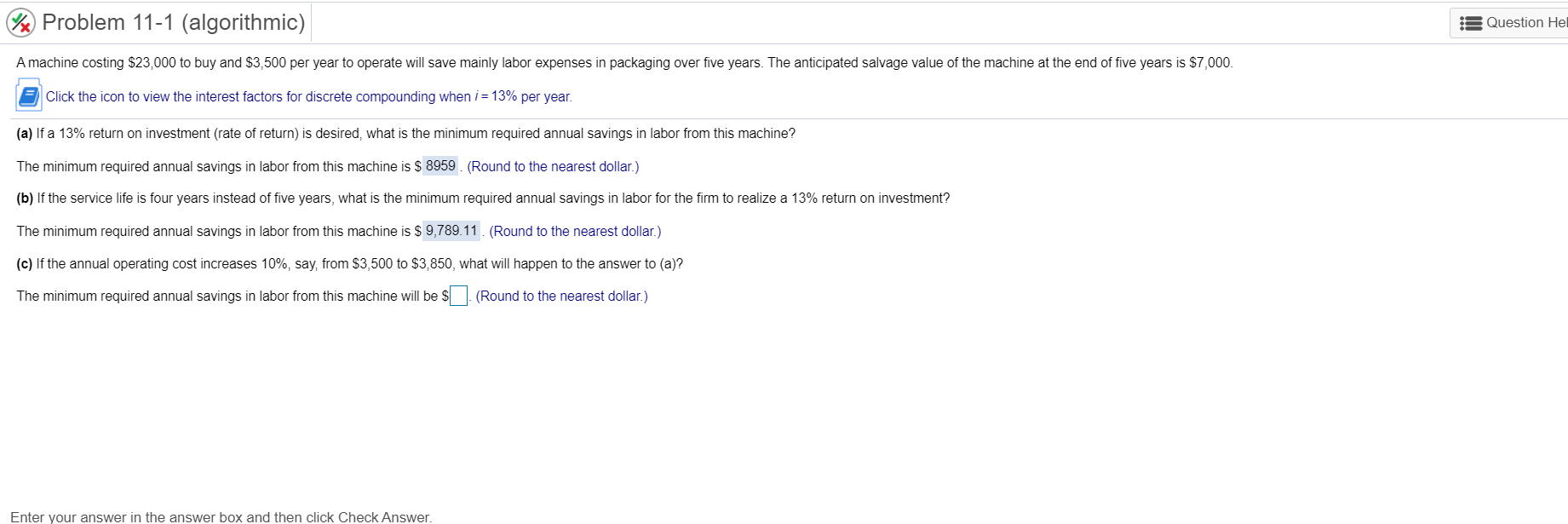

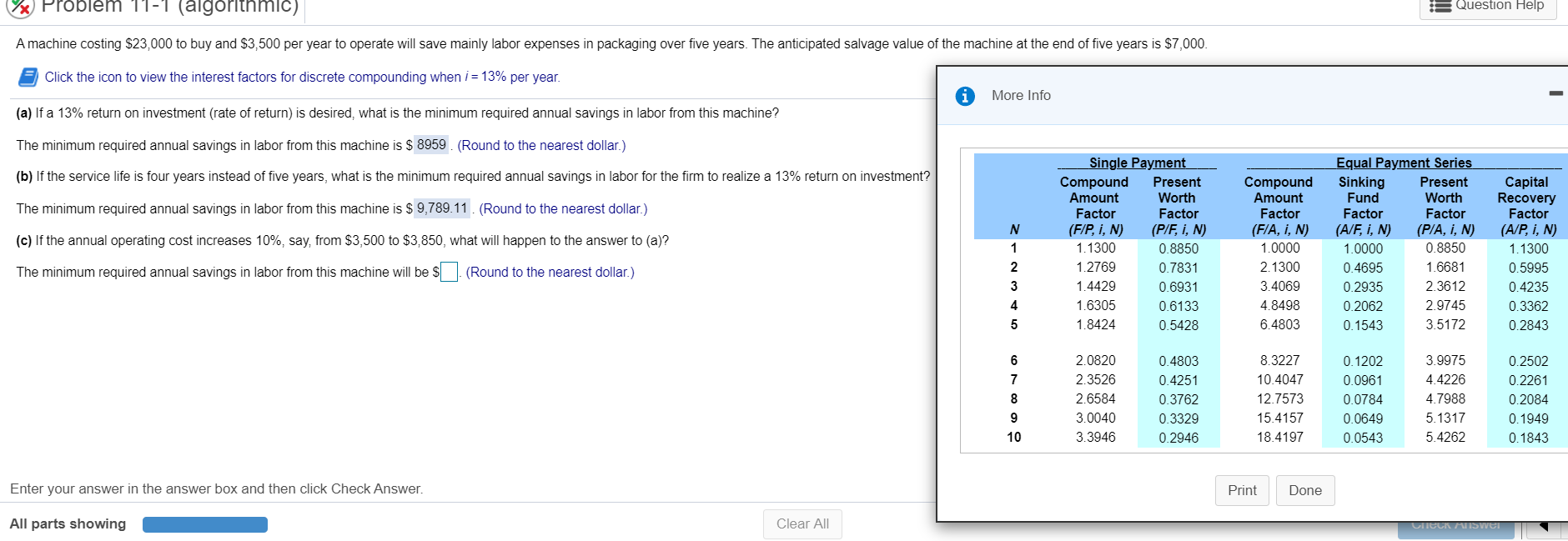

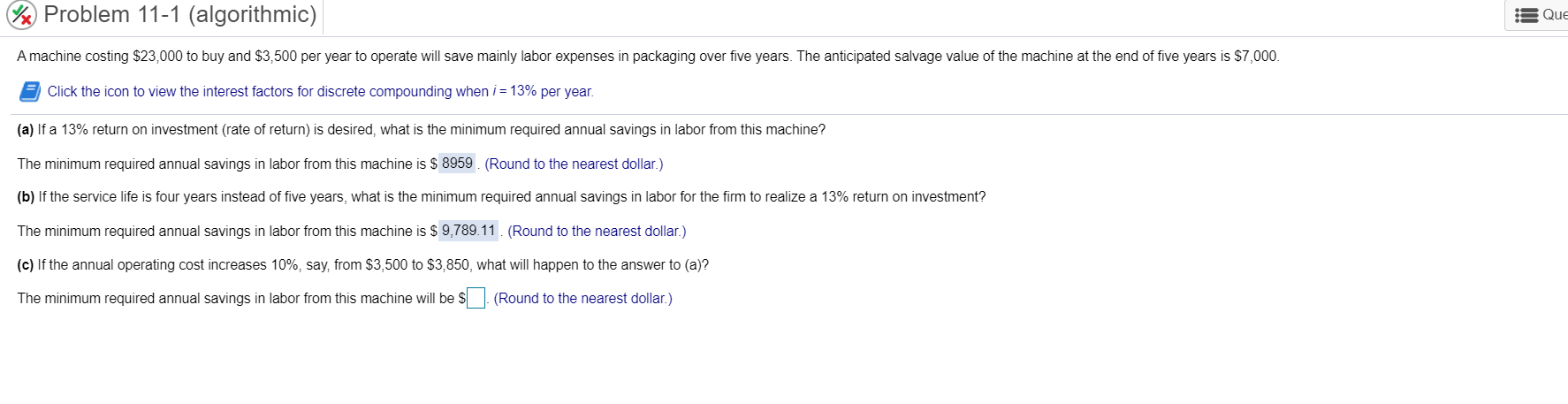

%) Problem 11-1 (algorithmic) Question Help A machine i More Info Click | (a) If a 13% The minimu (b) If the se N The minimu Single Payment Compound Present Amount Worth Factor Factor (F/P, I, N) (P/F, I, N) 1.1300 0.8850 1.2769 0.7831 1.4429 0.6931 1.6305 0.6133 1.8424 0.5428 Compound Amount Factor (F/A, I, N) 1.0000 2.1300 3.4069 4.8498 6.4803 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, I, N) 1.0000 0.8850 0.4695 1.6681 0.2935 2.3612 2.9745 0.1543 3.5172 Capital Recovery Factor (A/P, I, N) 1.1300 0.5995 0.4235 0.3362 0.2843 (c) If the an 2 3 4 0.2062 The minimu 5 6 7 8 9 10 2.0820 2.3526 2.6584 3.0040 3.3946 0.4803 0.4251 0.3762 0.3329 0.2946 8.3227 10.4047 12.7573 15.4157 18.4197 0.1202 0.0961 0.0784 0.0649 0.0543 3.9975 4.4226 4.7988 5.1317 5.4262 0.2502 0.2261 0.2084 0.1949 0.1843 Enter your Print Done All parts slog % Problem 11-1 (algorithmic) is Question Hel A machine costing $23,000 to buy and $3,500 per year to operate will save mainly labor expenses in packaging over five years. The anticipated salvage value of the machine at the end of five years is $7,000. Click the icon to view the interest factors for discrete compounding when i = 13% per year. (a) If a 13% return on investment (rate of return) is desired, what is the minimum required annual savings in labor from this machine? The minimum required annual savings in labor from this machine is $ 8959. (Round to the nearest dollar.) (b) If the service life is four years instead of five years, what is the minimum required annual savings in labor for the firm to realize a 13% return on investment? The minimum required annual savings in labor from this machine is $ 9,789.11. (Round to the nearest dollar.) (c) If the annual operating cost increases 10%, say, from $3,500 to $3,850, what will happen to the answer to (a)? The minimum required annual savings in labor from this machine will be $. (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer. Problem 11-1 (algorithmic) Question Help A machine costing $23,000 to buy and $3,500 per year to operate will save mainly labor expenses in packaging over five years. The anticipated salvage value of the machine at the end of five years is $7,000. Click the icon to view the interest factors for discrete compounding when i = 13% per year. More Info (a) If a 13% return on investment (rate of return) is desired, what is the minimum required annual savings in labor from this machine? The minimum required annual savings in labor from this machine is $ 8959. (Round to the nearest dollar.) (b) If the service life is four years instead of five years, what is the minimum required annual savings in labor for the firm to realize a 13% return on investment? The minimum required annual savings in labor from this machine is $ 9,789.11. (Round to the nearest dollar.) N 1 (c) If the annual operating cost increases 10%, say, from $3,500 to $3,850, what will happen to the answer to (a)? The minimum required annual savings in labor from this machine will be $. (Round to the nearest dollar.) Single Payment Compound Present Amount Worth Factor Factor (FIP, i, N) (P/F, I, N) 1.1300 0.8850 1.2769 0.7831 1.4429 0.6931 1.6305 0.6133 1.8424 0.5428 Compound Amount Factor (F/A, I, N) 1.0000 2.1300 3.4069 4.8498 6.4803 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, I, N) 1.0000 0.8850 0.4695 1.6681 0.2935 2.3612 0.2062 2.9745 0.1543 3.5172 Capital Recovery Factor (A/P, I, N) 1.1300 0.5995 0.4235 0.3362 0.2843 2 3 4 5 6 7 8 9 10 2.0820 2.3526 2.6584 3.0040 3.3946 0.4803 0.4251 0.3762 0.3329 0.2946 8.3227 10.4047 12.7573 15.4157 18.4197 0.1202 0.0961 0.0784 0.0649 0.0543 3.9975 4.4226 4.7988 5.1317 5.4262 0.2502 0.2261 0.2084 0.1949 0.1843 Enter your answer in the answer box and then click Check Answer. Print Done All parts showing Clear All / Problem 11-1 (algorithmic) Que A machine costing $23,000 to buy and $3,500 per year to operate will save mainly labor expenses in packaging over five years. The anticipated salvage value of the machine at the end of five years is $7,000. Click the icon to view the interest factors for discrete compounding when i = 13% per year. (a) If a 13% return on investment (rate of return) is desired, what is the minimum required annual savings in labor from this machine? The minimum required annual savings in labor from this machine is $ 8959. (Round to the nearest dollar.) (b) If the service life is four years instead of five years, what is the minimum required annual savings in labor for the firm to realize a 13% return on investment? The minimum required annual savings in labor from this machine is $ 9,789.11. (Round to the nearest dollar.) (c) If the annual operating cost increases 10%, say, from $3,500 to $3,850, what will happen to the answer to (a)? The minimum required annual savings in labor from this machine will be $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts