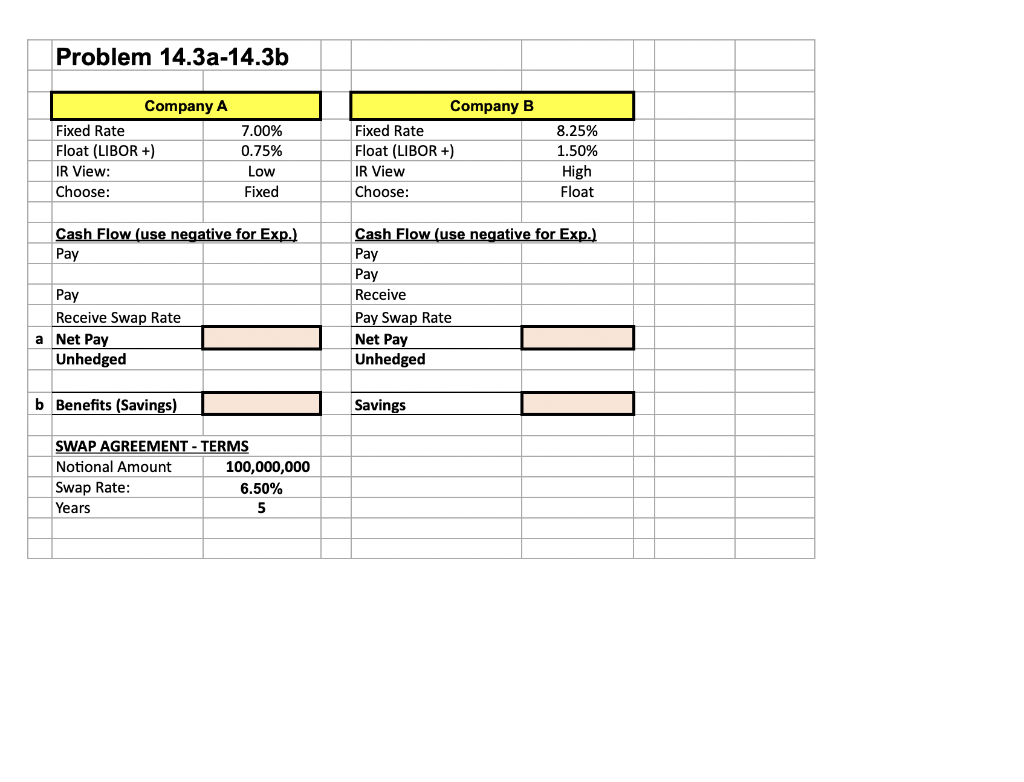

Question: Problem 14.3a-14.3b Company A Fixed Rate Float (LIBOR) IR View: Choose: 7.00% 0.75% Low Fixed Company B Fixed Rate Float (LIBOR +) IR View Choose:

Problem 14.3a-14.3b Company A Fixed Rate Float (LIBOR) IR View: Choose: 7.00% 0.75% Low Fixed Company B Fixed Rate Float (LIBOR +) IR View Choose: 8.25% 1.50% High Float Cash Flow (use negative for Exp.) Pay Pay Receive Swap Rate a Net Pay Unhedged Cash Flow (use negative for Exp.) Pay Pay Receive Pay Swap Rate Net Pay Unhedged b Benefits (Savings) Savings SWAP AGREEMENT - TERMS Notional Amount 100,000,000 Swap Rate: 6.50% Years 5 Problem 14.3a-14.3b Company A Fixed Rate Float (LIBOR) IR View: Choose: 7.00% 0.75% Low Fixed Company B Fixed Rate Float (LIBOR +) IR View Choose: 8.25% 1.50% High Float Cash Flow (use negative for Exp.) Pay Pay Receive Swap Rate a Net Pay Unhedged Cash Flow (use negative for Exp.) Pay Pay Receive Pay Swap Rate Net Pay Unhedged b Benefits (Savings) Savings SWAP AGREEMENT - TERMS Notional Amount 100,000,000 Swap Rate: 6.50% Years 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts