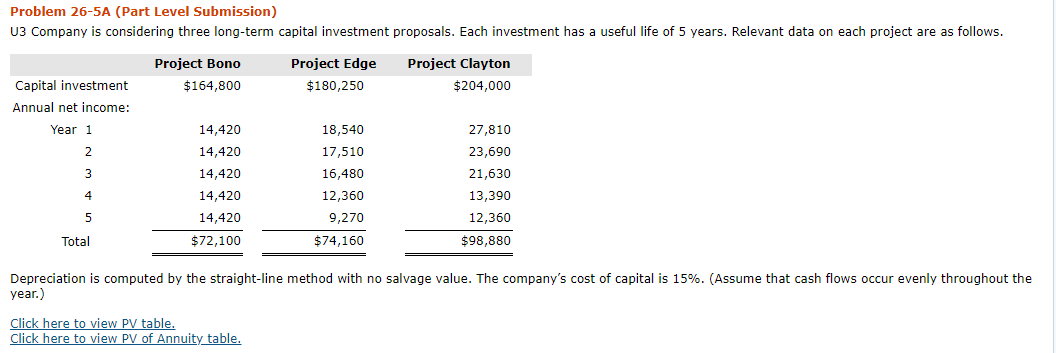

Question: Problem 26-5A (Part Level Submission) U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data

Problem 26-5A (Part Level Submission) U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge Project Clayton $204,000 Capital investment $164,800 $180,250 Annual net income: 14,420 Year 1 18,540 27,810 14,420 17,510 2 23,690 16,480 3 14,420 21,630 4 14,420 12,360 13,390 12,360 5 14,420 9,270 $72,100 $74,160 $98,880 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. click here to view PV of Annuity table. (b) X Your answer is incorrect. Try again. Compute the net present value for each project. (Round answers to 0 decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Project Bono Project Edge Project Clayton Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts