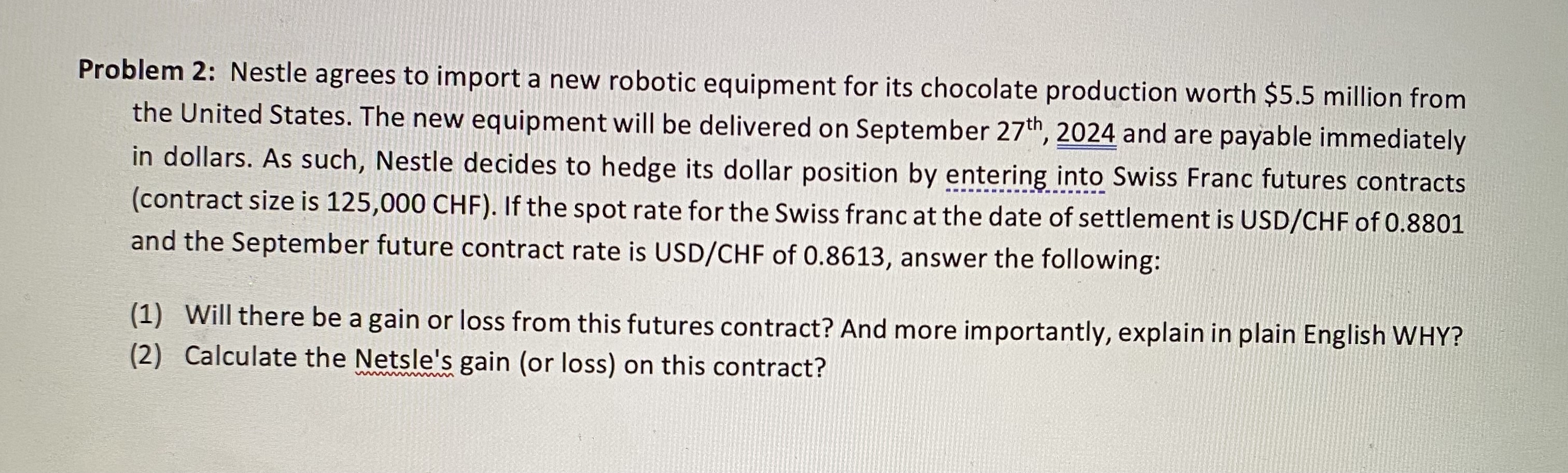

Question: Problem 2 : Nestle agrees to import a new robotic equipment for its chocolate production worth $ 5 . 5 million from the United States.

Problem : Nestle agrees to import a new robotic equipment for its chocolate production worth $ million from the United States. The new equipment will be delivered on September and are payable immediately in dollars. As such, Nestle decides to hedge its dollar position by entering into Swiss Franc futures contracts contract size is If the spot rate for the Swiss franc at the date of settlement is USDCHF of and the September future contract rate is USDCHF of answer the following:

Will there be a gain or loss from this futures contract? And more importantly, explain in plain English WHY?

Calculate the Netsle's gain or loss on this contract?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock