Question: Problem 2 A company is considering two mutually exclusive investment options. The initial investment cost for the first option (Alternative 1) is $500,000. It will

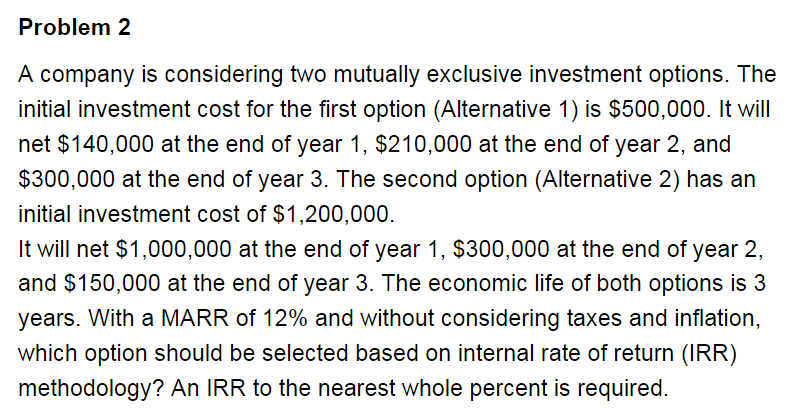

Problem 2 A company is considering two mutually exclusive investment options. The initial investment cost for the first option (Alternative 1) is $500,000. It will net $140,000 at the end of year 1, $210,000 at the end of year 2, and $300,000 at the end of year 3. The second option (Alternative 2) has an initial investment cost of $1,200,000. It will net $1,000,000 at the end of year 1, $300,000 at the end of year 2, and $150,000 at the end of year 3. The economic life of both options is 3 years. With a MARR of 12% and without considering taxes and inflation, which option should be selected based on internal rate of return (IRR) methodology? An IRR to the nearest whole percent is required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts