Question: can u please answer these 2 problems ? Problem 2(4+4+4+4+2+2=20 points ) ESW designed a new inventory management system. ESW managers must choose among three

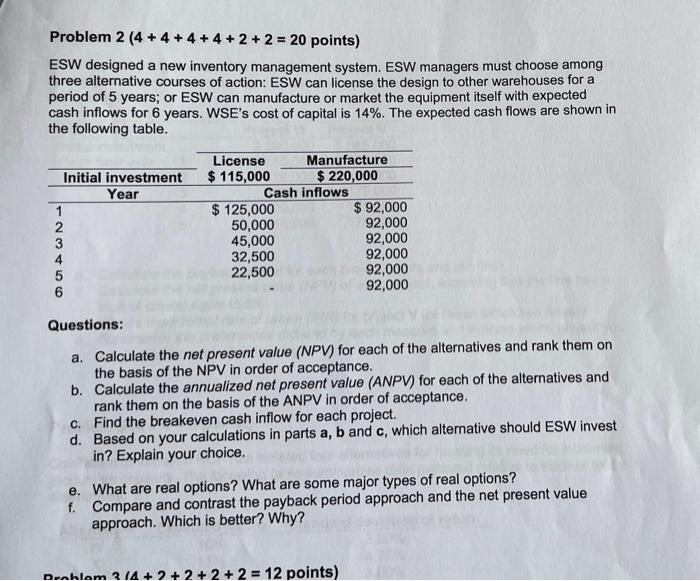

Problem 2(4+4+4+4+2+2=20 points ) ESW designed a new inventory management system. ESW managers must choose among three alternative courses of action: ESW can license the design to other warehouses for a period of 5 years; or ESW can manufacture or market the equipment itself with expected cash inflows for 6 years. WSE's cost of capital is 14%. The expected cash flows are shown in the following table. Questions: a. Calculate the net present value (NPV) for each of the alternatives and rank them on the basis of the NPV in order of acceptance. b. Calculate the annualized net present value (ANPV) for each of the alternatives and rank them on the basis of the ANPV in order of acceptance. c. Find the breakeven cash inflow for each project. d. Based on your calculations in parts a,b and c, which alternative should ESW invest in? Explain your choice. e. What are real options? What are some major types of real options? f. Compare and contrast the payback period approach and the net present value approach. Which is better? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts