Question: Problem 2 4 - 3 A ( Algo ) Applying payback period,accounting rate of return, and net present valueLO P 1 , P 2 ,

Problem A Algo Applying payback period,accounting rate of return, and net present valueLO P P P

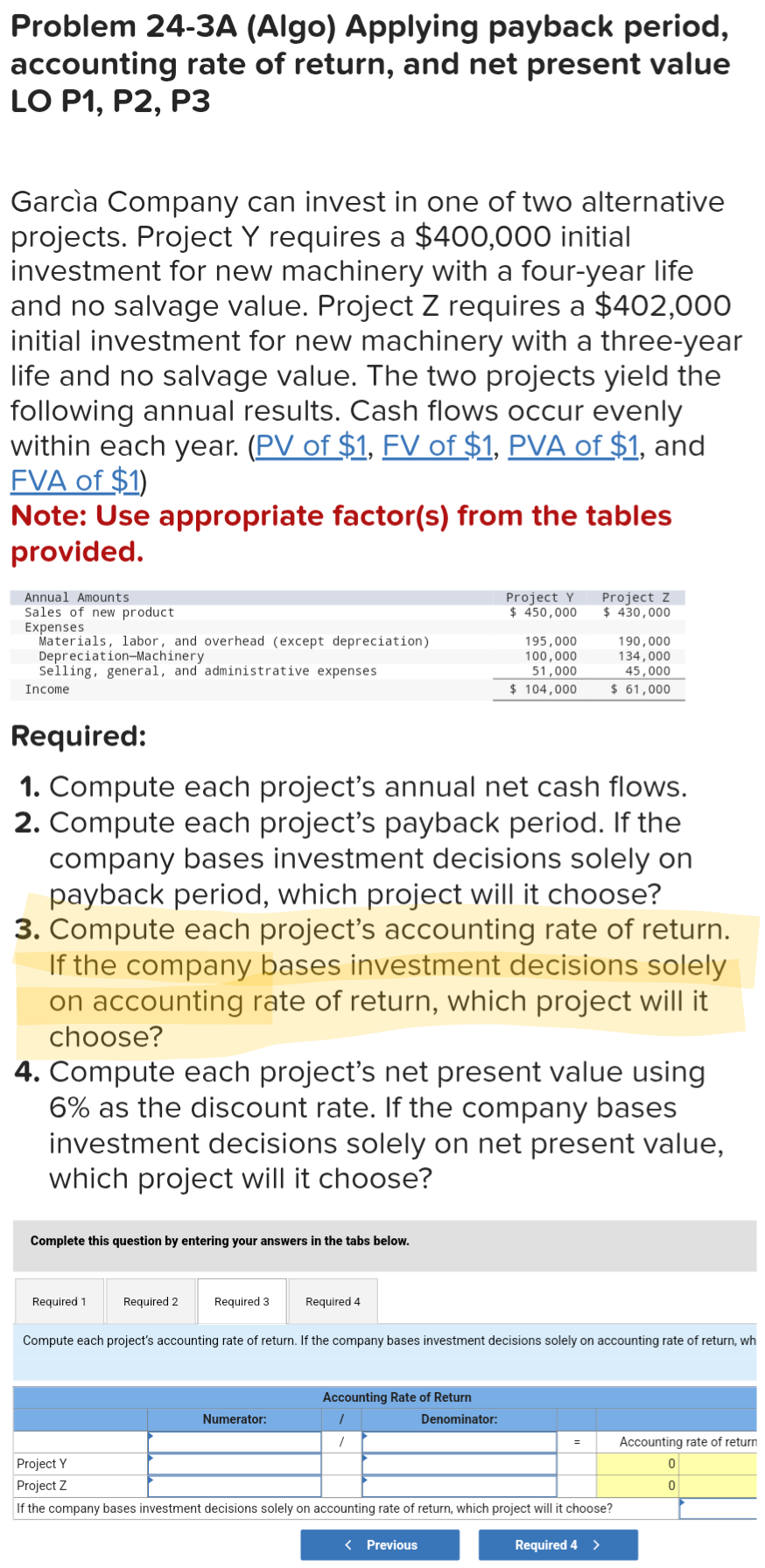

Please complete part and using the images below, please use correct chart format thank you.

Note: Use appropriate factors from the tablesprovided.Annual AmountsSales of new productExpensesMaterials, labor, and overhead except depreciationDepreciationMachinerySelling, general, and administrative expensesIncomeRequired:Required Years Compute each project's annual net cash flows Compute each project's payback period. If thecompany bases investment decisions solely onpayback period, which project will it choose? Compute each project's accounting rate of return.If the company bases investment decisions solelyon accounting rate of return, which project will itchoose? Compute each project's net present value using as the discount rate. If the company basesinvestment decisions solely on net present value,which project will it choose?Net present valueYears Complete this question by entering your answers in thebelow.Required Project YProject ZNet present valueRequired Required Compute each project's net present value using as thediscount rate. If the company bases investment decisionssolely on net present value, which project will it choose?Note: Do not round intermediate calculations. Round yourpresent value factor to decimals and final answers to thenearest whole dollar.Net Cash Flows xNet Cash FlowsXProject Y$ Present Valueof Annuity atPrevious$ Present ValueAnnuity atIf the company bases investment decisions solely on net present value, whichproject will it choose?Present Value ofNet Cash FlowsProject Z$ Present Value ofNet Cash FlowsRequired$ Garcia Company can invest in one of two alternativeprojects. Project Y requires a $ initialinvestment for new machinery with a fouryear lifeand no salvage value. Project Z requires a $initial investment for new machinery with a threeyearlife and no salvage value. The two projects yield thefollowing annual results. Cash flows occur evenlywithin each year. PV of $ FV of $ PVA of $ andFVA of $Note: Use appropriate factors from the tablesprovided.Annual AmountsSales of new productExpensesMaterials, labor, and overhead except depreciationDepreciationMachinerySelling, general, and administrative expensesIncomeRequired:Complete this question by entering your answers in the tabs below.Required Required Project YProject Z Compute each project's annual net cash flows Compute each project's payback period. If thecompany bases investment decisions solely onpayback period, which project will it choose? Compute each project's accounting rate of return.If the company bases investment decisions solelyon accounting rate of return, which project will itchoose?Required Compute each project's net present value using as the discount rate. If the company basesinvestment decisions solely on net present value,which project will it choose?Required Numerator:Project Y$ Accounting Rate of ReturnDenominator:$ PreviousProject Z$ Compute each project's accounting rate of return. If the company bases investment decisions solely on accounting rate of return, wh$ If the company bases investment decisions solely on accounting rate of return, which project will it choose?Required Accounting rate of return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock