Question: Problem 2 (10 pts.) e 2017 sales for Mojo, Inc. were $48 million. The percentage of sales of each balance sheet item that varies directly

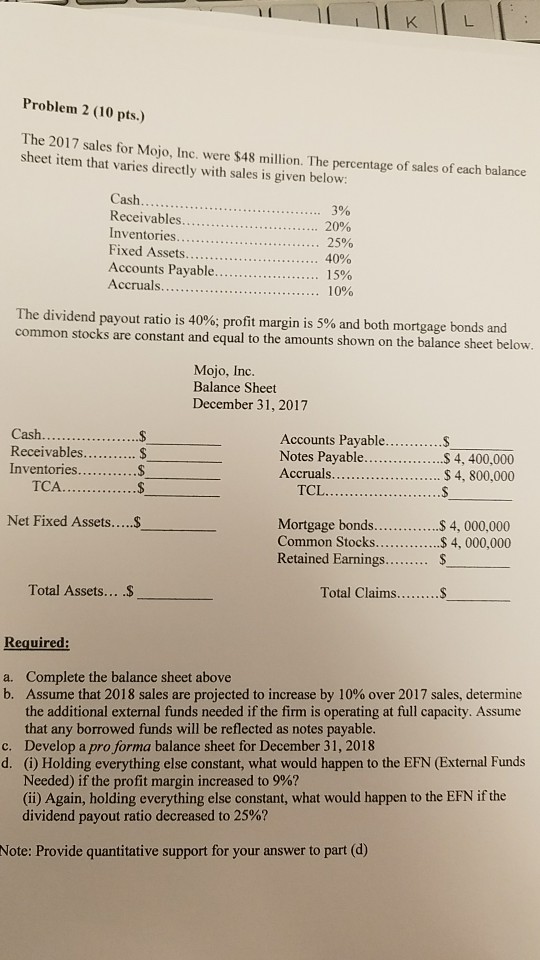

Problem 2 (10 pts.) e 2017 sales for Mojo, Inc. were $48 million. The percentage of sales of each balance sheet item that varies directly with sales is given below: Cash Receivables 3% 2090 25% Fixed Assets. Accounts Payable Accruals 15% 1096 The dividend payout ratio is 40%; profit margin is 5% and both mortgage bonds and ommon stocks are constant and equal to the amounts shown on the balance sheet below Mojo, Inc. Balance Sheet December 31, 2017 Cash.. Receivables Inventories...S Accounts Payable. Notes Payable. Accrualabie $4, 400,000 TCA TCL. Net Fixed Assets... Mortgage bonds. Common Stocks Retained Earnings S 4, 000,000 $4, 000,000 Total Assets... . Total Claims Complete the balance sheet above Assume that 2018 sales are projected to increase by 10% over 2017 sales, determine the additional external funds needed if the firm is operating at full capacity. Assume that any borrowed funds will be reflected as notes payable. Develop a pro forma balance sheet for December 31, 2018 (i) Holding everything else constant, what would happen to the EFN (External Funds Needed) if the profit margin increased to 9%? (ii) Again, holding everything else constant, what would happen to the EFN if the dividend payout ratio decreased to 25%? a. b. c. d. Note: Provide quantitative support for your answer to part (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts