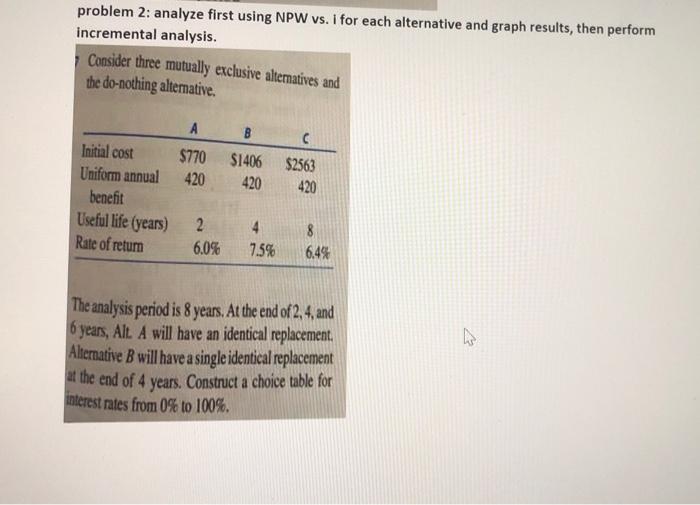

Question: problem 2: analyze first using NPW vs. I for each alternative and graph results, then perform incremental analysis. Consider three mutually exclusive alternatives and the

problem 2: analyze first using NPW vs. I for each alternative and graph results, then perform incremental analysis. Consider three mutually exclusive alternatives and the do-nothing alternative B $770 420 $1406 420 C. $2563 420 Initial cost Uniform annual benefit Useful life (years) Rate of return 2 6.0% 7.5% 8 6.4% a The analysis period is 8 years. At the end of 2, 4, and 6 years, Alt. A will have an identical replacement. Alternative B will have a single identical replacement at the end of 4 years. Construct a choice table for interest rates from 0% to 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts