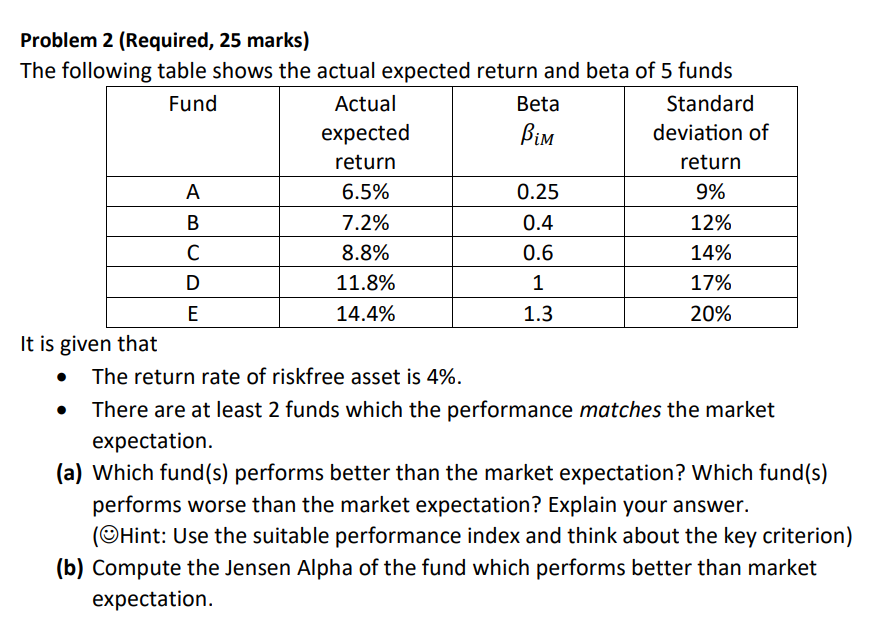

Question: Problem 2 ( Required , 2 5 marks ) The following table shows the actual expected return and beta of 5 fundsActual expected returnBeta

Problem Required marks The following table shows the actual expected return and beta of fundsActual expected returnBeta betatext iM Standard deviation of return It is given that The return rate of riskfree asset is There are at least funds which the performance matches the market expectation. a Which funds performs better than the market expectation? Which funds performs worse than the market expectation? Explain your answer. Hint: Use the suitable performance index and think about the key criterionb Compute the Jensen Alpha of the fund which performs better than market expectation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock