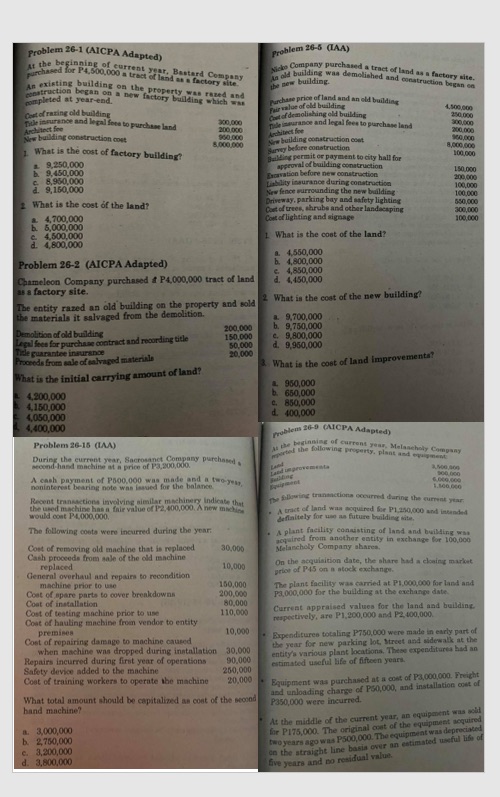

Question: Problem 26-1 (AICPA Adapted) Problem 26-5 (LAA) at the beginning of current year, Bastard Company Purchased for P4,500,000 a tract of land as a factory

Problem 26-1 (AICPA Adapted) Problem 26-5 (LAA) at the beginning of current year, Bastard Company Purchased for P4,500,000 a tract of land as a factory site. jake Company purchased a tract of land as a factory site. in old building was demolished and construction began on an existing building on the property was razed and the new building. Instruction began on a new factory building which was completed at year-end. purchase price of land and an old building Thet of razing old building Fair value of eld building fort of demolishing old building The insurance and legal for to purchase Land pain surance and legal fees to purchase land Wow building construction cost New building construction cost 1 What is the cost of factory building? gummy before construction 9,250,000 gelding permit or payment to city hall for 9.450.000 approval of building construction Thravation before new construction 150 0DO 9.950.000 240,900 9.150,000 Ability insurance during construction 100,020 New fence surrounding the new building 190,000 What is the cost of the land? Driveway, parking bay and safety lighting Cost of trees, shrubs and other landscaping 300,000 4,700,000 Con of lighting and signage 100/060 b. 6,000 000 e. 4,500,000 What is the cost of the land? d. 4,800,000 4.550,000 Problem 26-2 (AICPA Adapted) b. 4,800,000 4,850 000 Chameleon Company purchased # P4,090,000 tract of land . 4,450,000 as a factory site. 2 What is the cost of the new building? The entity razed an old building on the property and sold the materials it salvaged from the demolition. 5.700,000 200,000 b. 9.750,000 Demolition of old building Legal fees for purchase contract and recording title 150,000 C. 9.800,000 50,000 d. 9,950,000 Tide guarantee insurance Proceeds from sale of salvaged materials 20,000 What is the cost of land Improvements? What is the initial carrying amount of land? 950,000 4,200,000 b. 650,000 4,150,000 850,000 4,050,000 d. 400,000 4,400,000 Problem 169 (AICPA Adapted) Problem 26-15 (LAA) he the beginning of current year, Melancholy Company During the current year, Sacrosanct Company purchased exported the following property, plant and equipment second hand machine at a price of P3,200,000. Land unprovements cash payment of Poop,090 was made and a two-per noninterest bearing note was issued for the balance. Recent transactions involving similar machinery indicate that The flowing transactions occurred during the current pear the used machine has a fair value of 12,400,090, A new machine would cont P-4000,000, A tract of land was acquired for P1 240,000 and intended definitely for use as future building site, The following costs were incurred during the year. A plant facility consisting of land and building was acquired from another entity in exchange for 100,000 Cost of removing old machine that is replaced 30,006 Melancholy Company shares, Cash proceeds from sale of the old machine replaced 10 000 On the acquisition date, the share had a claing market General overhaul and repairs to recondition price of P45 on a stock exchange. machine prior to use 160,000 The plant facility was carried at P1,000,000 for land and Coat of spare parts to cover breakdowns 200,000 Pa,000,000 for the building at the exchange date. Cost of installation Cost of testing machine prior to use 110,005 Current appraised values for the land and building. Cost of hauling machine from vendor to entity respectively, are PI,200,000 and P2, 400,000. premises 10,000 Expend turen totaling P750,000 were made in early part of Cost of ropairing damage to machine caused the year for new parking lot, Street and sidewalk at the when machine was dropped during installation 30,000 entity's various plant locations, These expenditures had an Repairs incurred during first year of operations 90.000 estimated useful life of fifteen years. Safety device added to the machine 260,900 Cost of training workers to operate the machine 20,090 Equipment was purchased at a cost of P3,000,000. Freight and unloading charge of P50,000, and installation cost of What total amount should be capitalized as cost of the second P350,000 were incurred. hand machine? At the middle of the current year, an equipment was sold a. 3,000,000 far P175,000. The original cost of the equipment acquired b. 2,760,000 two years ago was P500,000. The equipment was depreciated 3,200,000 on the straight line basia over an estimated useful life of d. 3.800,000 five years and no residual value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts