Question: PROBLEM 2: Show how you would conduct profitable arbitrage using the instruments and prices listed in each part below. In the Transaction column, list each

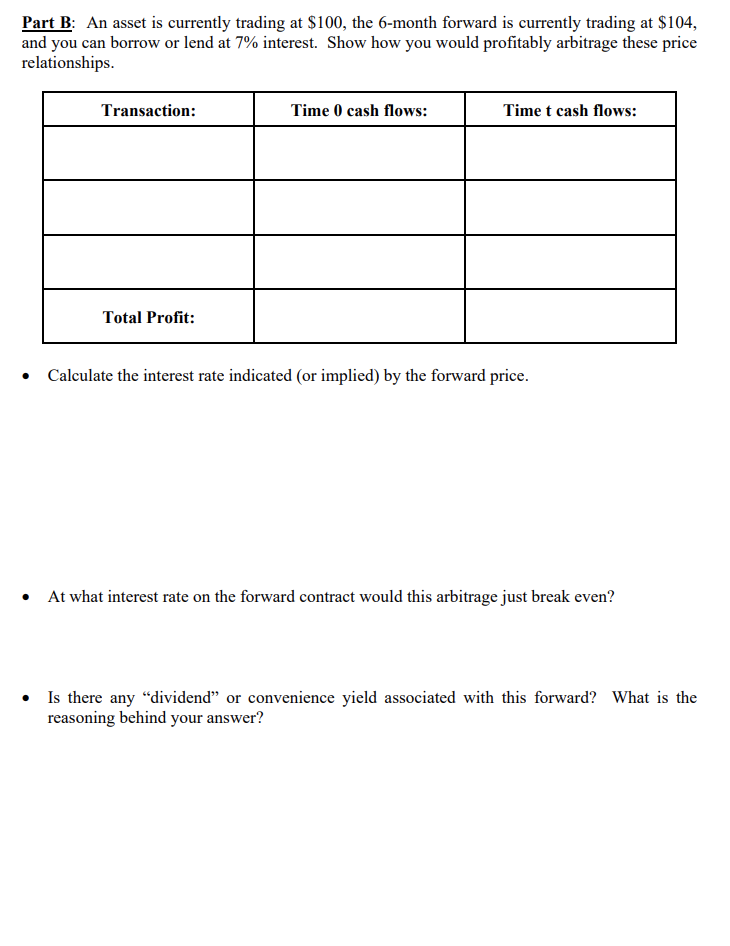

PROBLEM 2: Show how you would conduct profitable arbitrage using the instruments and prices listed in each part below. In the Transaction column, list each instrument and whether you are buying (long) or selling (short). Next, enter the values for the Time 0 and Time t cash flows with the correct signs. Finally, in the last row of the table, calculate the profit from the arbitrage. Part B: An asset is currently trading at S100, the 6-month forward is currently trading at S104, and you can borrow or lend at 7% interest. Show how you would profitably arbitrage these price relationships. Transaction: Time 0 cash flows: Time t cash flows: Total Profit: Calculate the interest rate indicated (or implied) by the forward price. At what interest rate on the forward contract would this arbitrage just break even? . reasoning behind your answer? PROBLEM 2: Show how you would conduct profitable arbitrage using the instruments and prices listed in each part below. In the Transaction column, list each instrument and whether you are buying (long) or selling (short). Next, enter the values for the Time 0 and Time t cash flows with the correct signs. Finally, in the last row of the table, calculate the profit from the arbitrage. Part B: An asset is currently trading at S100, the 6-month forward is currently trading at S104, and you can borrow or lend at 7% interest. Show how you would profitably arbitrage these price relationships. Transaction: Time 0 cash flows: Time t cash flows: Total Profit: Calculate the interest rate indicated (or implied) by the forward price. At what interest rate on the forward contract would this arbitrage just break even? . reasoning behind your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts