Question: PROBLEM 15-2 Income Allocation and Capital Statements LO 6 Dave, Brian, and Paul are partners in a retail appliance store. The partnership was formed

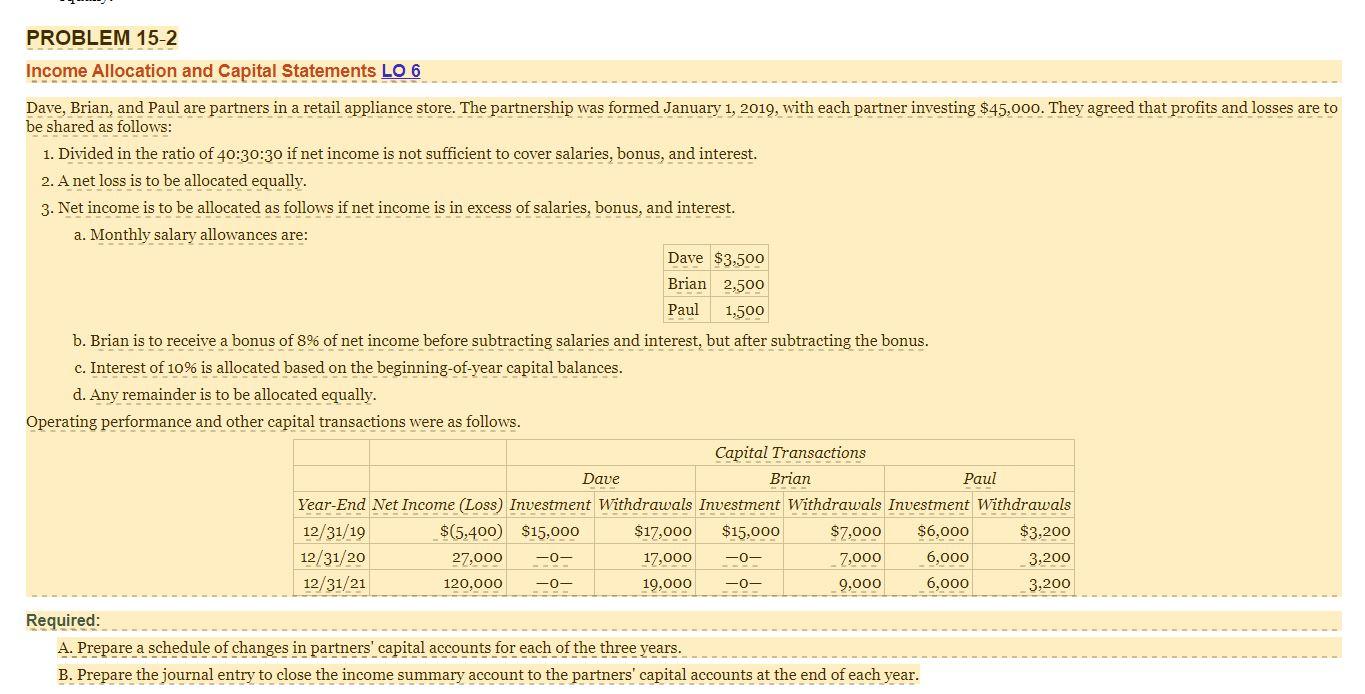

PROBLEM 15-2 Income Allocation and Capital Statements LO 6 Dave, Brian, and Paul are partners in a retail appliance store. The partnership was formed January 1, 2019, with each partner investing $45,000. They agreed that profits and losses are to be shared as follows: 1. Divided in the ratio of 40:30:30 if net income is not sufficient to cover salaries, bonus, and interest. 2. A net loss is to be allocated equally. 3. Net income is to be allocated as follows if net income is in excess of salaries, bonus, and interest. a. Monthly salary allowances are: Dave $3,500 Brian 2,500 Paul 1,500 b. Brian is to receive a bonus of 8% of net income before subtracting salaries and interest, but after subtracting the bonus. c. Interest of 10% is allocated based on the beginning-of-year capital balances. d. Any remainder is to be allocated equally. Operating performance and other capital transactions were as follows. Required: Dave Capital Transactions Brian Paul Year-End Net Income (Loss) Investment Withdrawals Investment Withdrawals Investment Withdrawals 12/31/19 12/31/20 12/31/21 $(5,400) $15,000 $17,000 $15,000 $7,000 $6,000 $3,200 27,000 -0- 120,000 -0- 17,000 19,000 -0-

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts