Question: Problem 2 Decision Tree problem: (Note: For the drawing, you can use a software or do it by hand.) (40pt) Your friend is a construction

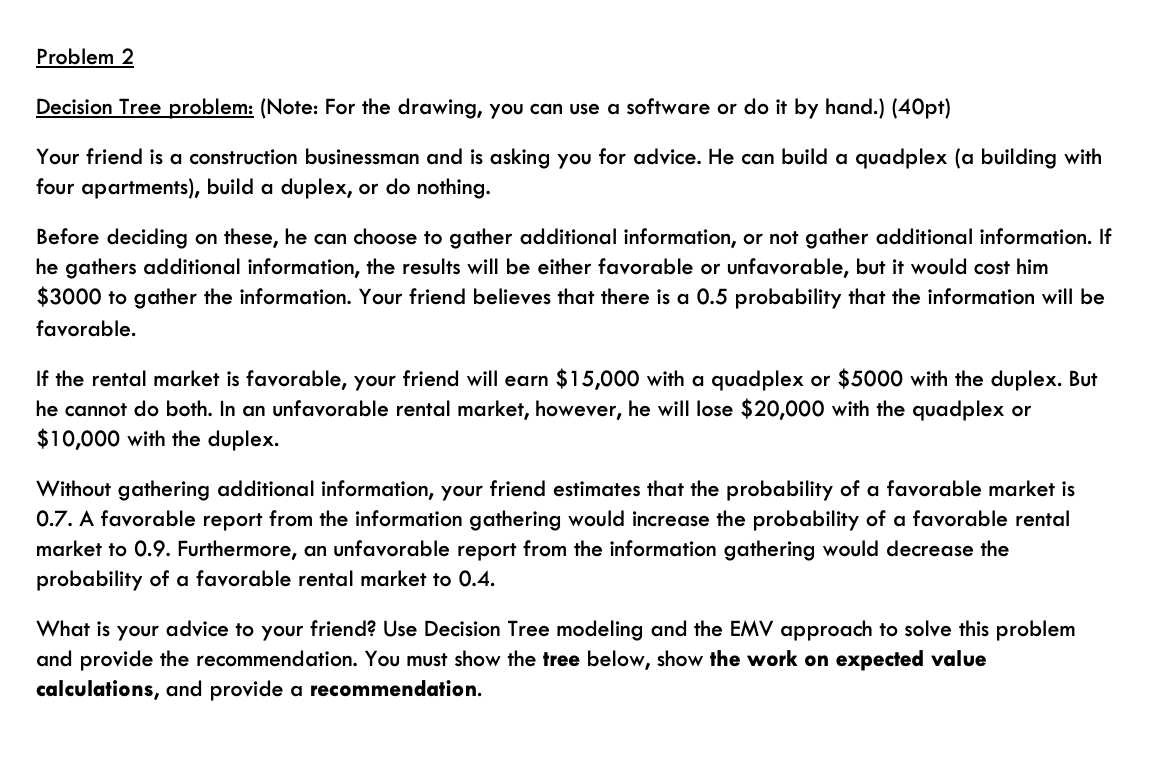

Problem 2 Decision Tree problem: (Note: For the drawing, you can use a software or do it by hand.) (40pt) Your friend is a construction businessman and is asking you for advice. He can build a quadplex (a building with four apartments), build a duplex, or do nothing. Before deciding on these, he can choose to gather additional information, or not gather additional information. If he gathers additional information, the results will be either favorable or unfavorable, but it would cost him $3000 to gather the information. Your friend believes that there is a 0.5 probability that the information will be favorable. If the rental market is favorable, your friend will earn $15,000 with a quadplex or $5000 with the duplex. But he cannot do both. In an unfavorable rental market, however, he will lose $20,000 with the quadplex or $10,000 with the duplex. Without gathering additional information, your friend estimates that the probability of a favorable market is 0.7. A favorable report from the information gathering would increase the probability of a favorable rental market to 0.9. Furthermore, an unfavorable report from the information gathering would decrease the probability of a favorable rental market to 0.4. What is your advice to your friend? Use Decision Tree modeling and the EMV approach to solve this problem and provide the recommendation. You must show the tree below, show the work on expected value calculations, and provide a recommendation. Problem 2 Decision Tree problem: (Note: For the drawing, you can use a software or do it by hand.) (40pt) Your friend is a construction businessman and is asking you for advice. He can build a quadplex (a building with four apartments), build a duplex, or do nothing. Before deciding on these, he can choose to gather additional information, or not gather additional information. If he gathers additional information, the results will be either favorable or unfavorable, but it would cost him $3000 to gather the information. Your friend believes that there is a 0.5 probability that the information will be favorable. If the rental market is favorable, your friend will earn $15,000 with a quadplex or $5000 with the duplex. But he cannot do both. In an unfavorable rental market, however, he will lose $20,000 with the quadplex or $10,000 with the duplex. Without gathering additional information, your friend estimates that the probability of a favorable market is 0.7. A favorable report from the information gathering would increase the probability of a favorable rental market to 0.9. Furthermore, an unfavorable report from the information gathering would decrease the probability of a favorable rental market to 0.4. What is your advice to your friend? Use Decision Tree modeling and the EMV approach to solve this problem and provide the recommendation. You must show the tree below, show the work on expected value calculations, and provide a recommendation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock