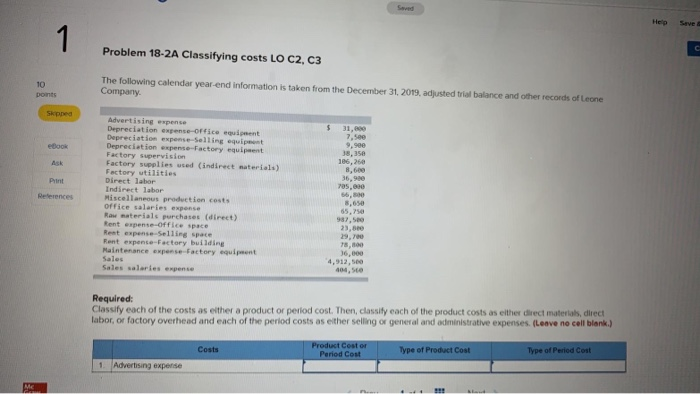

Question: Problem 18-2A Classifying costs LO C2, C3 The following calendar year-end Information is taken from the December 31, 2019, adjusted trial balance and other records

Problem 18-2A Classifying costs LO C2, C3 The following calendar year-end Information is taken from the December 31, 2019, adjusted trial balance and other records of Leone Company ebook 7.5 9.See 38.35 Advertising pense Depreciation expense-office e t Depreciatis expense Selling equit Depreciation expense Factory equipment Factory supervision Factory suplies used indirect materials) Factory utilities Direct lebar Indirect labor Miscellaneous production costs Office salaries expense Raw materials purchases (direct) Rent expense office space Reat expense-Selling space Rent expense Factory building Maintenance expense Factory equipment 705.000 66, 65.75 987,500 16.00 4,912,500 404,50 Sales salaries expense Required: Classify each of the costs as either a product or period cost. Then, classify each of the product costs as either direct material direct labor, or factory overhead and each of the period costs as either selling or general and administrative expenses. Leave no call blank.) Costs Product Cost or Period Cost Type of Product Cost Type of cost 1. Advertising expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts