Question: Problem 2: Binomial Options Pricing (5 points) Imagine a case where there were only two possible stock prices in one month: $100 and $80, occurring

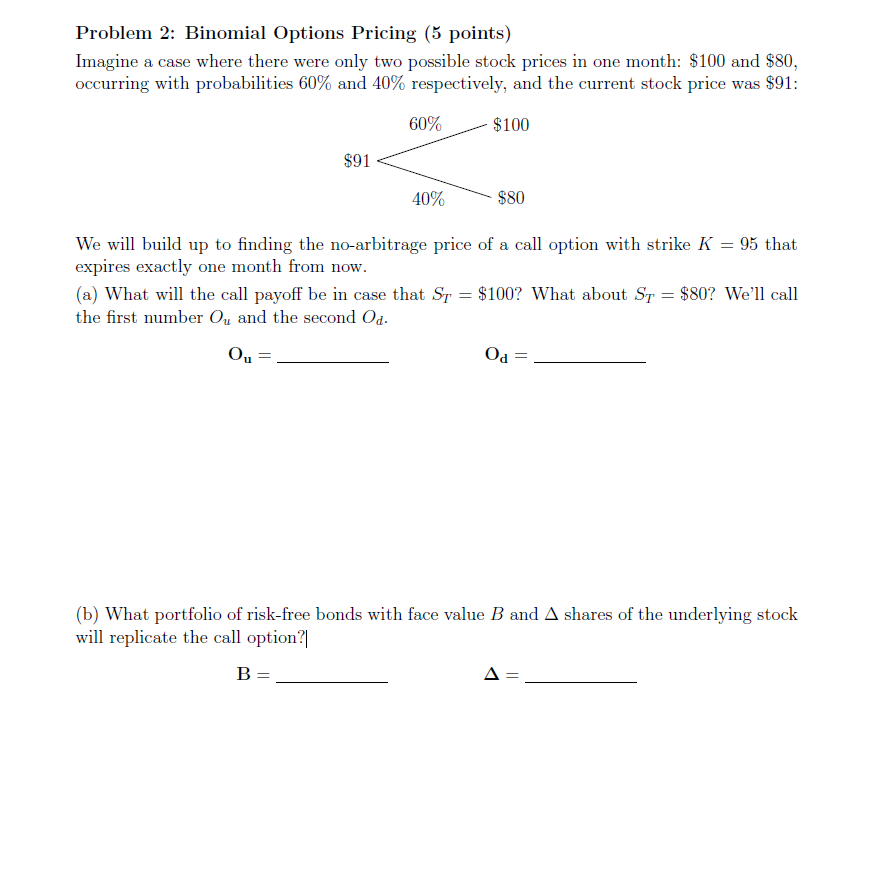

Problem 2: Binomial Options Pricing (5 points) Imagine a case where there were only two possible stock prices in one month: $100 and $80, occurring with probabilities 60% and 40% respectively, and the current stock price was $91: 60% $100 $91 40% $80 We will build up to finding the no-arbitrage price of a call option with strike K = 95 that expires exactly one month from now. (a) What will the call payoff be in case that St = $100? What about ST = $80? We'll call the first number Ou and the second Od. = Ou Od (b) What portfolio of risk-free bonds with face value B and A shares of the underlying stock will replicate the call option?|| B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts