Question: Problem 2 (15%) Suppose a market maker sells a call option on a stock. To reduce the risk, the market maker invests the call option

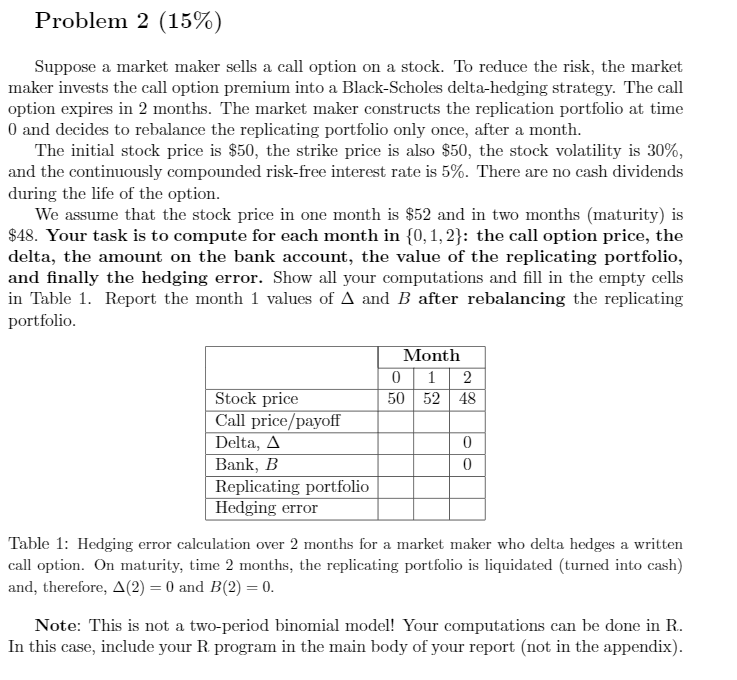

Problem 2 (15%) Suppose a market maker sells a call option on a stock. To reduce the risk, the market maker invests the call option premium into a Black-Scholes delta-hedging strategy. The call option expires in 2 months. The market maker constructs the replication portfolio at time O and decides to rebalance the replicating portfolio only once, after a month. The initial stock price is $50, the strike price is also $50, the stock volatility is 30%, and the continuously compounded risk-free interest rate is 5%. There are no cash dividends during the life of the option. We assume that the stock price in one month is $52 and in two months (maturity) is $48. Your task is to compute for each month in {0, 1, 2}: the call option price, the delta, the amount on the bank account, the value of the replicating portfolio, and finally the hedging error. Show all your computations and fill in the empty cells in Table 1. Report the month 1 values of A and B after rebalancing the replicating portfolio Month 0 1 2 Stock price 50 52 48 Call price/payoff Delta, A 0 Bank, B 0 Replicating portfolio Hedging error Table 1: Hedging error calculation over 2 months for a market maker who delta hedges a written call option. On maturity, time 2 months, the replicating portfolio is liquidated (turned into cash) and, therefore, A(2) = 0 and B(2) = 0. Note: This is not a two-period binomial model! Your computations can be done in R. In this case, include your R program in the main body of your report (not in the appendix). Problem 2 (15%) Suppose a market maker sells a call option on a stock. To reduce the risk, the market maker invests the call option premium into a Black-Scholes delta-hedging strategy. The call option expires in 2 months. The market maker constructs the replication portfolio at time O and decides to rebalance the replicating portfolio only once, after a month. The initial stock price is $50, the strike price is also $50, the stock volatility is 30%, and the continuously compounded risk-free interest rate is 5%. There are no cash dividends during the life of the option. We assume that the stock price in one month is $52 and in two months (maturity) is $48. Your task is to compute for each month in {0, 1, 2}: the call option price, the delta, the amount on the bank account, the value of the replicating portfolio, and finally the hedging error. Show all your computations and fill in the empty cells in Table 1. Report the month 1 values of A and B after rebalancing the replicating portfolio Month 0 1 2 Stock price 50 52 48 Call price/payoff Delta, A 0 Bank, B 0 Replicating portfolio Hedging error Table 1: Hedging error calculation over 2 months for a market maker who delta hedges a written call option. On maturity, time 2 months, the replicating portfolio is liquidated (turned into cash) and, therefore, A(2) = 0 and B(2) = 0. Note: This is not a two-period binomial model! Your computations can be done in R. In this case, include your R program in the main body of your report (not in the appendix)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts