Question: Problem 18.3A Using the straight-line and units-of-output methods of depreciation. LO 18-2 On January 5, 2019, Williams Company purchased equipment for $512,000 that had an

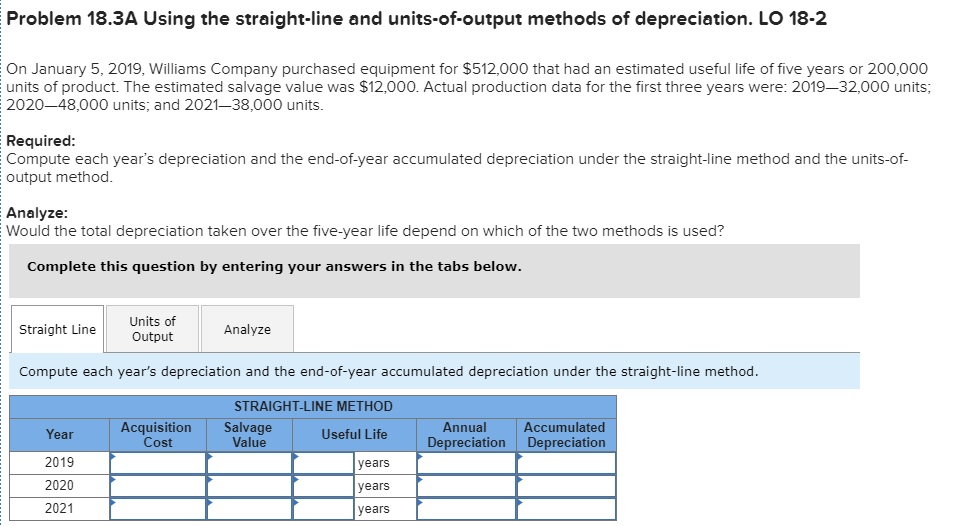

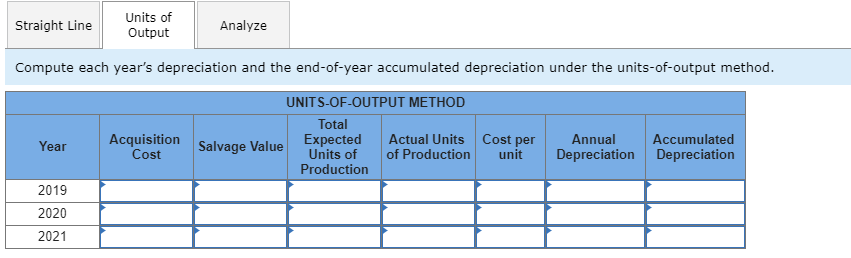

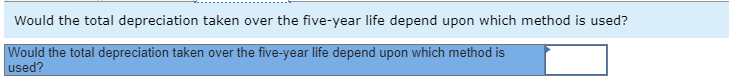

Problem 18.3A Using the straight-line and units-of-output methods of depreciation. LO 18-2 On January 5, 2019, Williams Company purchased equipment for $512,000 that had an estimated useful life of five years or 200,000 units of product. The estimated salvage value was $12,000. Actual production data for the first three years were: 201932,000 units; 202048,000 units, and 202138,000 units. Required: Compute each year's depreciation and the end-of-year accumulated depreciation under the straight-line method and the units-of- output method. Analyze: Would the total depreciation taken over the five-year life depend on which of the two methods is used? Complete this question by entering your answers in the tabs below. Straight Line Units of Output Analyze Compute each year's depreciation and the end-of-year accumulated depreciation under the straight-line method. Acquisition Cost Annual Depreciation Accumulated Depreciation 2019 2020 2021 STRAIGHT-LINE METHOD Salvage Useful Life Value years years years Straight Line Units of Output Analyze Compute each year's depreciation and the end-of-year accumulated depreciation under the units-of-output method. UNITS-OF-OUTPUT METHOD Total Actual Units Expected Salvage Value Units of of Production Production Acquisition Cost Year Cost per unit Annual Depreciation Accumulated Depreciation 2019 2020 2021 Would the total depreciation taken over the five-year life depend upon which method is used? Would the total depreciation taken over the five-year life depend upon which method is used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts