Question: Problem 12-4 Preparing a Payroll Check 1. Use the information on the payroll register to prepare a payroll check for Janice Burns for the week

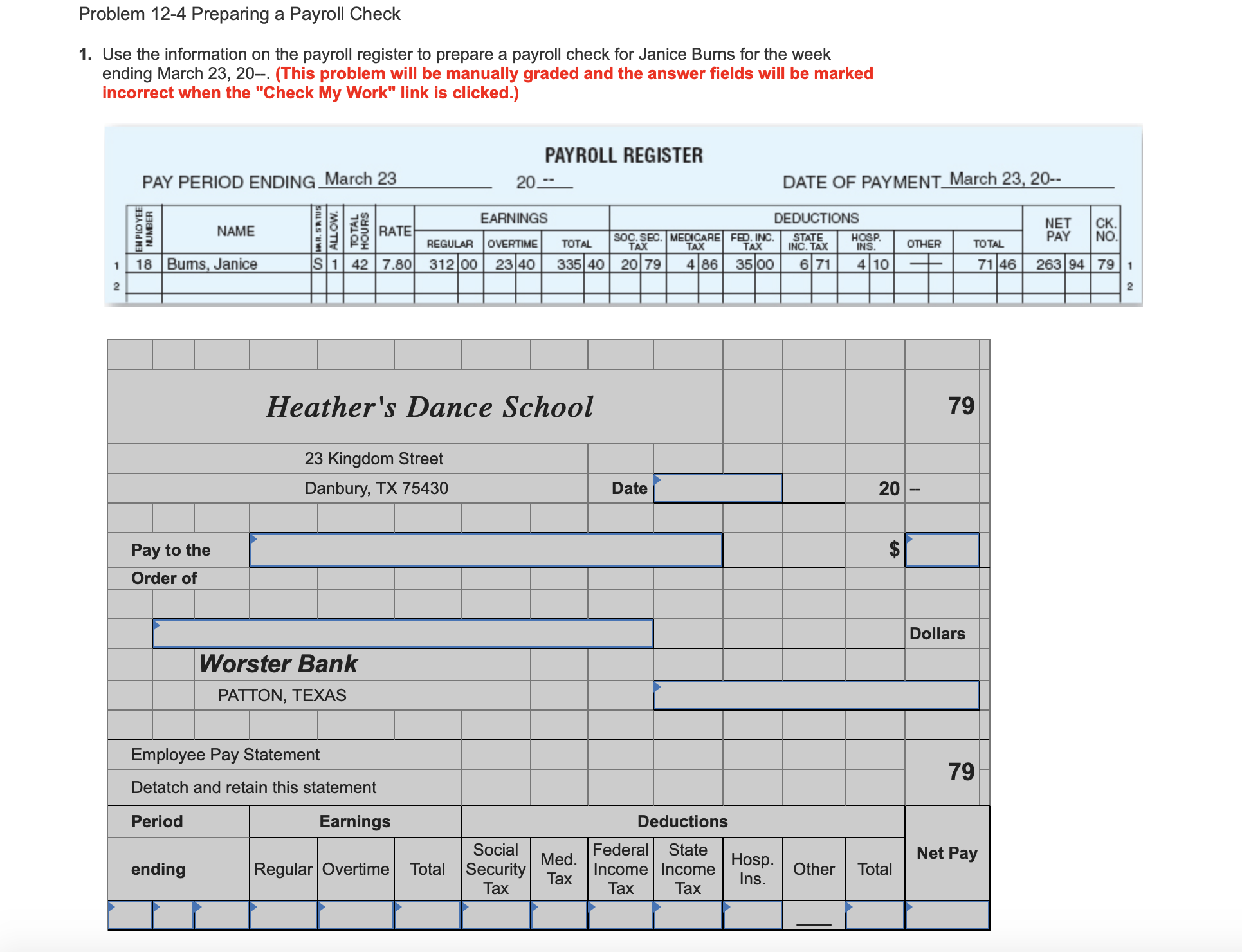

Problem 12-4 Preparing a Payroll Check 1. Use the information on the payroll register to prepare a payroll check for Janice Burns for the week ending March 23, 20--. (This problem will be manually graded and the answer fields will be marked incorrect when the "Check My Work" link is clicked.) PAYROLL REGISTER PAY PERIOD ENDING March 23 20_-- DATE OF PAYMENT March 23, 20-- EARNINGS DEDUCTIONS NET NUMBER EW PLO YEE NAME RATE HOSP. PAY D IMR. SR. REGULAR OVERTIME TOTAL TAX SOC. SEC. MEDICARE FED. INC.X NO OTHER TOTAL 1 1 18 Bums, Janice S 1 42 7.80 312 00 23 40 335 40 20 79 4 86 35 00 6 71 4 10 71 46 263 94 79 1 2 Heather's Dance School 79 23 Kingdom Street Danbury, TX 75430 Date 20 -- Pay to the Order of Dollars Worster Bank PATTON, TEXAS Employee Pay Statement 79 Detatch and retain this statement Period Earnings Deductions Social Med Federal State Hosp. Net Pay ending Regular | Overtime Total Security Other Total Tax Income | Income Ins. Tax Tax Tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts