Question: PROBLEM 2: Show how you would conduct profitable arbitrage using the instruments and prices listed in each part below. In the Transaction column, list each

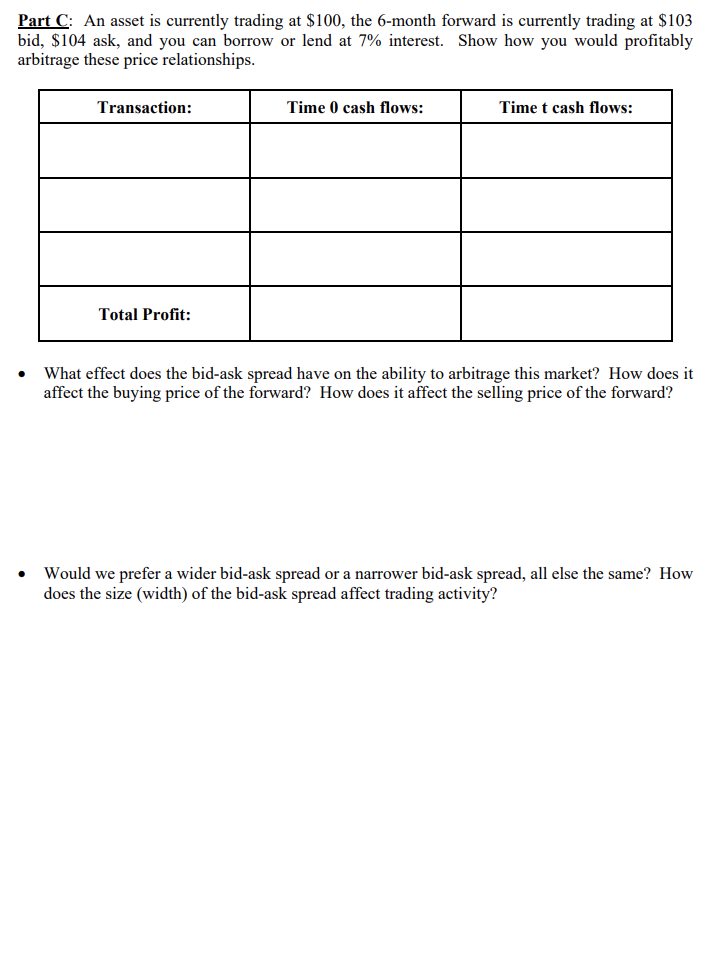

PROBLEM 2: Show how you would conduct profitable arbitrage using the instruments and prices listed in each part below. In the Transaction column, list each instrument and whether you are buying (long) or selling (short). Next, enter the values for the Time 0 and Time t cash flows with the correct signs. Finally, in the last row of the table, calculate the profit from the arbitrage. Part C: An asset is currently trading at S100, the 6-month forward is currently trading at S103 bid. S104 ask, and you can borrow or lend at 7% interest. Show how you would profitably arbitrage these price relationships Transaction: Time 0 cash flows: Time t cash flows: Total Profit: .What effect does the bid-ask spread have on the ability to arbitrage this market? How does it affect the buying price of the forward? How does it affect the selling price of the forward? Would we prefer a wider bid-ask spread or a narrower bid-ask spread, all else the same? How does the size (width) of the bid-ask spread affect trading activity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts