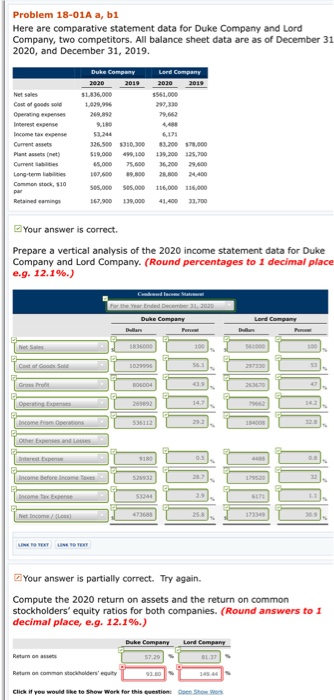

Question: Problem 18-01A a, b1 Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December

Problem 18-01A a, b1 Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31 2020, and December 31, 2019. Lord Company Duke Company 2020 2019 2020 201 Net sales $1836,000 s561,000 Cost of goods sole 029.996 297,330 Operating expenses 269,892 79,662 Interest expense 9.180 4,488 Income tax expense 3244 617 Current assets 326.500 310,300 3,200 78,000 Plant assets (net) s19,000 49 100 139,200 2,700 Curment ablities 5,000 75,600 36,200 29600 Long-term labities Common steck, $10 89,800 28,800 107,600 24400 505.000 505.000 116,000 316000 par Retained earnings 167,900 139,000 41,400 33,700 Your answer is correct. Prepare a vertical analysis of the 2020 income statement data for Duke Company and Lord Company. (Round percentages to 1 decimal place e.g. 12.1%.) Cndeed Ieceme Statrmce for the Year Ended December 31, 2020 Duke Company Lord Company P Dlar 1836000 Net Sales 100 56000 Cost of Goods Sold 56.3 1029995 27330 Grass Profit B0s004 43.9 2360 9662 Operating Expenses 269892 14.7 32.8 Income From Operanions 29.2 536112 184008 other Expenses and Losses Interest Expense 9180 9.5 Income Before Income Taxes 28.7 19520 526932 29 6171 Income Tax Expense s324 Net Income/(ess) 473688 25.8 173349 UNEO TE Your answer is partially correct. Try again. Compute the 2020 return on assets and the return on common stockholders' equity ratios for both companies. (Round answers to 1 decimal place, e.g. 12.1 %.) Duke Company Lord Company Retun on assets 57.29 BL37 93.80% 14944 Return on comman stockholders' equity oen ShowWork Click if you would Ske to Show Work for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts