Question: PROBLEM 2: Show how you would conduct profitable arbitrage using the instruments and prices listed in each part below. In the Transaction column, list each

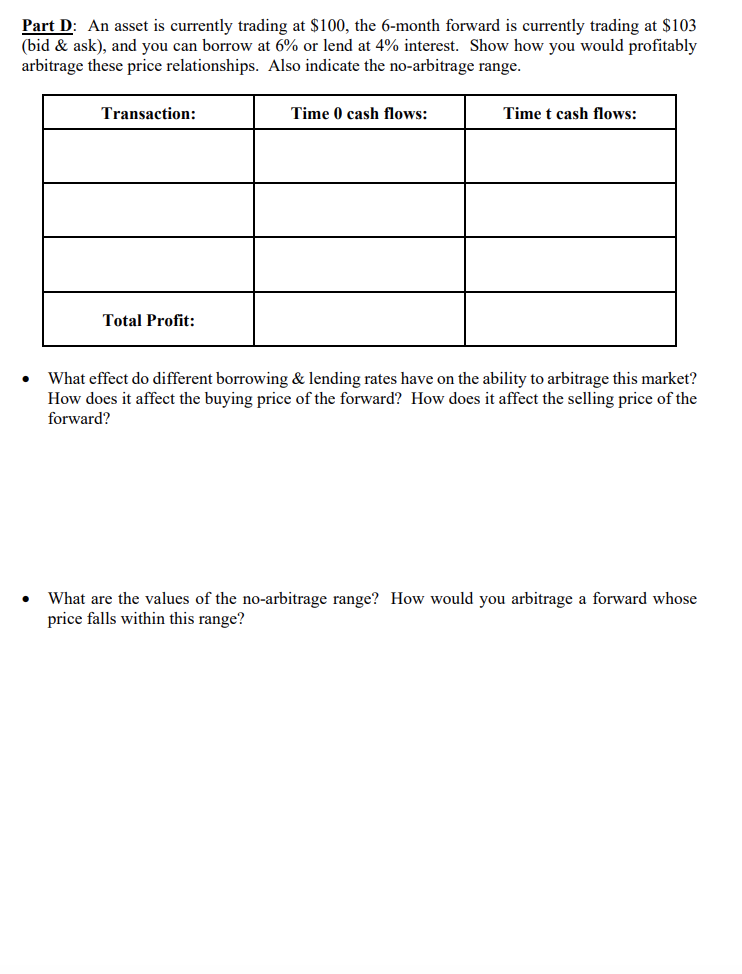

PROBLEM 2: Show how you would conduct profitable arbitrage using the instruments and prices listed in each part below. In the Transaction column, list each instrument and whether you are buying (long) or selling (short). Next, enter the values for the Time 0 and Time t cash flows with the correct signs. Finally, in the last row of the table, calculate the profit from the arbitrage. Part D: An asset is currently trading at $100, the 6-month forward is currently trading at $103 (bid & ask), and you can borrow at 6% or lend at 4% interest. Show how you would profitably arbitrage these price relationships. Also indicate the no-arbitrage range. Transaction: Time 0 cash flows: Time t cash flows: Total Profit: What effect do different borrowing & lending rates have on the ability to arbitrage this market? How does it affect the buying price of the forward? How does it affect the selling price of the forward? What are the values of the no-arbitrage range? How would you arbitrage a forward whose price falls within this range

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts