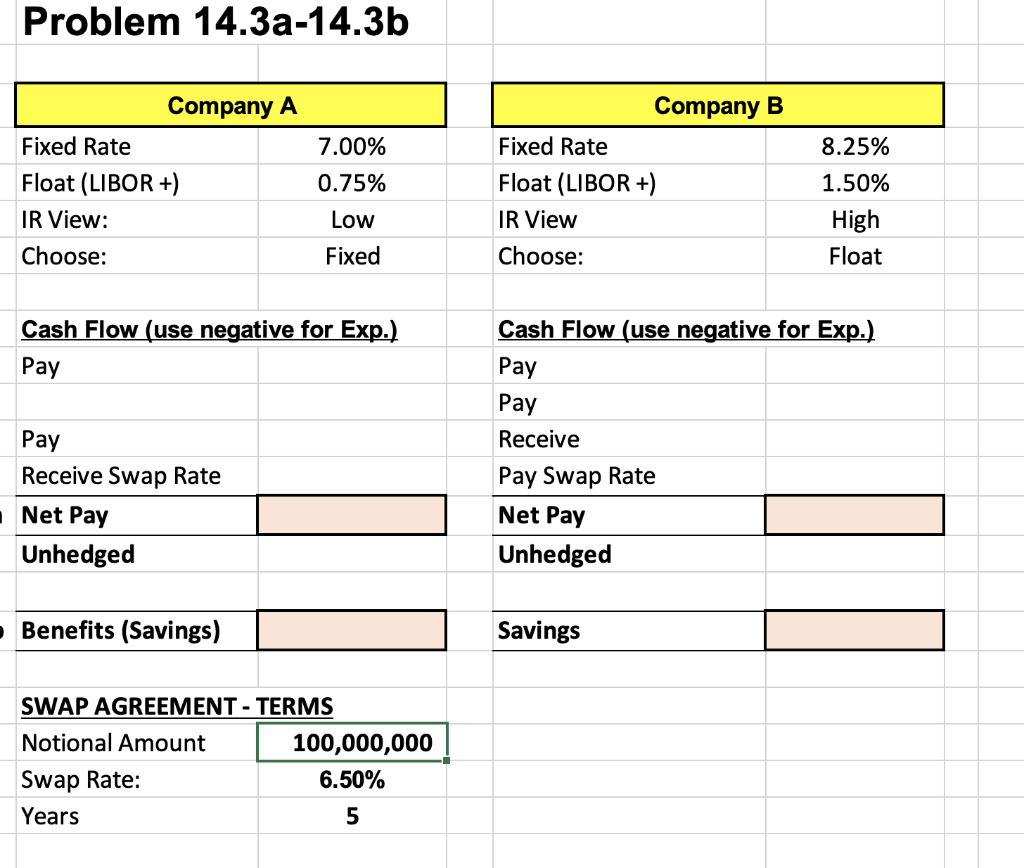

Question: Problem 14.3a-14.3b 8.25% Company A Fixed Rate Float (LIBOR +) IR View: Choose: 7.00% 0.75% Low Fixed Company B Fixed Rate Float (LIBOR +) IR

Problem 14.3a-14.3b 8.25% Company A Fixed Rate Float (LIBOR +) IR View: Choose: 7.00% 0.75% Low Fixed Company B Fixed Rate Float (LIBOR +) IR View Choose: 1.50% High Float Cash Flow (use negative for Exp.) Pay Pay Cash Flow (use negative for Exp.) Pay Pay Receive Pay Swap Rate Net Pay Unhedged Receive Swap Rate Net Pay Unhedged Benefits (Savings) Savings SWAP AGREEMENT - TERMS Notional Amount 100,000,000 Swap Rate: 6.50% Years 5 Problem 14.3a-14.3b 8.25% Company A Fixed Rate Float (LIBOR +) IR View: Choose: 7.00% 0.75% Low Fixed Company B Fixed Rate Float (LIBOR +) IR View Choose: 1.50% High Float Cash Flow (use negative for Exp.) Pay Pay Cash Flow (use negative for Exp.) Pay Pay Receive Pay Swap Rate Net Pay Unhedged Receive Swap Rate Net Pay Unhedged Benefits (Savings) Savings SWAP AGREEMENT - TERMS Notional Amount 100,000,000 Swap Rate: 6.50% Years 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts