Question: value: 1.70 points Problem 18-2A Classifying costs LO C2, C3 The following calendar year-end information is taken from the December 31, 2015, adjust and other

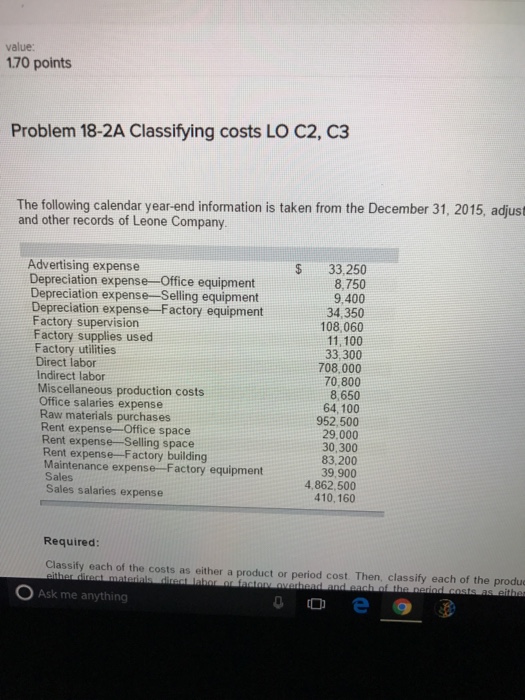

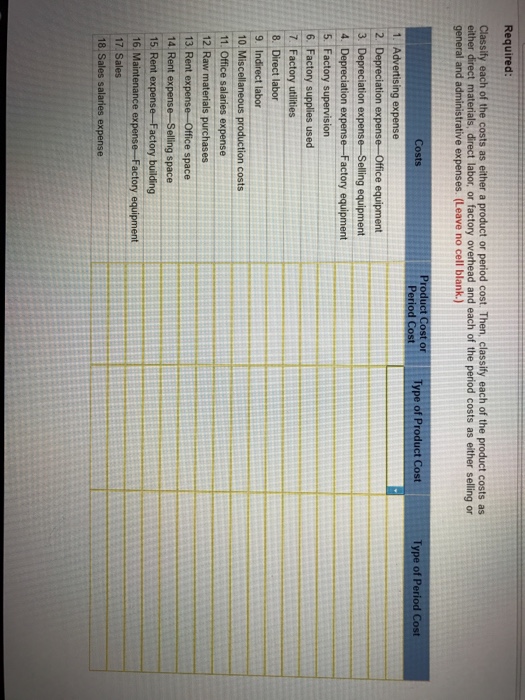

value: 1.70 points Problem 18-2A Classifying costs LO C2, C3 The following calendar year-end information is taken from the December 31, 2015, adjust and other records of Leone Company Advertising expense Depreciation expense Office equipment $33,250 8,750 9,400 34,350 108,060 11,100 33,300 708,000 70,800 8,650 64.100 952,500 29,000 30,300 83,200 39,900 4,862,500 410,160 Depreciation expense-Selling equipment Depreciation expense Factory equipment Factory supervision Factory supplies used Factory utilities Direct labor Indirect labor Miscellaneous production costs Office salaries expense Raw materials purchases Rent expense-Office space Rent expense-Selling space Rent expense-Factory building Maintenance expense-Factory equipment Sales Sales salaries expense Required: Classify each of the costs as either a product or period cost. Then, classify each of the produ Ask me anything

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts