Question: Problem 2(4+4+4+4+2+2=20 points ) ESW designed a new inventory management system. ESW managers must choose among three altemative counses of actione ESW can license the

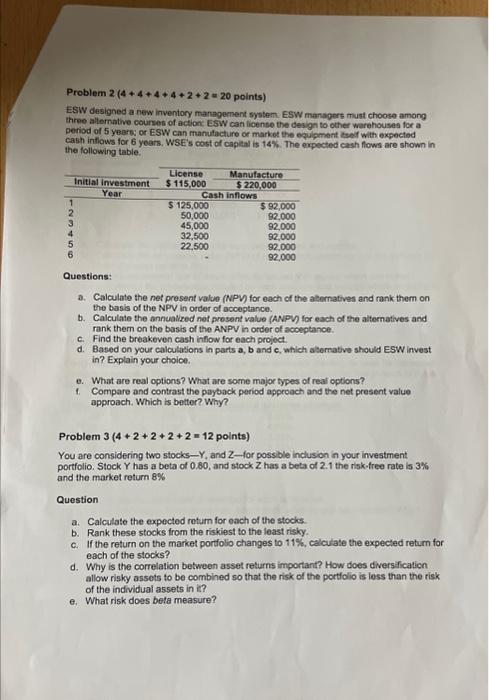

Problem 2(4+4+4+4+2+2=20 points ) ESW designed a new inventory management system. ESW managers must choose among three altemative counses of actione ESW can license the design to other warehouses for a period of 5 years, or ESW can manufacture or market the design to ocher warehousest lsed with expectod cash inflows for 6 yoars. WSE's cost of capital is 14\%. The expected cash flows are shown in the following table. Questions: a. Calculate the net present value (WPV) for each of the alernatives and rank them on the basls of the NPV in order of acceptance. b. Calculate the annualized net prosent value (ANPV) for each of the alternatives and rank them on the basis of the ANPY in order of acoeptance. c. Find the breakeven cash intlow for each project. d. Based on your calculations in parts a, b and c, which aternative should ESW invest in? Explain your choice. e. What are real options? What are some major types of real options? 1. Compare and contrast the payback period approoch and the net present value approach. Which is better? Why? Problem 3(4+2+2+2+2=12 polnts ) You are considering two stocks Y, and Z-for possible inclusion in your investment portfolio. Stock Y has a beta of 0.80 , and stock Z has a beta of 2.1 the risk-free rate is 3%. and the market retum 8% Question a. Calculate the expected roturn for each of the stocks. b. Rank these stocks from the riskiest to the least risky. c. If the return on the market portiolio changes to 11%, calculate the expecled return for each of the stocks? d. Why is the correlation between asset returns important? How does diversification allow risky assets to be combined so that the risk of the portfolio is less than the risk of the individual assets in ? e. What risk does beta measure? Problem 2(4+4+4+4+2+2=20 points ) ESW designed a new inventory management system. ESW managers must choose among three altemative counses of actione ESW can license the design to other warehouses for a period of 5 years, or ESW can manufacture or market the design to ocher warehousest lsed with expectod cash inflows for 6 yoars. WSE's cost of capital is 14\%. The expected cash flows are shown in the following table. Questions: a. Calculate the net present value (WPV) for each of the alernatives and rank them on the basls of the NPV in order of acceptance. b. Calculate the annualized net prosent value (ANPV) for each of the alternatives and rank them on the basis of the ANPY in order of acoeptance. c. Find the breakeven cash intlow for each project. d. Based on your calculations in parts a, b and c, which aternative should ESW invest in? Explain your choice. e. What are real options? What are some major types of real options? 1. Compare and contrast the payback period approoch and the net present value approach. Which is better? Why? Problem 3(4+2+2+2+2=12 polnts ) You are considering two stocks Y, and Z-for possible inclusion in your investment portfolio. Stock Y has a beta of 0.80 , and stock Z has a beta of 2.1 the risk-free rate is 3%. and the market retum 8% Question a. Calculate the expected roturn for each of the stocks. b. Rank these stocks from the riskiest to the least risky. c. If the return on the market portiolio changes to 11%, calculate the expecled return for each of the stocks? d. Why is the correlation between asset returns important? How does diversification allow risky assets to be combined so that the risk of the portfolio is less than the risk of the individual assets in ? e. What risk does beta measure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts