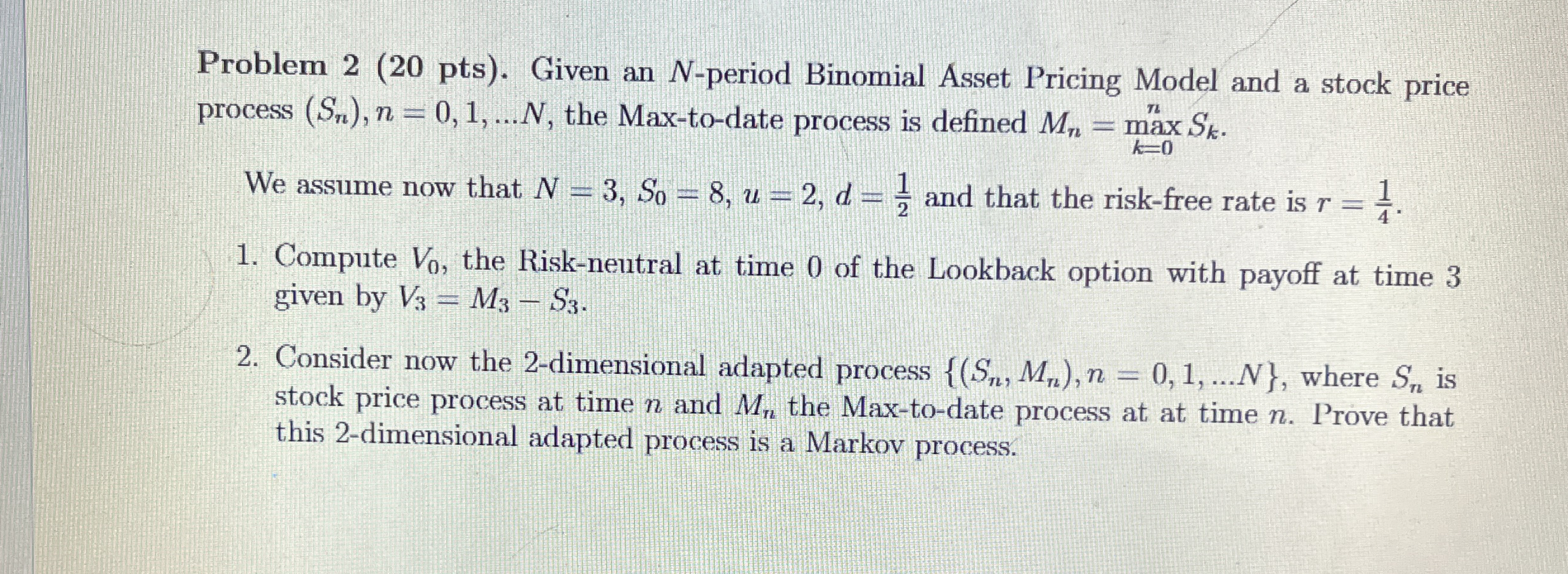

Question: Problem 2 ( 2 0 pts ) . Given an N - period Binomial Asset Pricing Model and a stock price process ( S n

Problem pts Given an period Binomial Asset Pricing Model and a stock price process dotsN, the Maxtodate process is defined

We assume now that and that the riskfree rate is

Compute the Riskneutral at time of the Lookback option with payoff at time given by

Consider now the dimensional adapted process dotsN where is stock price process at time and the Maxtodate process at at time Prove that this dimensional adapted process is a Markov process.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock