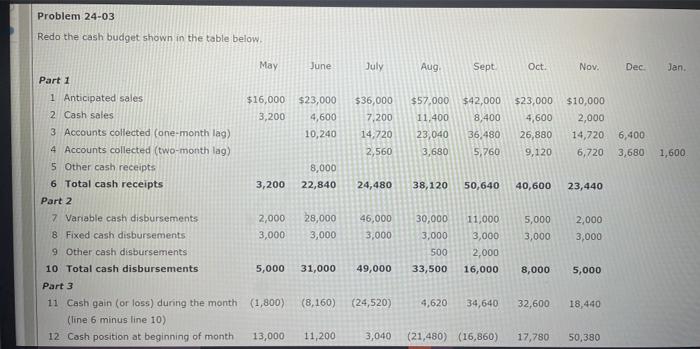

Question: Problem 24-03 Redo the cash budget shown in the table below. July Aug Sept Oct Nov. Dec Jan. $57,000 $36,000 7,200 11.400 $42,000 8,400 36,480

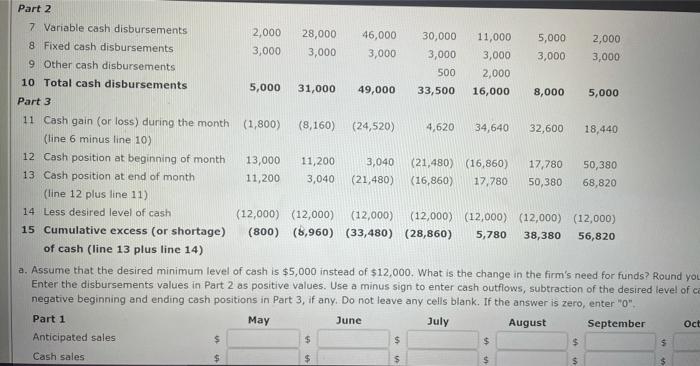

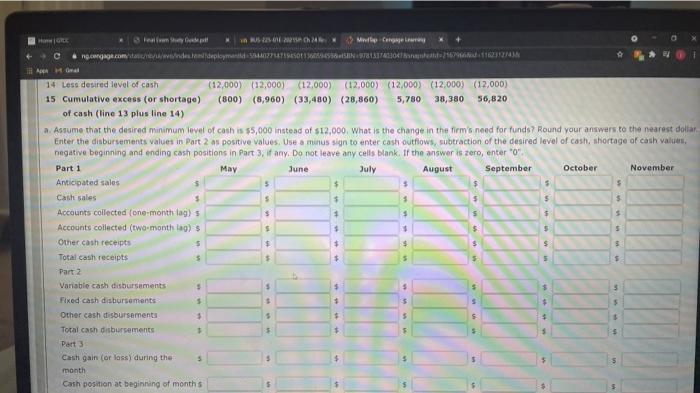

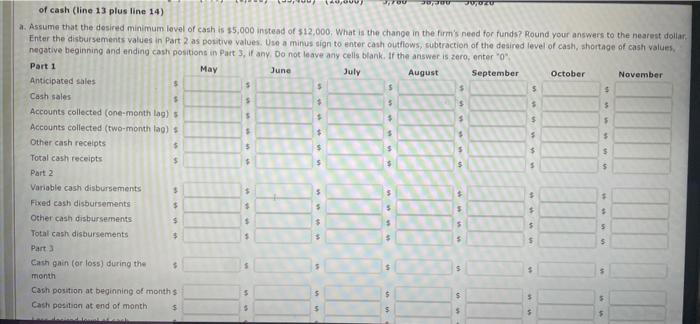

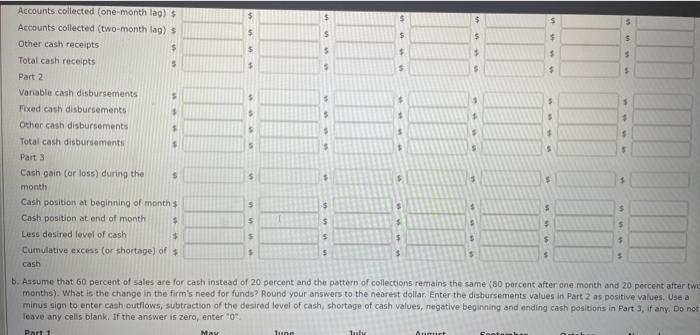

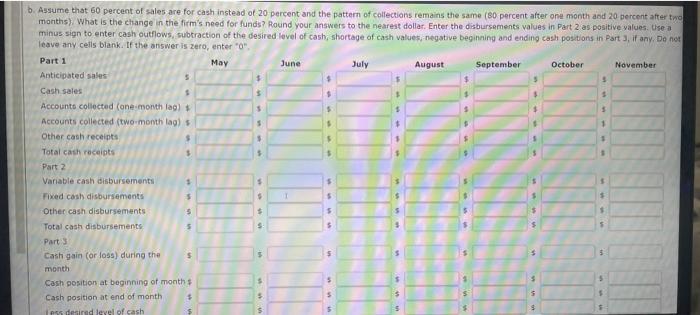

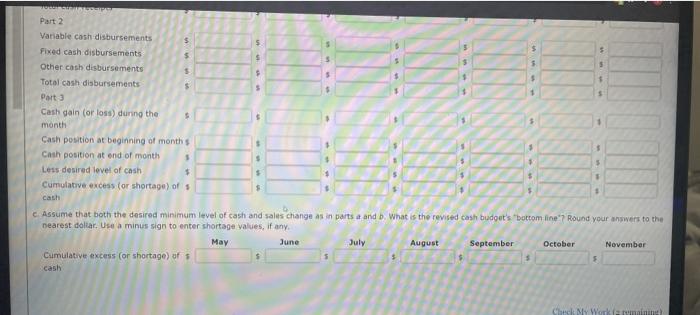

Problem 24-03 Redo the cash budget shown in the table below. July Aug Sept Oct Nov. Dec Jan. $57,000 $36,000 7,200 11.400 $42,000 8,400 36,480 5,760 $23,000 4,600 26,880 9,120 $10,000 2,000 14,720 6,720 14,720 2,560 23,040 3,680 6,400 3,680 1,600 24,480 38,120 50,640 40,600 23,440 May June Part 1 1 Anticipated sales $16,000 $23,000 2 Cash sales 3,200 4,600 3 Accounts collected (one-month lag) 10,240 4 Accounts collected (two-month lag) 5 Other cash receipts 8,000 6 Total cash receipts 3,200 22,840 Part 2 7 Variable cash disbursements 2,000 28,000 8 Fixed cash disbursements 3,000 3,000 9 Other cash disbursements 10 Total cash disbursements 5,000 31,000 Part 3 11 Cash gain (or loss) during the month (1,800) (8,160) (line 6 minus line 10) 12 Cash position at beginning of month 13,000 11,200 46,000 3,000 5,000 3,000 30,000 3,000 500 33,500 2,000 3,000 11,000 3,000 2,000 16,000 49,000 8,000 5,000 (24,520) 4,620 34,640 32,600 18,440 3,040 (21,480) (16,860) 17,780 50,380 Part 2 7 Variable cash disbursements 2,000 28,000 46,000 30,000 11,000 5,000 2,000 8 Fixed cash disbursements 3,000 3,000 3,000 3,000 3,000 3,000 3,000 9 Other cash disbursements 500 2,000 10 Total cash disbursements 5,000 31,000 49,000 33,500 16,000 8,000 5,000 Part 3 11 Cash gain (or loss) during the month (1,800) (8,160) (24,520) 4,620 34,640 32,600 18,440 (line 6 minus line 10) 12 Cash position at beginning of month 13,000 11,200 3,040 (21,480) (16,860) 17,780 50,380 13 Cash position at end of month 11,200 3,040 (21,480) (16,860) 17.780 50,380 68,820 (line 12 plus line 11) 14 Less desired level of cash (12,000) (12,000) (12,000) (12,000) (12,000) (12,000) (12,000) 15 Cumulative xcess (or shortage) (800) (8,960) (33,480) (28,860) 5,780 38,380 56,820 of cash (line 13 plus line 14) a. Assume that the desired minimum level of cash is $5,000 instead of $12,000. What is the change in the firm's need for funds? Round you Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of co negative beginning and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, enter "O". Part 1 May June July August September Oct Anticipated sales $ $ $ $ $ Cash sales $ $ $ $ $ 5 $ $ $ Safety US3MModlip ng congue.com www.rde.deployment SOZZUSEO365305978131702467966996299434 THAO 14 Loss desired level of cash (12,000) (12,000) (12,000) (12,000) (12,000) (12,000) (12.000) 15 Cumulative excess (or shortage) (800) (6,960) (33,480) (28,860) 5,780 38,380 56,820 of cash (line 13 plus line 14) a Assume that the desired minimum level of cash is $5,000 instead of $12,000, What is the change in the firm's need for funds7 Round your answers to the nearest dollar Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of cash, shortage of cash values negative beginning and ending cash positions in Part 3; if any. Do not leave any cells blank. If the answer is zero, enter "o" Part 1 May June July August September October November Anticipated sales $ $ Cash sales 5 $ $ Accounts collected (one-month lag) 5 $ $ Accounts collected (two month lag) $ $ 5 Other cash receipts 5 Total cash receipts 5 5 $ Part 2 Variable cash disbursements $ $ Fixed cash disbursements $ Other cash disbursements $ 5 $ Total cash disbursements 5 Part 3 Cash gain (or loss during the month Cash position at beginning of months $ $ $ $ 5 5 $ $ $ $ 3 $ 5 5 5 $ S S $ July VA 4 OU 30 JUOTU of cash (line 13 plus line 14) 2. Assume that the desired minimum level of cash is $5,000 instead of 512,000. What is the change in the firm's need for funds? Round your answers to the nearest dollar Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of cash, shortage of cash values negative beginning and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, entero Part 1 May June August September October November Anticipated sales $ 5 5 $ $ $ Cash sales 5 $ $ S 5 Accounts collected (one-month lag) 5 $ $ $ $ $ Accounts collected (two-month lag) & $ $ $ Other cash receipts $ 5 $ $ Total cash receipts $ $ 5 5 Part 2 Variable cash disbursements $ $ $ $ 5 Fixed cash disbursements $ $ 5 $ $ $ Other cash disbursements $ $ $ 5 5 5 Total cash disbursements $ 3 5 $ Part Cash gain (or loss) during the $ $ $ month Cash position at beginning of months 5 5 Cash position at end of month $ 5 5 $ 5 5 Accounts collected (one-month lag) Accounts collected (two-month lag) s $ $ Other cash receipts $ $ $ $ 5 Total cash receipts 5 $ $ $ $ $ Part 2 Variable cash disbursements 5 $ 5 Fixed cash disbursements + Other cash disbursements Total cash disbursements 5 $ 5 Part 3 Cash gain (or loss) during the $ $ $ $ month Cash position at beginning of month $ $ $ $ Cash position at end of month $ $ $ $ 5 Less desired level of cash $ & $ $ 5 Cumulative excess (or shortage) of $ $ $ $ $ cash b. Assume that 60 percent of sales are for cash instead of 20 percent and the pattern of collections remains the same (80 percent after one month and 20 percent after two months). What is the change in the firm's need for funds? Round your answers to the nearest dollar. Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of cash, shortage of cash values, negative beginning and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, enter"0" Tunn Tui Part 1 Aurt $ MAN $ 1 1 b. Assume that 60 percent of sales are for cash instead of 20 percent and the pattern of collections remains the same (80 percent after one month and 20 percent after two months) What is the change in the firm's need for funds? Round your answers to the nearest dollar. Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of cash, shortage of cash values, negative beginning and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, entero Part 1 May June July August September October November Anticipated sales $ Cash sales Accounts collected one month lag) Accounts collected (two month lag) s Other cash receipts Total cash receipts Part 2 Variable cash disbursements 1 Fixed cash disbursements 5 Other cash disbursements Total cash disbursements S Part 3 Cash gain (or loss) during the $ month Cash position at beginning of months 5 Cash position at end of month s $ les desired level of cash 5 5 S 5 $ 5 5 $ Part 2 Variable cash disbursements $ $ Fixed cash disbursements $ $ $ Other cash disbursements $ $ $ Total cash disbursements $ Part 3 Cash gain (or loss) during the S 1 month Cash position at beginning of months Cash position at end of month 5 5 Less desired level of cash $ Cumulative excess for shortage of 5 $ 1 cash C. Assume that both the desired minimum level of cash and sales change as in Darts and D. What is the revised cash budget's "bottom line? Round your answers to the nearest doltar. Use a minus sign to enter shortage values, if any. May June July August September October November Cumulative excess (or shortage of 5 $ cash Check My Worklarining Problem 24-03 Redo the cash budget shown in the table below. July Aug Sept Oct Nov. Dec Jan. $57,000 $36,000 7,200 11.400 $42,000 8,400 36,480 5,760 $23,000 4,600 26,880 9,120 $10,000 2,000 14,720 6,720 14,720 2,560 23,040 3,680 6,400 3,680 1,600 24,480 38,120 50,640 40,600 23,440 May June Part 1 1 Anticipated sales $16,000 $23,000 2 Cash sales 3,200 4,600 3 Accounts collected (one-month lag) 10,240 4 Accounts collected (two-month lag) 5 Other cash receipts 8,000 6 Total cash receipts 3,200 22,840 Part 2 7 Variable cash disbursements 2,000 28,000 8 Fixed cash disbursements 3,000 3,000 9 Other cash disbursements 10 Total cash disbursements 5,000 31,000 Part 3 11 Cash gain (or loss) during the month (1,800) (8,160) (line 6 minus line 10) 12 Cash position at beginning of month 13,000 11,200 46,000 3,000 5,000 3,000 30,000 3,000 500 33,500 2,000 3,000 11,000 3,000 2,000 16,000 49,000 8,000 5,000 (24,520) 4,620 34,640 32,600 18,440 3,040 (21,480) (16,860) 17,780 50,380 Part 2 7 Variable cash disbursements 2,000 28,000 46,000 30,000 11,000 5,000 2,000 8 Fixed cash disbursements 3,000 3,000 3,000 3,000 3,000 3,000 3,000 9 Other cash disbursements 500 2,000 10 Total cash disbursements 5,000 31,000 49,000 33,500 16,000 8,000 5,000 Part 3 11 Cash gain (or loss) during the month (1,800) (8,160) (24,520) 4,620 34,640 32,600 18,440 (line 6 minus line 10) 12 Cash position at beginning of month 13,000 11,200 3,040 (21,480) (16,860) 17,780 50,380 13 Cash position at end of month 11,200 3,040 (21,480) (16,860) 17.780 50,380 68,820 (line 12 plus line 11) 14 Less desired level of cash (12,000) (12,000) (12,000) (12,000) (12,000) (12,000) (12,000) 15 Cumulative xcess (or shortage) (800) (8,960) (33,480) (28,860) 5,780 38,380 56,820 of cash (line 13 plus line 14) a. Assume that the desired minimum level of cash is $5,000 instead of $12,000. What is the change in the firm's need for funds? Round you Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of co negative beginning and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, enter "O". Part 1 May June July August September Oct Anticipated sales $ $ $ $ $ Cash sales $ $ $ $ $ 5 $ $ $ Safety US3MModlip ng congue.com www.rde.deployment SOZZUSEO365305978131702467966996299434 THAO 14 Loss desired level of cash (12,000) (12,000) (12,000) (12,000) (12,000) (12,000) (12.000) 15 Cumulative excess (or shortage) (800) (6,960) (33,480) (28,860) 5,780 38,380 56,820 of cash (line 13 plus line 14) a Assume that the desired minimum level of cash is $5,000 instead of $12,000, What is the change in the firm's need for funds7 Round your answers to the nearest dollar Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of cash, shortage of cash values negative beginning and ending cash positions in Part 3; if any. Do not leave any cells blank. If the answer is zero, enter "o" Part 1 May June July August September October November Anticipated sales $ $ Cash sales 5 $ $ Accounts collected (one-month lag) 5 $ $ Accounts collected (two month lag) $ $ 5 Other cash receipts 5 Total cash receipts 5 5 $ Part 2 Variable cash disbursements $ $ Fixed cash disbursements $ Other cash disbursements $ 5 $ Total cash disbursements 5 Part 3 Cash gain (or loss during the month Cash position at beginning of months $ $ $ $ 5 5 $ $ $ $ 3 $ 5 5 5 $ S S $ July VA 4 OU 30 JUOTU of cash (line 13 plus line 14) 2. Assume that the desired minimum level of cash is $5,000 instead of 512,000. What is the change in the firm's need for funds? Round your answers to the nearest dollar Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of cash, shortage of cash values negative beginning and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, entero Part 1 May June August September October November Anticipated sales $ 5 5 $ $ $ Cash sales 5 $ $ S 5 Accounts collected (one-month lag) 5 $ $ $ $ $ Accounts collected (two-month lag) & $ $ $ Other cash receipts $ 5 $ $ Total cash receipts $ $ 5 5 Part 2 Variable cash disbursements $ $ $ $ 5 Fixed cash disbursements $ $ 5 $ $ $ Other cash disbursements $ $ $ 5 5 5 Total cash disbursements $ 3 5 $ Part Cash gain (or loss) during the $ $ $ month Cash position at beginning of months 5 5 Cash position at end of month $ 5 5 $ 5 5 Accounts collected (one-month lag) Accounts collected (two-month lag) s $ $ Other cash receipts $ $ $ $ 5 Total cash receipts 5 $ $ $ $ $ Part 2 Variable cash disbursements 5 $ 5 Fixed cash disbursements + Other cash disbursements Total cash disbursements 5 $ 5 Part 3 Cash gain (or loss) during the $ $ $ $ month Cash position at beginning of month $ $ $ $ Cash position at end of month $ $ $ $ 5 Less desired level of cash $ & $ $ 5 Cumulative excess (or shortage) of $ $ $ $ $ cash b. Assume that 60 percent of sales are for cash instead of 20 percent and the pattern of collections remains the same (80 percent after one month and 20 percent after two months). What is the change in the firm's need for funds? Round your answers to the nearest dollar. Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of cash, shortage of cash values, negative beginning and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, enter"0" Tunn Tui Part 1 Aurt $ MAN $ 1 1 b. Assume that 60 percent of sales are for cash instead of 20 percent and the pattern of collections remains the same (80 percent after one month and 20 percent after two months) What is the change in the firm's need for funds? Round your answers to the nearest dollar. Enter the disbursements values in Part 2 as positive values. Use a minus sign to enter cash outflows, subtraction of the desired level of cash, shortage of cash values, negative beginning and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, entero Part 1 May June July August September October November Anticipated sales $ Cash sales Accounts collected one month lag) Accounts collected (two month lag) s Other cash receipts Total cash receipts Part 2 Variable cash disbursements 1 Fixed cash disbursements 5 Other cash disbursements Total cash disbursements S Part 3 Cash gain (or loss) during the $ month Cash position at beginning of months 5 Cash position at end of month s $ les desired level of cash 5 5 S 5 $ 5 5 $ Part 2 Variable cash disbursements $ $ Fixed cash disbursements $ $ $ Other cash disbursements $ $ $ Total cash disbursements $ Part 3 Cash gain (or loss) during the S 1 month Cash position at beginning of months Cash position at end of month 5 5 Less desired level of cash $ Cumulative excess for shortage of 5 $ 1 cash C. Assume that both the desired minimum level of cash and sales change as in Darts and D. What is the revised cash budget's "bottom line? Round your answers to the nearest doltar. Use a minus sign to enter shortage values, if any. May June July August September October November Cumulative excess (or shortage of 5 $ cash Check My Worklarining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts