Question: Problem 3: Binomial Options Pricing (8 points) Suppose a case where there are only two possible stock prices in one year: $100 and $80, occurring

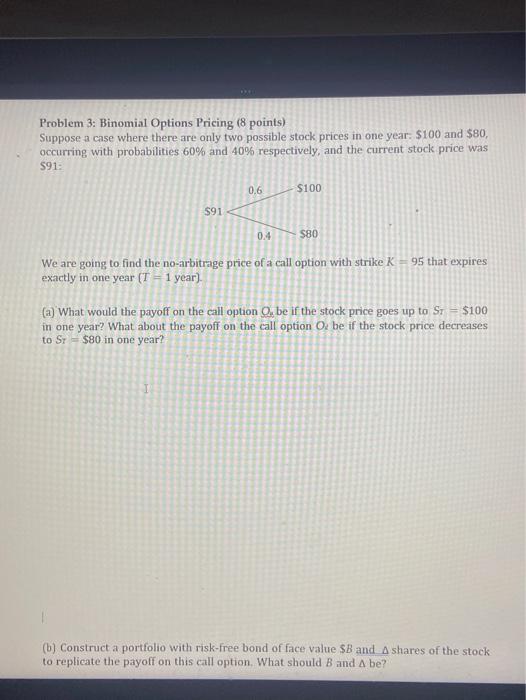

Problem 3: Binomial Options Pricing (8 points) Suppose a case where there are only two possible stock prices in one year: $100 and $80, occurring with probabilities 60% and 40% respectively, and the current stock price was S91: 0.6 $100 $91 0.4 S80 We are going to find the no-arbitrage price of a call option with strike K = 95 that expires exactly in one year (T = 1 year) (a) What would the payoff on the call option O, be if the stock price goes up to S1 = $100 in one year? What about the payoff on the call option Od be if the stock price decreases to Sr = $80 in one year? 1 (b) Construct a portfolio with risk-free bond of face value $B and A shares of the stock to replicate the payoff on this call option. What should B and A be? (c) What is the no-arbitrage price of this call option, assuring the risk-free rate is 192 (d) Suppose the call option is traded for the price you found in part (C), what is the expected return for the call option? What is the one-year expected holding period return for the underlying stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts